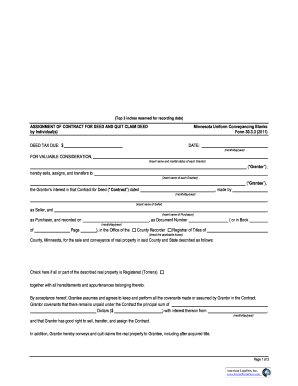

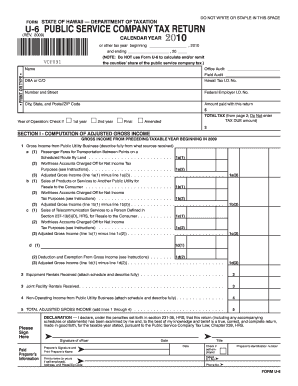

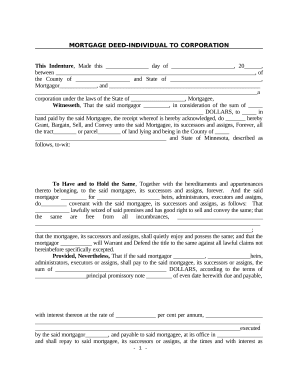

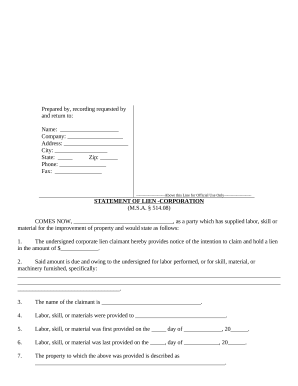

Select Minnesot tax Business Forms relevant to your business and sector. Begin editing your business templates and securely complete them in your DocHub account.

Speed up your form administration with the Minnesot tax Business Forms category with ready-made document templates that meet your requirements. Access the form template, modify it, fill it, and share it with your contributors without breaking a sweat. Start working more efficiently with the documents.

The best way to manage our Minnesot tax Business Forms:

Explore all the opportunities for your online file management with our Minnesot tax Business Forms. Get your totally free DocHub account today!