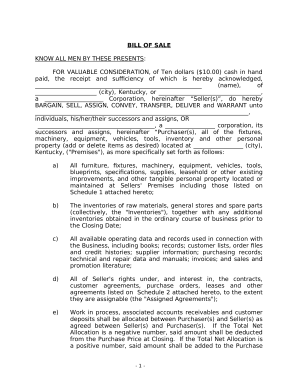

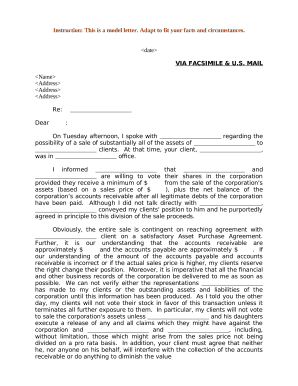

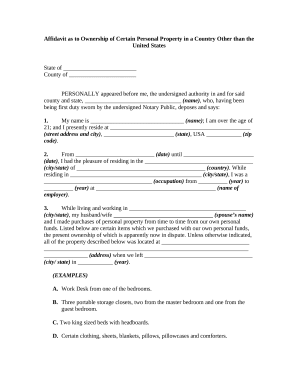

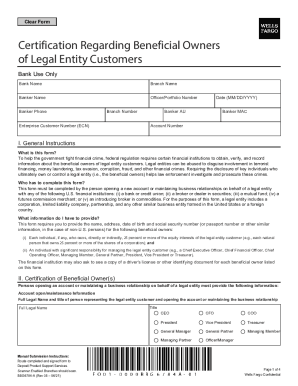

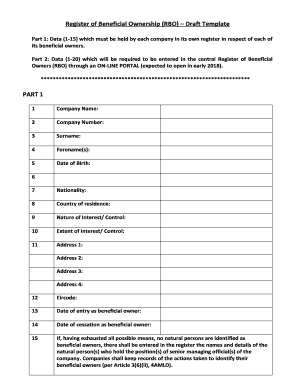

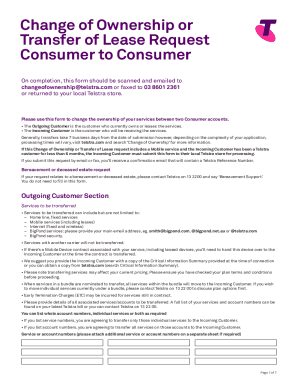

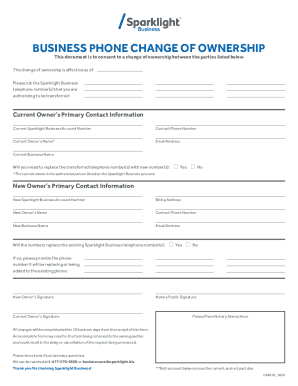

Obtain easy-to-customize Legal ownership Business Forms in our extensive online catalog. Search for the appropriate form, get it, and begin editing it immediately with DocHub free account.

Document administration takes up to half of your business hours. With DocHub, you can reclaim your office time and boost your team's productivity. Access Legal ownership Business Forms online library and explore all form templates related to your day-to-day workflows.

Effortlessly use Legal ownership Business Forms:

Speed up your day-to-day document administration with the Legal ownership Business Forms. Get your free DocHub account right now to explore all forms.