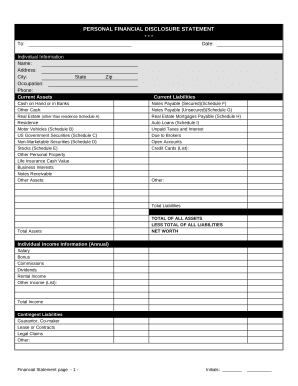

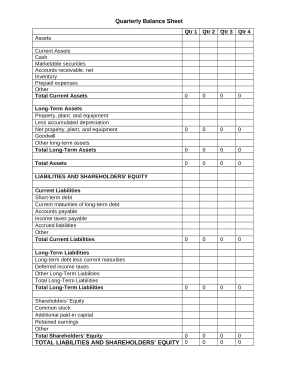

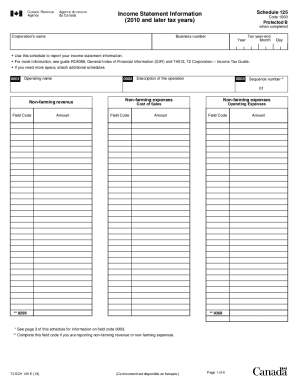

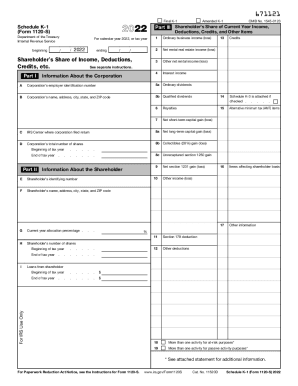

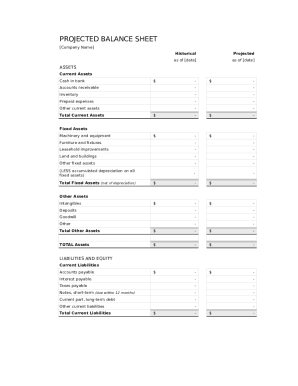

Collaborate and edit Self employed Balance Sheet Templates in real-time. Get a free DocHub and handle your financial records with accuracy, stay ahead your competition, and safeguard your data.

Document managing can stress you when you can’t discover all the documents you need. Fortunately, with DocHub's vast form collection, you can get all you need and swiftly deal with it without the need of switching among apps. Get our Self employed Balance Sheet Templates and begin utilizing them.

The best way to manage our Self employed Balance Sheet Templates using these easy steps:

Try out DocHub and browse our Self employed Balance Sheet Templates category easily. Get your free account today!