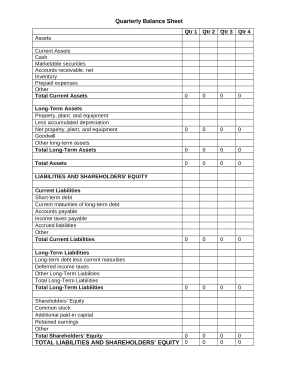

Select 36 month Balance Sheet Templates to ensure your financial processes' transparency and accuracy. Effortlessly complete and safely distribute your forms with your team and other contributors.

Your workflows always benefit when you can find all of the forms and files you require on hand. DocHub gives a a huge library of document templates to relieve your day-to-day pains. Get hold of 36 month Balance Sheet Templates category and quickly browse for your document.

Begin working with 36 month Balance Sheet Templates in a few clicks:

Enjoy fast and easy document managing with DocHub. Check out our 36 month Balance Sheet Templates online library and look for your form today!