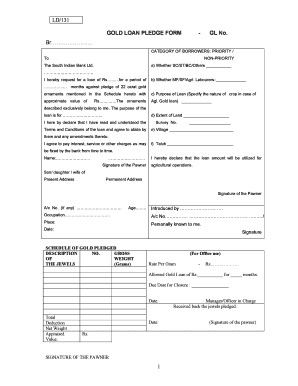

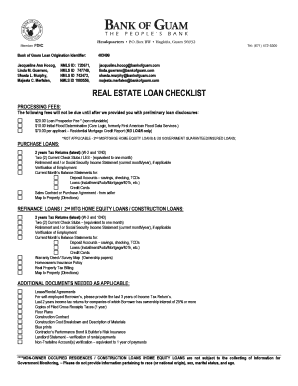

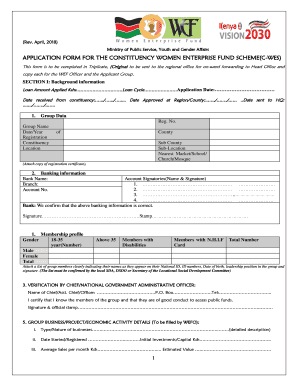

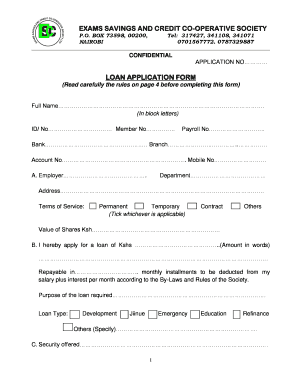

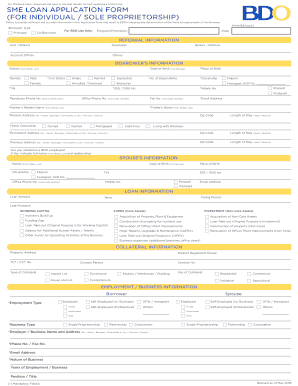

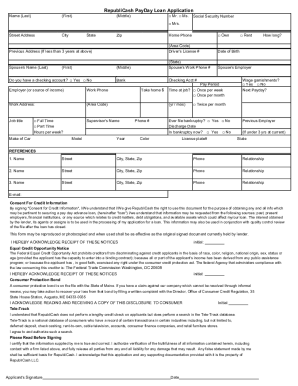

Navigate and adjust Sample loan Application Forms templates with a free DocHub account. Complete, send, or print your documents and speed up document submission procedure without delays.

Your workflows always benefit when you are able to get all of the forms and files you may need at your fingertips. DocHub delivers a a large collection documents to ease your everyday pains. Get a hold of Sample loan Application Forms category and quickly browse for your document.

Start working with Sample loan Application Forms in several clicks:

Enjoy seamless form managing with DocHub. Discover our Sample loan Application Forms collection and discover your form right now!