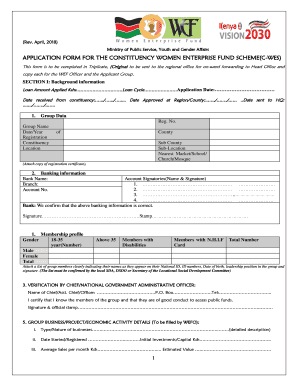

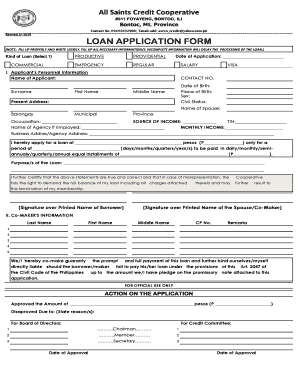

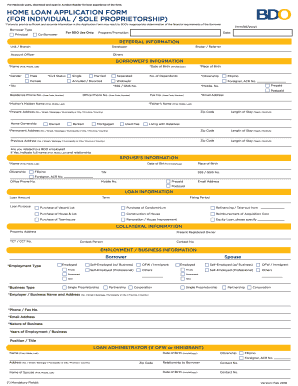

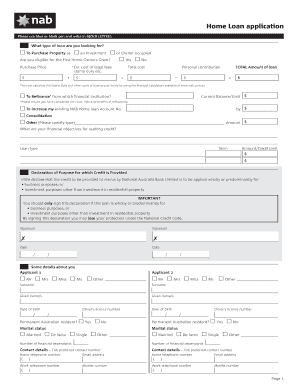

Get and load Of loan Application Forms to simplify your application submission workflow. Select from a range of different ready-made forms and easily edit them in DocHub online editor.

Document administration can stress you when you can’t locate all of the documents you need. Fortunately, with DocHub's extensive form collection, you can get everything you need and promptly take care of it without the need of changing between applications. Get our Of loan Application Forms and begin utilizing them.

Using our Of loan Application Forms using these easy steps:

Try out DocHub and browse our Of loan Application Forms category with ease. Get your free account right now!