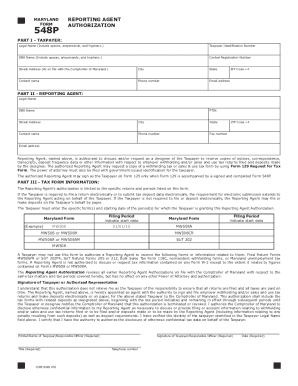

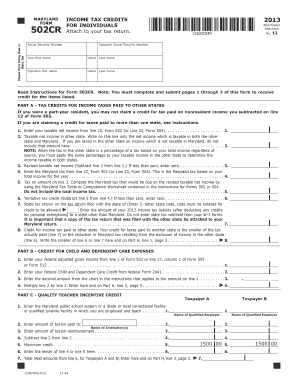

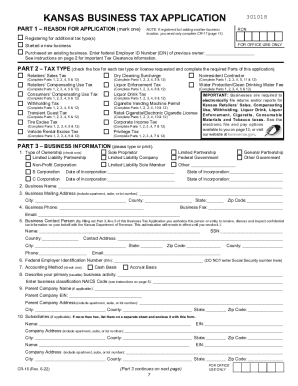

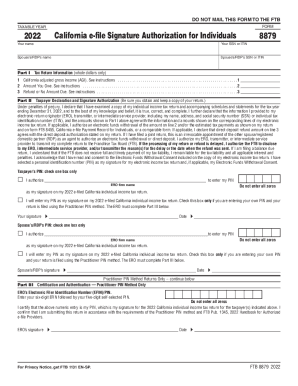

Select from numerous of ready-made Efin Application Forms templates and streamline your processes with a few clicks. Obtain, upload, and fill out your document wherever you are with DocHub.

Improve your document managing using our Efin Application Forms collection with ready-made form templates that suit your requirements. Get the form template, modify it, complete it, and share it with your contributors without breaking a sweat. Begin working more effectively with your documents.

How to use our Efin Application Forms:

Explore all the possibilities for your online document administration using our Efin Application Forms. Get your totally free DocHub profile today!