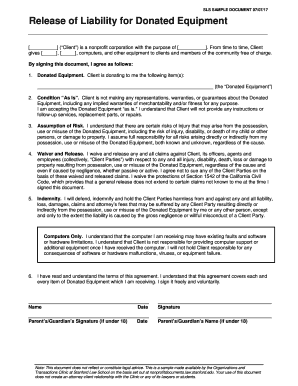

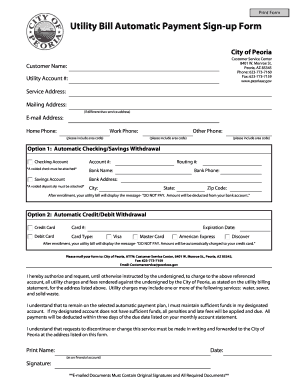

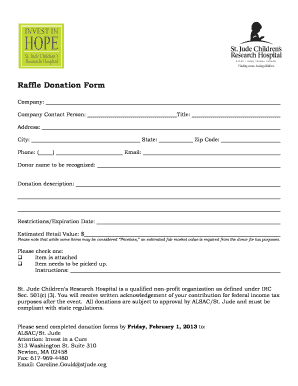

Make the donation process easier with DocHub's Blank Donation Forms library. Edit, complete, and securely store finished documents in your profile.

Speed up your file administration with the Blank Donation Forms library with ready-made templates that suit your requirements. Get your document template, modify it, complete it, and share it with your contributors without breaking a sweat. Start working more efficiently with the documents.

How to use our Blank Donation Forms:

Examine all the opportunities for your online document administration with the Blank Donation Forms. Get a totally free DocHub profile right now!