Definition and Purpose of Publication 915

Publication 915 is an informational guide provided by the Internal Revenue Service (IRS) that focuses on the federal income tax rules applicable to Social Security benefits and equivalent railroad retirement benefits. It serves as a key resource for individuals to understand the tax implications of these benefits, assisting in determining if they are taxable and how to report them accurately. Additionally, this document provides guidance on related deductions and the repayment of benefits. Understanding the purpose of Publication 915 is crucial for taxpayers who wish to comply with federal tax requirements while maximizing their deductions and credits.

Key Elements of Publication 915

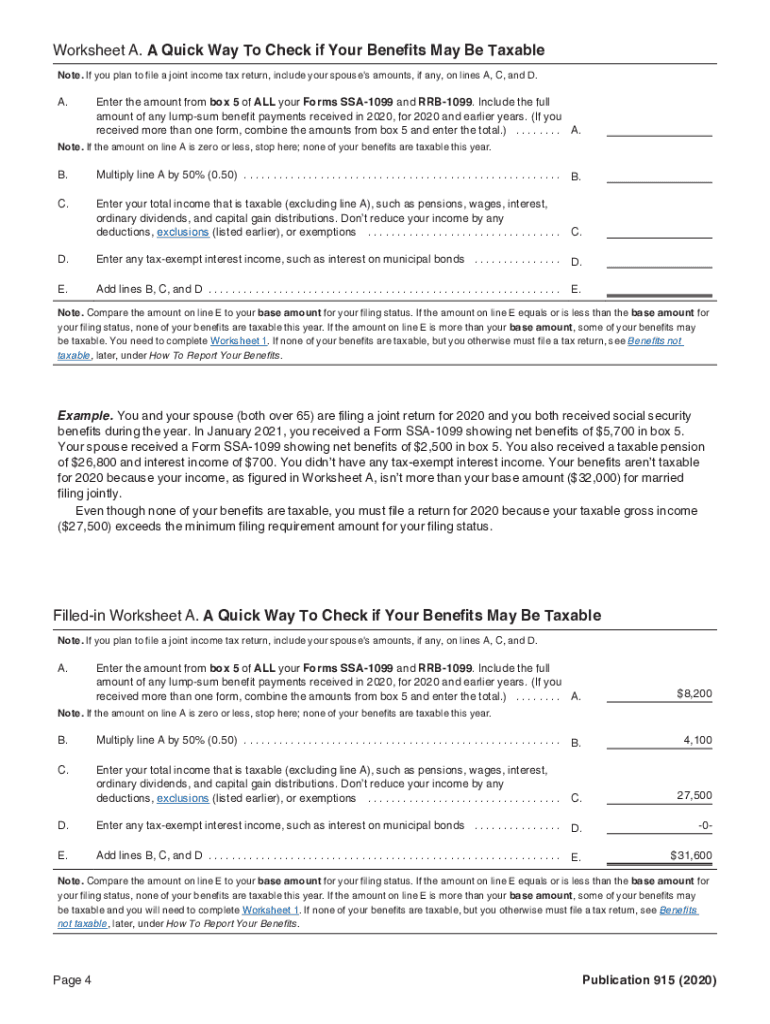

- Taxability of Benefits: It explains the conditions under which Social Security and railroad retirement benefits become taxable, providing thresholds and scenarios for clarity.

- Worksheets: The publication includes worksheets designed to assist in calculating the taxable amount of benefits. These are practical tools that guide users step-by-step through the computations.

- Deductions and Repayments: It outlines deductions related to benefits and strategies for handling repayments, offering a detailed examination of possible scenarios taxpayers might face.

- Resources for Assistance: Information regarding where to obtain further help and access additional tax forms is also provided, ensuring that users can find support when needed.

How to Use Publication 915

To effectively utilize Publication 915, begin by identifying whether your benefits fall within the categories it covers. The process typically involves:

- Determining Eligibility: Evaluate if your benefits potentially impact your taxable income.

- Utilizing Worksheets: Complete the included worksheets to ascertain your benefits' taxability.

- Reviewing Guidance: Follow the detailed instructions for reporting taxable benefits on your federal tax return.

- Consulting Additional Resources: Use the publication to find references to other documents or IRS resources if further clarification is needed.

Steps to Complete the Publication 915 Requirements

Fulfilling the requirements outlined in Publication 915 involves several key steps:

- Identify All Sources of Income: Gather all necessary documents that report your Social Security or equivalent railroad retirement benefits.

- Use the Worksheet Provided: Accurately complete the worksheet included to determine the taxable portion of your benefits.

- Input Data Correctly: Ensure all calculations and inputs on your tax return are precise to avoid discrepancies.

- File on Time: Meet the filing deadline to eliminate penalties and keep your tax records up-to-date.

IRS Guidelines on Publication 915

Publication 915 is guided by the IRS's framework relating to Social Security and railroad retirement benefits taxation. These guidelines help in maintaining compliance and understanding the nuances of handling taxable benefits correctly. The IRS provides detailed parameters within Publication 915, ensuring taxpayers are well-informed about their filing obligations.

Important Terms Related to Publication 915

Understanding specific terminology within Publication 915 can enhance comprehension and application:

- Taxable Income: Income subject to federal tax, including the portion of Social Security benefits that exceeds a specific base amount.

- Base Amount: A threshold that determines the taxability of Social Security benefits according to various filing statuses.

- Provisional Income: Combined income that determines how much of your Social Security benefits are taxable.

- Offset: Adjustments for repaid benefits to reduce taxable income.

Required Documents for Publication 915

To accurately report Social Security benefits as outlined in Publication 915, taxpayers need several documents:

- Form SSA-1099: Details annual benefits received from Social Security.

- Railroad Retirement Form RRB-1099: Specifies benefits received through the railroad retirement system.

- Income Records: Documentation of other income sources for the tax year, necessary for calculating provisional income.

Penalties for Non-Compliance with Publication 915

Failing to comply with the guidelines set forth in Publication 915 may lead to significant penalties:

- Fines for Underreporting: Inadequate reporting of taxable benefits can result in penalties and interest on unpaid taxes.

- Delayed Refunds: Errors or omissions might lead to processing delays and postponement of any potential tax refunds.

- Audits: Consistent discrepancies could increase the risk of a tax audit by the IRS, requiring further verification of records.

These comprehensive insights into Publication 915 ensure readers remain informed, enhancing their ability to fulfill tax obligations accurately and efficiently.