Definition & Meaning

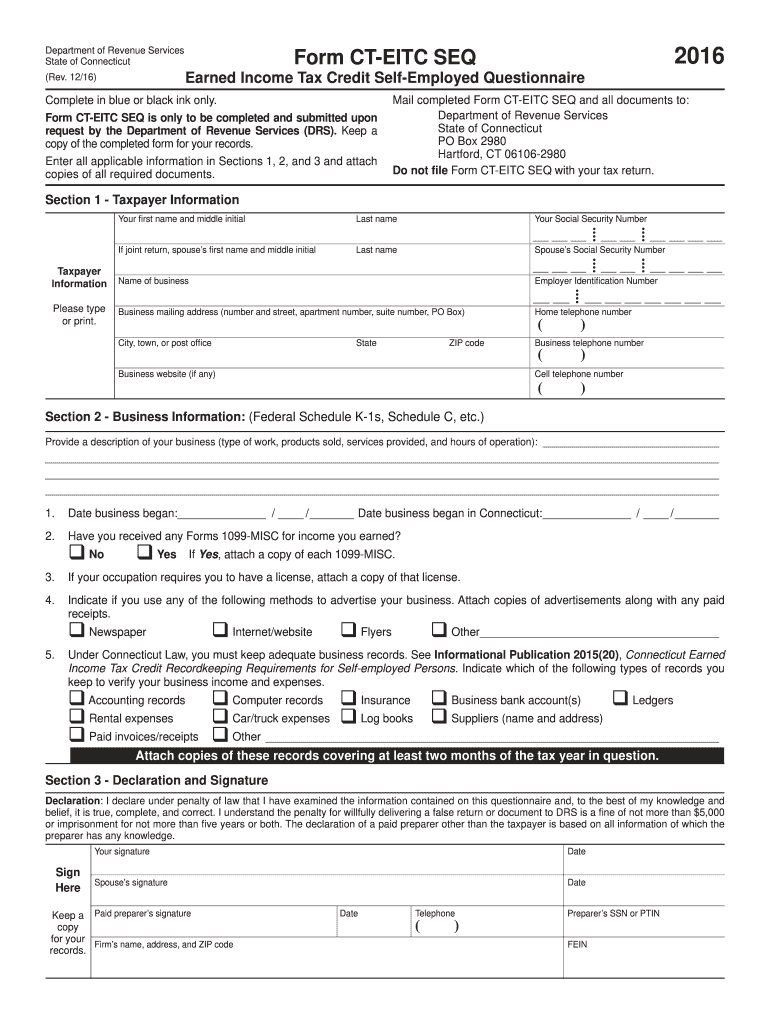

The 2016 CT SEQ Form, formally recognized as Form CT-EITC SEQ, serves as a questionnaire specifically for self-employed individuals in Connecticut who seek to claim the Earned Income Tax Credit (EITC). This form is designed to systematically gather all necessary personal and business information from taxpayers, ensuring accurate compliance with state directives regarding EITC claims. It plays a pivotal role in the formal acknowledgment of self-employment earnings, which is critical for determining eligibility for tax benefits under the Connecticut EITC program.

How to Use the 2016 CT SEQ Form

Using the 2016 CT SEQ Form involves a systematic approach to detail every aspect of your income and business operations for assessment. Start by gathering all relevant documentation as specified, such as business licenses, tax records, and income statements. Each section of the form requires precise information regarding your business activities, income sources, and record-keeping practices. It is essential to accurately complete each field to ensure that all necessary details are captured. Additionally, once filled, review the form for any errors or omissions before submission to avoid potential delays in the evaluation process.

Steps to Complete the 2016 CT SEQ Form

- Gather Documentation: Start by collecting all relevant documents, such as invoices and contracts, which substantiate your self-employment income.

- Personal Information: Fill in your personal data, including your full name, address, and social security number, to verify your identity.

- Business Details: Provide comprehensive information about your business, such as its type, operational scope, and location.

- Income Verification: Report your self-employed earnings, ensuring consistency with financial statements and bank deposits.

- Expense Documentation: Log your business expenses meticulously to ensure correct deduction calculations.

- Submission Review: Carefully review the complete form to verify all information is accurate and legible.

Who Typically Uses the 2016 CT SEQ Form

This form is primarily used by self-employed individuals residing in Connecticut who wish to claim the Earned Income Tax Credit. Typical users include small business owners, freelancers, gig economy workers, and independent contractors. These individuals rely on the form to substantiate their earnings and qualify for state tax credits, reducing their overall tax liability and increasing potential refunds.

Key Elements of the 2016 CT SEQ Form

The form comprises several key sections that are essential for determining EITC eligibility:

- Personal Information: Captures your identifying details and residency status.

- Business Type and Activity: Requires descriptions of your business structure and daily operations.

- Income Sources: Focuses on all revenue streams, ensuring transparency in reporting.

- Record-Keeping Practices: Evaluates the methods used for maintaining accurate financial records.

Required Documents

To complete the 2016 CT SEQ Form accurately, specific documents are required:

- Business Licenses and Permits: Confirm the legal operation of your business.

- Tax Returns: Provide a comparative basis for reported earnings.

- Financial Statements: Ensure accurate depiction of income and expenses.

- Advertising Proof: Verifies business promotion efforts, serving as evidence of active trade.

Filing Deadlines / Important Dates

Adhering to deadlines is crucial for timely EITC claims. The state of Connecticut often aligns deadlines with federal tax deadlines, typically set in mid-April, although exact dates can vary. Extensions may be available, but must be requested within state guidelines. Additionally, any document request from the Department of Revenue Services should be addressed promptly to avoid penalties or delays in credit allocation.

Penalties for Non-Compliance

Non-compliance with the requirements of the 2016 CT SEQ Form can result in several penalties, including:

- Denial of EITC Claims: Inaccurate or incomplete submissions may lead to disqualification from receiving the tax credit.

- Financial Penalties: Fines may be imposed for underreporting income or failing to provide requested documentation.

- Increased Scrutiny: Non-compliance can trigger audits or further investigation into one's tax filings.