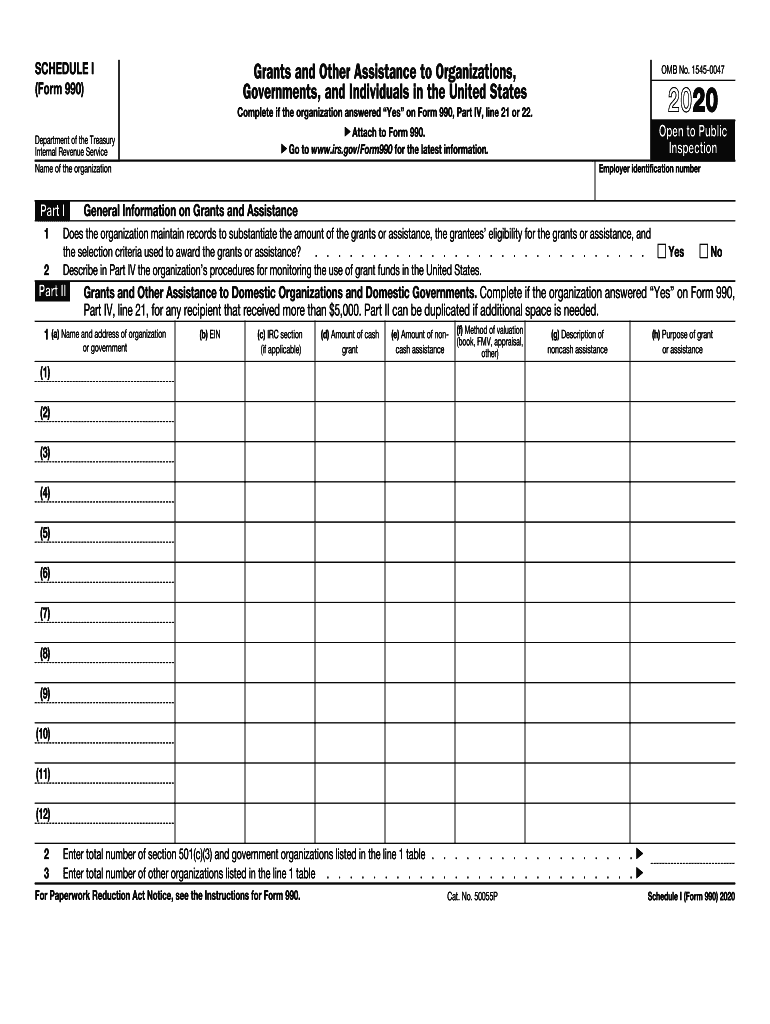

Definition and Meaning of Schedule I

Schedule I (Form 990) is an essential document used by organizations to report specific information about grants and assistance provided to domestic entities and individuals within a tax year. It plays a pivotal role in ensuring transparency by detailing the amounts granted, types of assistance, and monitoring procedures undertaken by the organization. This form provides insights into how funds are allocated, granting authorities the ability to verify the proper use of financial resources.

Steps to Complete Schedule I

-

Gather Necessary Information: Begin by collecting detailed information about the recipients of grants or assistance. This includes names, addresses, amounts granted, and the specific types of assistance provided.

-

Complete the Identification Section: Fill in the section that identifies the organization filing the form, including EIN, tax year, and contact details.

-

Detail Each Grant: For each grant or assistance, provide a description, the purpose of the funding, and monitoring methods employed to ensure proper use.

-

Review Monitoring Procedures: Clearly outline the steps taken by the organization to monitor the use of funds by recipients, ensuring compliance with the intended purpose of the grant.

-

Finalize and Double-check: After all the information is filled in, review the form for accuracy and completeness before submission.

Importance of Schedule I

Filing Schedule I is crucial for organizations that provide grants or assistance because it maintains transparency regarding fund allocation. It serves as a compliance tool to ensure that the financial resources are used for their intended purposes and substantiates the organization’s fiscal responsibility. Regular completion and submission of Schedule I can bolster an organization’s reputation and credibility with stakeholders and the IRS.

Who Typically Uses Schedule I

Schedule I is typically used by non-profit organizations, charitable entities, and certain other tax-exempt organizations that distribute grants or other types of assistance to individuals or domestic organizations. These entities are obliged to disclose detailed information about the assistance provided as part of their annual tax filings.

Key Elements of Schedule I

- Recipient Information: Details about each grant recipient, such as name, address, and identification number.

- Grant Amounts: Exact amounts of money or assistance provided to each recipient.

- Types of Assistance: Descriptions of the assistance provided, whether monetary, goods, or services.

- Monitoring Procedures: A clear outline of how the organization ensures the proper use of funds.

IRS Guidelines for Schedule I

The IRS provides specific guidelines for completing Schedule I, which include:

- Ensuring all sections are filled accurately.

- Reporting all grants and assistance provided.

- Using the form to highlight any significant monitoring activities undertaken during the tax year.

Organizations must adhere strictly to these guidelines to avoid penalties or issues during audits.

Filing Deadlines for Schedule I

Schedule I is usually filed as part of Form 990. The filing deadline typically coincides with the organization's tax filing deadline, which for most entities is the fifteenth day of the fifth month following the end of their fiscal year. For organizations operating on a calendar year basis, this deadline is May 15.

Form Submission Methods

Schedule I can be submitted to the IRS through various methods:

- Online Submission: Most organizations choose to file electronically using IRS-approved e-file providers.

- Mail: Physical submissions are also accepted if sent to the appropriate IRS address.

- In-Person: Although less common, some organizations may also deliver the form in person to their local IRS office.

Ensuring accurate and timely submission is critical for compliance and to avoid potential penalties.

Examples of Schedule I Usage

-

Non-Profit Organizations: A non-profit provides educational grants to disadvantaged communities. Schedule I allows them to report all recipients and funds allocated transparently.

-

Charitable Organizations: Charities involved in disaster relief may use Schedule I to report in-kind assistance valued over a certain amount.

-

Foundations: Private foundations providing scholarships must file Schedule I to document how funds are distributed and used according to stated objectives.

These examples highlight the diverse scenarios where Schedule I plays a crucial role in reporting and compliance.

Each section in the detailed content above is crafted to provide comprehensive insight into the form Schedule I, ensuring maximum utility and understanding for readers engaging with this form.