Definition & Meaning

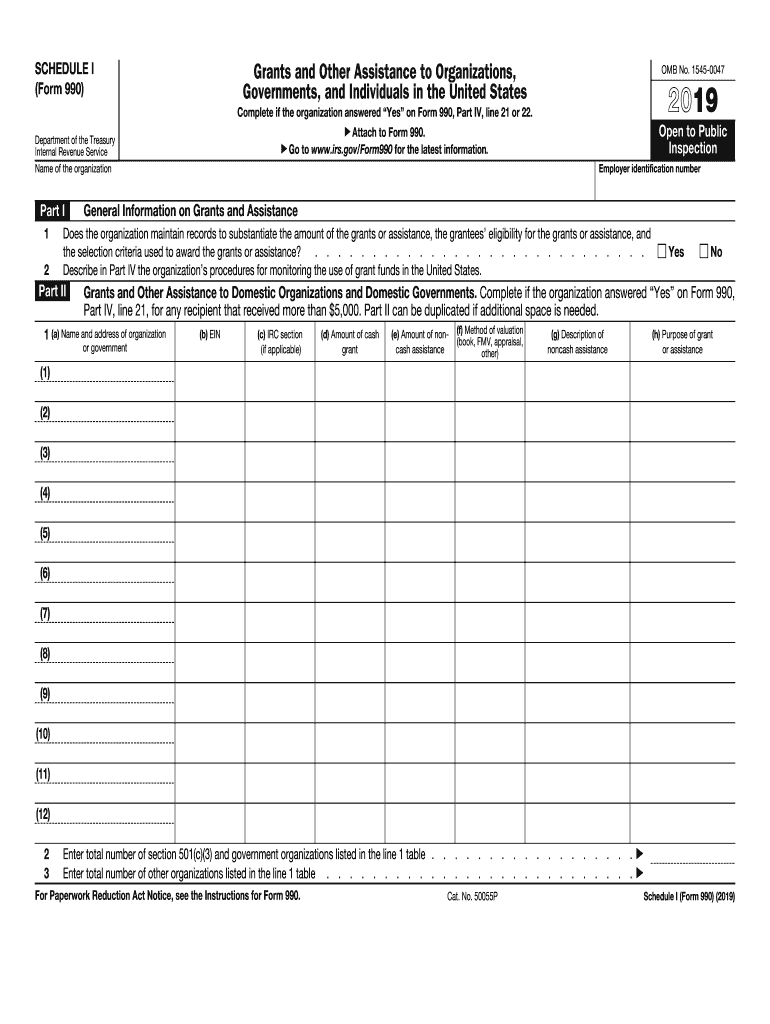

Schedule I (Form 990) is a supplementary form used by organizations that file Form 990. It provides detailed reporting of grants and assistance provided to domestic entities and individuals during the tax year. It requires precise information about the recipients, the types and amounts of assistance given, and the procedures in place for monitoring these grants. This form helps ensure transparency and accountability in the distribution of organizations' financial resources.

How to Use Schedule I

Utilizing Schedule I requires organizations to detail their financial assistance programs. Each entry on the form needs clear documentation, including the purpose of the grant, the recipient type (individual or entity), and whether the assistance was in cash or noncash. The organization should also describe any selection criteria or oversight mechanisms for distributing funds. This detailed reporting helps maintain the nonprofit's compliance with IRS regulations and demonstrates proper fund usage.

Steps to Complete Schedule I

-

Gather Information: Collect details about all grants and assistance provided during the tax year. This includes the recipient’s name, address, EIN (if applicable), and the nature and purpose of each grant.

-

Organize Data: Classify the assistance according to type—cash or noncash—and identify any specific purposes, such as scholarships or social service support.

-

Fill Out the Form: Enter all required information on Schedule I, ensuring accuracy and completeness. Pay careful attention to special sections that require explanation or additional details.

-

Review and Submit: Double-check all entries for errors or omissions. Submit Schedule I along with Form 990 to ensure comprehensive reporting.

Key Elements of Schedule I

- Recipient Information: Includes the name, address, and identification number of recipients.

- Assistance Type and Amount: Details on whether the assistance was cash or noncash and the total amount provided.

- Purpose and Monitoring: Description of the assistance’s purpose and how the organization monitors the use of these funds to ensure they meet the intended goals.

Important Terms Related to Schedule I

- Grantee: An individual or entity that receives a grant.

- Noncash Assistance: Includes any support in forms other than direct monetary payment, such as supplies or services.

- Form 990: An annual information return required by the IRS for tax-exempt organizations.

Legal Use of Schedule I

Schedule I plays a critical role in ensuring legal compliance with tax regulations. By reporting detailed information about assistance programs, organizations demonstrate adherence to IRS requirements and transparency in financial operations. Failure to accurately complete Schedule I can result in penalties or revocation of tax-exempt status.

IRS Guidelines

The IRS provides specific instructions for completing Schedule I as part of Form 990. These guidelines outline the necessary information each organization must report and provide instructions on how to classify and document various types of assistance. Organizations should thoroughly review these guidelines to ensure compliance and avoid potential filing errors.

Filing Deadlines / Important Dates

Schedule I, as part of Form 990, must be filed by the 15th day of the 5th month following the end of the organization’s tax year. For example, if the fiscal year ends on December 31, the deadline is May 15 of the following year. Timely filing is crucial to maintain compliance and prevent late penalties.