Definition & Meaning

The "non requesting person search" is a term primarily associated with tax forms that involve determining the responsibility of a non-requesting spouse for tax liabilities. This specific search is particularly relevant when one spouse seeks relief from joint tax obligations, but the other does not join the request. It plays a crucial role in identifying and evaluating the non-requesting spouse's role and responsibility in shared financial matters. Understanding this term can assist individuals in navigating complex tax scenarios efficiently.

How to Use the Non Requesting Person Search

Utilizing the non requesting person search typically involves accessing tax forms and records that help clarify the non-requesting spouse's financial involvement. This process often requires gathering comprehensive documentation, such as past tax returns, marital agreements, and any relevant communication about financial obligations. By methodically compiling these documents, taxpayers and their representatives can better assess whether relief provisions apply. Professional guidance is often recommended due to the intricacies involved.

Steps to Complete the Non Requesting Person Search

- Collect Necessary Documents: Gather all tax returns, financial statements, and pertinent correspondence with tax authorities.

- Analyze Tax Returns: Examine joint tax returns to pinpoint the contributions and liabilities of each spouse.

- Review Marital Agreements: Check any prenuptial or separation agreements for clauses related to tax liabilities.

- Consult Tax Professionals: Seek advice from tax accountants or attorneys for an expert analysis.

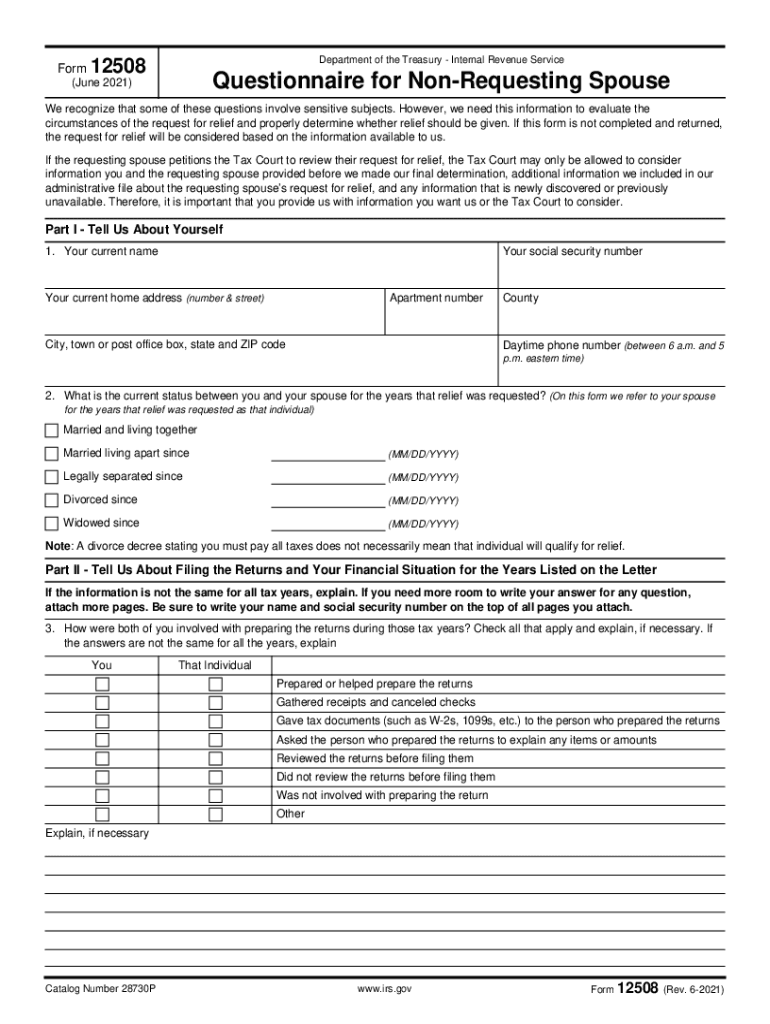

- Prepare Submission Forms: Complete IRS forms like Form 12508 if applicable, ensuring accurate and comprehensive information.

- Submit to the IRS: File all necessary documents and forms, adhering to IRS guidelines for processing.

Why Should You Conduct a Non Requesting Person Search

Conducting a non requesting person search is essential for individuals dealing with shared tax liabilities. It provides clarity on personal financial responsibilities, offering assurance that one is not unfairly held accountable for a partner's obligations. It's particularly beneficial in cases of divorce or separation, helping protect personal financial interests by verifying accurate allocation of tax responsibilities. This search also assists in qualifying for tax relief, ensuring compliant and fair tax handling.

Who Typically Uses the Non Requesting Person Search

This search is predominantly utilized by individuals facing shared tax responsibilities, such as spouses or former spouses. Tax advisors and attorneys often conduct these searches on behalf of their clients to offer expert insights and ensure compliance with tax laws. Additionally, individuals who suspect discrepancies in shared tax liabilities or are undergoing divorce proceedings may proactively engage in this search to safeguard their financial interests.

Required Documents

Successfully performing a non requesting person search necessitates assembling several key documents:

- Past joint tax returns

- Marital agreements like prenups or separation contracts

- Correspondence with the IRS

- Financial statements and income records

- Legal documents relevant to marital financial arrangements

Each document contributes to a comprehensive understanding of the non-requesting spouse's financial involvement and responsibilities.

Legal Use of the Non Requesting Person Search

The non requesting person search is legally sanctioned under U.S. tax law to ensure equitable accountability for tax liabilities. It aids in implementing relief provisions accurately and fairly, as outlined by the IRS. Using this search ensures compliance and facilitates due diligence in determining liability for shared tax debts. Understanding the legal boundaries and seeking professional advice are paramount to utilizing this tool correctly.

Examples of Using the Non Requesting Person Search

Consider a scenario where a recently divorced individual discovers they are liable for unpaid taxes due on prior joint returns. By conducting a non requesting person search, they can gather evidence to argue for relief, demonstrating that their ex-spouse was primarily responsible for the financial decisions leading to the tax debt. Another example involves a taxpayer being audited; they use this search to clarify the division of financial responsibilities and refute improper liability claims.