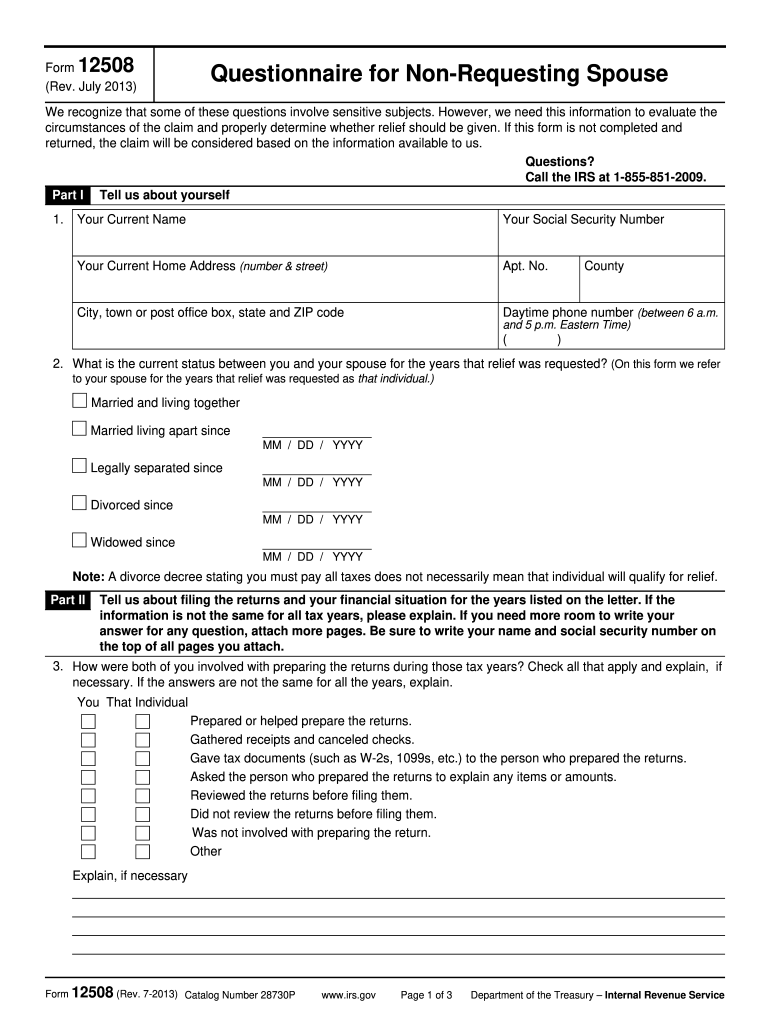

Definition and Meaning of IRS Form 12508

IRS Form 12508, known as the Questionnaire for Non-Requesting Spouse, is a document used by the Internal Revenue Service to gather information regarding a spouse’s involvement in tax matters during specific years when relief was requested. The form helps the IRS evaluate claims for relief by assessing personal identification details, the couple’s marital status, roles in tax preparation, financial situations, and any asset transfers. It is a pivotal tool for taxpayers seeking equitable relief from joint tax liabilities.

Purpose and Functionality

- Evaluating Tax Relief Claims: The primary function of IRS Form 12508 is to determine eligibility for equitable relief in joint tax liabilities.

- Comprehensive Information Collection: It gathers detailed information, ensuring the IRS has a full understanding of the financial and personal dynamics involved.

- Support for Non-Requesting Spouses: The form serves as a mechanism for spouses who may not have been involved with significant financial decisions but face potential liabilities.

Steps to Complete IRS Form 12508

Completing IRS Form 12508 involves several precise steps that ensure all pertinent information is accurately conveyed.

- Gather Personal Information: Begin by providing basic personal details, including name, address, and Social Security number.

- Marital and Financial Details: Include information about your marriage's duration, your financial contributions, and any asset transfers between spouses.

- Roles in Tax Preparation: Clearly state each partner’s involvement in preparing and filing tax returns.

- Detail Financial Circumstances: Describe your understanding and involvement in the financial aspects of your household.

- Provide Supplemental Information: Attach any additional documents or explanations that support your responses or clarify complex situations.

Detailed Guidance

- Accuracy is Key: Ensure every detail entered is accurate to prevent complications or delays in processing.

- Supporting Documents: Organize and attach relevant financial records, marital documents, and any communication with the IRS that supports your claims.

How to Obtain IRS Form 12508

There are multiple ways to obtain a copy of IRS Form 12508, ensuring accessibility for all taxpayers.

- Online Access: The form is available for download from the IRS official website in PDF format, making it easy for users to access it directly.

- Local IRS Offices: Physical copies can be picked up from IRS offices nationwide.

- Request by Mail: For those who prefer a mailed copy, requesting one through the IRS mailing service is viable.

Considerations for Accessibility

- Digital Formats: Downloading the form allows for easy printing and completion, using software if preferred.

- Assistance Available: IRS offices can offer guidance on obtaining and completing the form accurately.

Key Elements of IRS Form 12508

IRS Form 12508 consists of multiple critical sections that require detailed attention.

- Personal Identification Questions: Provides a baseline for reviewing the spouse’s involvement.

- Assessment of Marital Status: Evaluates how marital dynamics might impact financial responsibilities.

- Roles in Tax Filing: Clarifies each spouse’s responsibility and awareness regarding tax duties.

- Financial Contributions and Transfers: Crucial for understanding the financial interplay in the marriage.

Nuances and Variations

- Varying Degrees of Complexity: Individual circumstances might necessitate different levels of detail.

IRS Guidelines for Completing the Form

Ensuring compliance with IRS guidelines when completing Form 12508 is essential.

- Examine General Instructions: Review comprehensive IRS instructions to understand the requirements thoroughly.

- Verification of Information: Double-check all data for accuracy and completeness.

- Consultation with Tax Professionals: Consider seeking professional advice if any section of the form seems complex or ambiguous.

Adherence to Standards

- Avoid Ambiguities: Providing clear and concise information is imperative.

- IRS Support Resources: Utilize IRS helplines or online resources for additional guidance.

Who Typically Uses IRS Form 12508

The form is predominantly used by certain individuals seeking relief from joint tax liabilities.

- Non-Requesting Spouses: Specifically designed for spouses not directly involved in financial decision-making.

- Taxpayers Seeking Relief: Those requesting equitable relief from joint tax obligations will often find this form necessary.

Scenarios and Examples

- Example Cases: Spouses who were unaware of financial misdoings yet face liabilities will utilize this form to detail their circumstances.

- Diverse Use Cases: Whether under legal separation or divorced but still dealing with past financial issues, this form provides critical documentation support.

Penalties for Non-Compliance

Not adhering to guidelines or incomplete/late submission can attract penalties.

- Potential Fines: Financial penalties may apply for any erroneous or fraudulent submissions.

- Impact on Relief Status: Non-compliance can jeopardize the potential for obtaining relief or may lead to further scrutiny from the IRS.

Avoiding Common Mistakes

- Thorough Review Process: Ensure all information is double-checked and accurately reflects your situation.

- Seek Assistance as Needed: Engaging with tax professionals can prevent costly errors and ensure compliance.

Important Dates and Filing Deadlines

Meeting all deadlines related to IRS Form 12508 is crucial for its effective processing.

- Typical Timeframes: While specific deadlines may vary, aligning submission with tax deadlines is often necessary.

- Reminder Systems: Employ calendar reminders or IRS notification tools to stay informed about key dates.

Ensuring Timely Submission

- Proactive Planning: Begin the process well in advance of any deadline.

- Prompt Resolution of Queries: Address any uncertainties during the completion process swiftly to avoid delays.

By covering these essential blocks, this content ensures users have a comprehensive understanding of IRS Form 12508, aiding in the correct and timely submission of the form.