Definition & Meaning

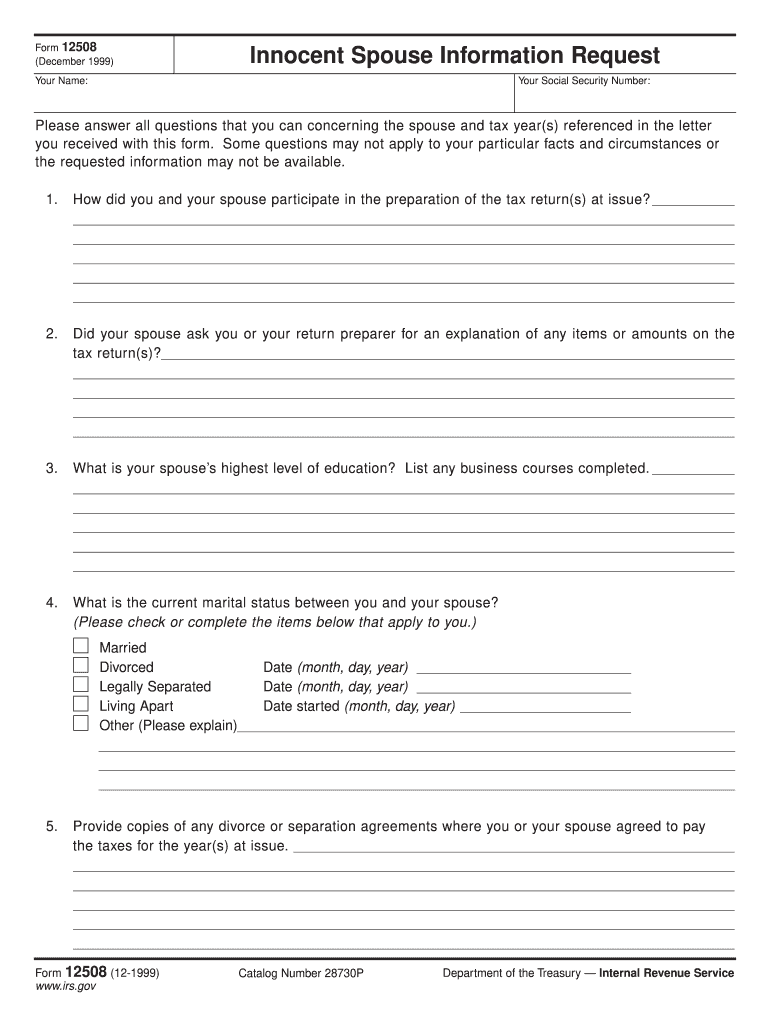

Form 12508 is known as the Innocent Spouse Information Request, issued by the Internal Revenue Service (IRS). It plays a critical role in disputes where an individual seeks relief from being held accountable for their spouse’s tax liabilities. This form collects detailed information about the taxpayer's knowledge and participation in tax filing to determine eligibility for innocent spouse relief. Key sections of the form focus on the individual’s involvement in financial decisions and tax return preparation within the marriage, addressing specific tax years.

How to Use Form 12508

Using Form 12508 involves gathering detailed information about your financial relationship with your spouse. This encompasses understanding both your roles in the tax reporting and financial management within the marriage. Start by reviewing the precise questions laid out in the form, which demand honest documentation of events like the preparation of tax returns, the education level of both spouses, and financial agreements. This information is pivotal in assessing your level of responsibility in the tax liabilities in question.

Steps to Complete Form 12508

Completing Form 12508 requires diligence and precision to ensure all relevant details are accurately captured. Here is a step-by-step guide:

-

Personal Information: Enter basic personal information, including names, addresses, and contact details of both you and your spouse.

-

Financial Contribution: Describe your financial contributions toward shared expenses and savings.

-

Tax Return Involvement: Clearly detail your role in preparing and understanding the joint tax returns.

-

Specific Tax Year Details: Answer questions related to specific tax years and the financial activities during those times.

-

Sign and Date: After completing the form, review for accuracy, then sign and date.

Remember, each section is designed to provide the IRS with a comprehensive view of your financial dynamics and responsibilities.

Who Typically Uses Form 12508

Form 12508 is predominantly used by married individuals or those who were previously married and are seeking relief from tax debts erroneously attributed to them due to their spouse’s actions. These instances can arise in situations of divorce, separation, or ongoing marital disputes where one party was not fully aware of financial misreporting. Often, individuals who were not actively involved in the financial or tax filing processes use this form to legally distance themselves from their spouse's tax errors.

Legal Use of Form 12508

The legal application of Form 12508 is rooted in the U.S. tax laws that allow innocent spouse relief under specific conditions. The form is essentially a taxpayer's statement to the IRS, providing evidence that they should not be held liable for taxes due to errors or omissions on a joint tax return. Eligibility for this relief is strictly assessed based on the documentation provided in Form 12508, aligned with legal criteria established by the IRS.

Key Elements of Form 12508

Form 12508 comprises several critical elements that support the IRS in evaluating the relief application:

- Financial Relationship: Information about how financial responsibilities and tax reporting were shared.

- Involvement in Tax Preparation: Clarification of each spouse’s role in tax-related activities.

- Educational and Financial Understanding: Details on the taxpayer’s education level and understanding of financial matters.

- Marital Contracts and Agreements: Disclosure of any agreements or audits that may influence tax responsibilities.

These components collectively provide a complete picture of the taxpayer's involvement in financial decisions and tax matters.

Examples of Using Form 12508

Consider an individual who discovers post-divorce that their former spouse underreported income, leading to unforeseen tax liabilities. In this scenario, Form 12508 helps demonstrate non-involvement in the financial misconduct. Another case involves a spouse who never participated in the tax filing, thus being unaware of the financial discrepancies. Completing Form 12508 accurately allows such individuals to potentially secure innocence from joint tax debts.

IRS Guidelines

The IRS has explicit guidelines that govern the acceptance and evaluation of Form 12508. These include:

- Eligibility Requirements: Only individuals meeting specific criteria can apply for innocent spouse relief.

- Document Verification: Accurate and thorough documentation is essential in supporting the relief claim.

- Submission Timeliness: Adherence to deadlines for submitting the form and related evidence is crucial for consideration.

Understanding and following IRS guidelines is crucial in improving the chances of a successful application.

Important Terms Related to Form 12508

Several terms are frequently associated with Form 12508 that are important to understand within this context:

- Innocent Spouse Relief: Legal provision allowing a spouse to avoid joint tax liabilities under certain conditions.

- Joint Tax Return: A tax return filed together by married taxpayers.

- Tax Liabilities: The total amount owed to the IRS, potentially including penalties and interest.

- Understatement of Taxes: Occurs when the reported tax amount is less than the owed tax due to errors or omissions.

Knowledge of these terms helps in comprehending the full scope and purpose of Form 12508 and its implications in tax liability cases.