Definition and Meaning

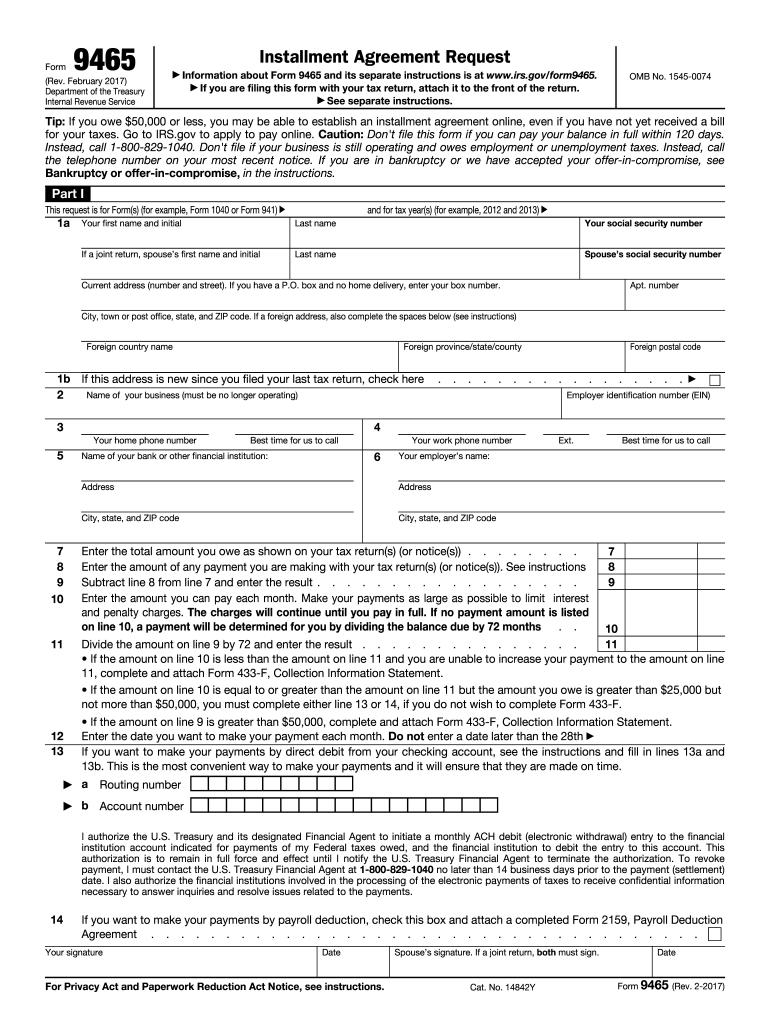

Form 9465, also known as the Installment Agreement Request, is utilized by taxpayers to establish a payment plan for their federal tax liabilities with the Internal Revenue Service (IRS). This form is particularly useful for individuals who owe taxes but are unable to pay the full amount immediately. With the installment agreement, taxpayers can negotiate a manageable monthly payment that allows them to settle their debts over time, providing financial relief and flexibility.

How to Use the 2017 Form 9465

The primary function of the 2017 Form 9465 is to initiate a monthly payment arrangement with the IRS. Taxpayers must accurately fill out the form with essential personal and financial information, including income, expenses, and the amount they propose to pay each month. It's crucial to ensure all data is current and correct to avoid delays or potential rejections. The form can be submitted online or via mail, depending on taxpayer preference and IRS requirements.

Steps to Complete the 2017 Form 9465

- Gather Required Information: Collect all necessary documentation, such as the total tax liability, personal identification details, and financial information including income and expenses.

- Fill Out Personal Information: Accurately provide name, address, Social Security Number (SSN), and any spousal information if applicable.

- Calculate Monthly Payment: Review your financial situation to determine a reasonable monthly payment amount. Consider using IRS guidelines or an IRS representative's assistance to ensure the proposed payment meets their criteria.

- Enter Payment Details: Specify the monthly payment amount and preferred payment day. It's advisable to choose a day shortly after your payday for consistent cash flow.

- Review and Submit: Double-check all entered details for accuracy before submitting the form to the IRS. Consider electronic submission for a quicker response.

Who Typically Uses the 2017 Form 9465

This form is predominantly used by individual taxpayers and small business owners who have found themselves with a balance due after their taxes are assessed. These groups often include self-employed individuals, retirees with unexpected tax obligations, or students who have entered the workforce and faced under-withholding issues. By setting up an installment agreement, these taxpayers can avoid more severe penalties and interest that accrue from unpaid taxes.

Eligibility Criteria

To qualify for an installment agreement using the 2017 Form 9465, taxpayers must meet specific conditions:

- Owe $50,000 or less in combined tax, penalties, and interest if requesting a streamline installment agreement.

- Demonstrate the inability to pay the full tax amount by the due date.

- Agree to pay the full amount within set time frames, normally limited to six years.

- Keep up with all current and future tax obligations and filings.

Required Documents

When completing Form 9465, the IRS may require specific documents to assess and validate the taxpayer's financial situation accurately:

- Copies of recent pay stubs or proof of income.

- Monthly expense statements, such as utilities and rent or mortgage payments.

- Previous year's tax returns if not already filed with IRS information.

- Proof of any additional income or debts to provide a comprehensive view of financial obligations.

Form Submission Methods

Taxpayers have multiple options for submitting their 2017 Form 9465:

- Online: The IRS offers an online application called the Online Payment Agreement, which provides a faster response and adjusts for immediate changes.

- Mail: The completed form can be mailed to the corresponding IRS service center based on the taxpayer's geographical location.

- In-Person: While not commonly used, taxpayers can also visit IRS centers for direct assistance with the form.

Penalties for Non-Compliance

Failure to establish an installment agreement or comply with agreed terms can lead to severe consequences:

- Accrual of additional penalties and interest on the unpaid tax amount.

- Potential wage garnishment, property liens, or bank levies imposed by the IRS.

- Damage to personal credit scores if the IRS takes collection actions.

Accurately utilizing and submitting the 2017 Form 9465 can aid taxpayers in avoiding these outcomes by providing a structured and manageable path to fulfilling their tax obligations.