Definition and Purpose of IRS Form 9465

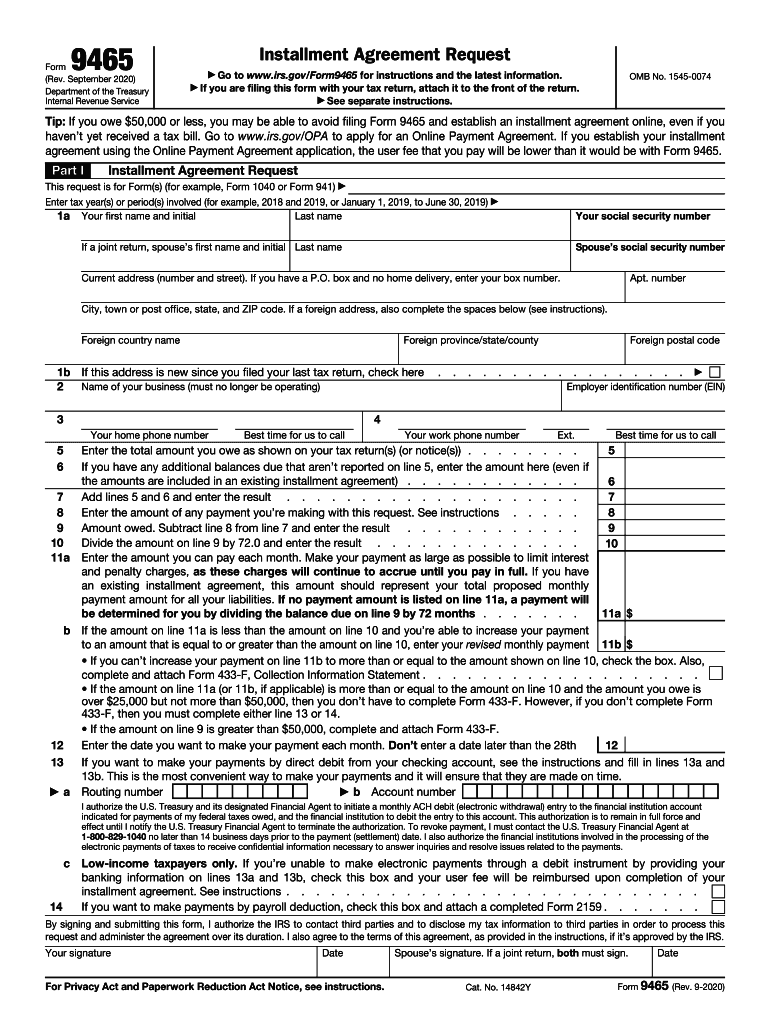

IRS Form 9465, officially known as the Installment Agreement Request, allows taxpayers to propose a monthly payment plan for settling tax liabilities that cannot be paid in full immediately. This form is instrumental in facilitating a structured payment method, easing the financial burden on taxpayers. It provides various sections to detail personal information, tax debt specifics, and proposed payment schedules. By using this form, taxpayers can avoid aggressive collection measures by the IRS while managing their financial obligations in a more controlled manner.

How to Obtain IRS Form 9465

There are several ways to access IRS Form 9465 for taxpayers seeking to establish an installment agreement. You can download the form from the official IRS website, where it is available in PDF format. Alternatively, taxpayers can call the IRS Customer Service and request a physical copy be sent to their mailing address. Additionally, various tax preparation software solutions, like TurboTax and H&R Block, often include this form for user convenience. It is crucial to ensure that you use the most current version of the form to avoid processing delays or errors.

Steps to Complete IRS Form 9465

Completing IRS Form 9465 involves several critical steps that require attention to detail:

- Provide Personal Information: Fill in your full name, Social Security Number, and contact information.

- State Tax Liability: Enter the total amount you owe, including interest and penalties.

- Propose Monthly Payments: Decide on a monthly payment amount that fits your budget and enter this in the designated section.

- Select Payment Method: Choose to pay either through direct debit from a bank account or payroll deductions.

- Additional Information: Include any extra details requested, ensuring the proposal adheres to IRS guidelines.

- Sign and Submit: After reviewing for accuracy, sign the document and submit it as per the given instructions.

Completing each section correctly streamlines the approval process, reducing potential delays or rejections.

Eligibility Criteria for IRS Form 9465

Eligibility for using IRS Form 9465 is predominantly based on the taxpayer's financial situation and the amount owed. Generally, this form is applicable if your total tax liability does not exceed $50,000. If the owed amount is higher, taxpayers may need to provide additional financial documentation or consider different payment options. The IRS might also consider your current level of compliance with filing and payment obligations before approving the installment request. Ensuring that all previous tax filings are up to date can improve the likelihood of approval.

Key Elements of IRS Form 9465

IRS Form 9465 encompasses several key elements vital for structuring a payment plan:

- Personal and Financial Information: Name, address, Social Security Number, bank details (if applicable).

- Tax Liability Details: Exact amounts owed to the IRS.

- Proposed Payment Terms: Monthly payment figures and preferred payment methods.

- Signatures: Taxpayer's endorsement confirming the accuracy and intention to pay.

Understanding these components ensures comprehensive preparation and submission of the form, thereby facilitating smoother processing by the IRS.

IRS Guidelines for Using Form 9465

The IRS provides specific guidelines to ensure the proper use of Form 9465. Taxpayers are advised to propose a monthly payment that is both feasible and substantial enough to settle the debt within a reasonable timeframe. The IRS expects adherence to these guidelines to prevent default on the agreement. Detailed instructions accompany the form to assist taxpayers in calculating appropriate figures and understanding their obligations once a plan is in place. Additionally, maintaining good communication with the IRS during the installment period can prevent unnecessary complications.

Form Submission Methods for IRS Form 9465

Submitting IRS Form 9465 can be done through various channels:

- Online Filing: Available through the IRS website for users comfortable with digital processes.

- By Mail: Traditional submission via postal services, requiring completion of the paper version.

- In-Person: Submission at an IRS office for taxpayers preferring direct interaction.

Each method has its own set of instructions and timelines, and choosing the right one depends on your preference for speed, security, and convenience.

Penalties for Non-Compliance

Failing to comply with the terms set forth in IRS Form 9465 can result in significant penalties. Taxpayers who default on their installment agreement may face additional interest and late payment penalties. The IRS also retains the right to revoke the arrangement and initiate collection actions, including garnishments and liens. Ensuring timely payments and communication with the IRS if experiencing financial hardship is crucial to maintain compliance and avoid these potential repercussions.

Practical Examples of Using IRS Form 9465

Real-world scenarios demonstrate the utility of IRS Form 9465. For instance, a self-employed individual with irregular income can benefit from an installment agreement by aligning payments with their cash flow. Similarly, retirees who exceed withholding amounts on pensions might use Form 9465 to spread tax liability over time. These examples underscore the form's adaptability to various financial circumstances, providing taxpayers with customizable solutions to manage tax debts effectively.

Application Process and Approval Time for IRS Form 9465

The application process for IRS Form 9465 involves gathering necessary financial information, accurately completing the form, and choosing an appropriate submission method. Once submitted, the IRS typically takes four to six weeks to process requests. Approval time may vary based on the complexity of the case and compliance with eligibility criteria. Meanwhile, taxpayers should continue making regular payments on any existing tax liabilities to prevent further penalties while their request is pending.