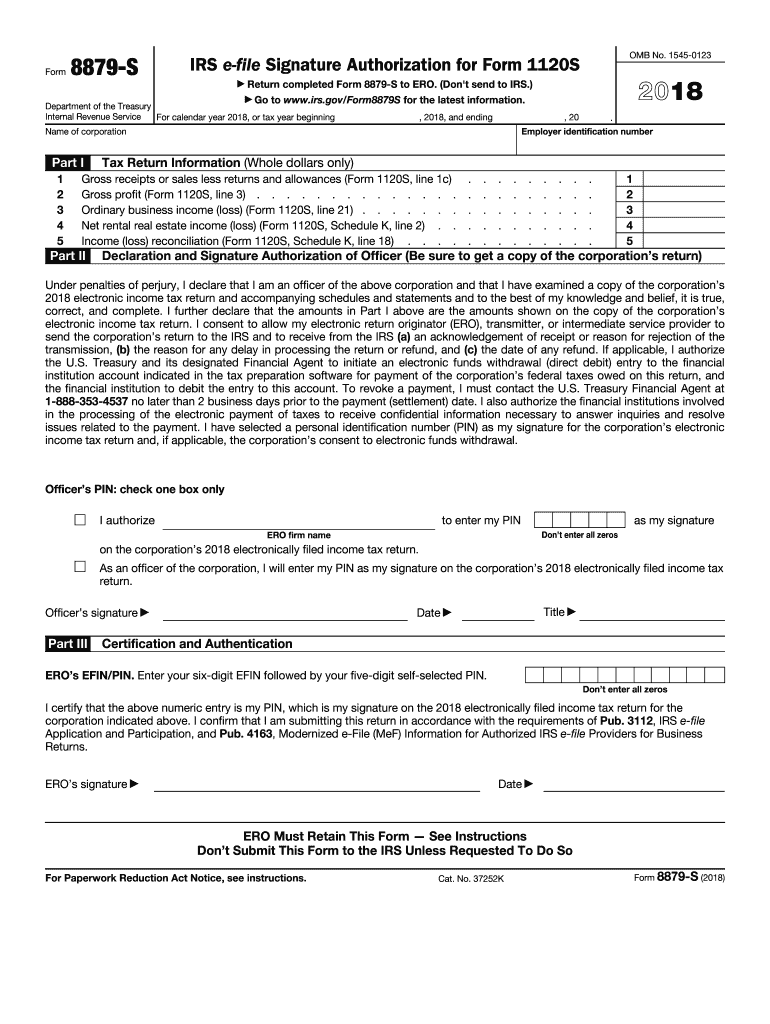

Definition and Purpose of the 2012 Blank 8879 Form

The 2012 blank 8879 form is known as the IRS e-file Signature Authorization. It is used to authorize an electronic return originator (ERO) to enter a taxpayer's personal identification number (PIN) on electronically filed tax returns. This form facilitates the electronic signing of the IRS Form 1040 series tax returns. The primary advantage of utilizing this form is that it simplifies the e-filing process for taxpayers, allowing them to provide consent for electronic submission without a physical signature. This form is essential for ensuring compliance with IRS requirements for electronic filing.

How to Use the 2012 Blank 8879 Form

- Authorization Process: The taxpayer must first review the return and verify its accuracy before completing Form 8879. This ensures the taxpayer is fully aware of the details being filed.

- PIN Documentation: After verification, the taxpayer authorizes the ERO to input a self-selected PIN onto the IRS e-filing system.

- Submission: Once the authorization is complete, the ERO will submit the tax return and retain Form 8879 in their records for at least three years.

Obtaining the 2012 Blank 8879 Form

Taxpayers and EROs can obtain the 2012 blank 8879 form directly from the IRS website as a downloadable PDF. Alternatively, many tax preparation software programs include this form within their system, integrating it into their electronic filing process. It is crucial for taxpayers to ensure that they have the correct year's form to match their tax return.

Steps to Complete the 2012 Blank 8879 Form

- Review Tax Return: Ensure all information on the tax return planned for e-filing is correct.

- PIN Selection: Choose a five-digit PIN that serves as an electronic signature.

- Sign and Date: Both the taxpayer and the ERO must sign and date the form.

- ERO Verification: Include the ERO's information and the date of IRS e-file submission.

Why Use the 2012 Blank 8879 Form

Using the 2012 blank 8879 form is advantageous for accelerating the tax filing process. It eliminates the need for physical signatures, reducing the potential for errors and processing delays. Additionally, this form complies with the IRS e-filing requirements, ensuring that taxpayers can electronically sign their returns with ease while maintaining legal validity.

Eligible Users of the 2012 Blank 8879 Form

Typically, this form is used by individual taxpayers who are filing their Form 1040 series returns electronically. This includes self-employed individuals, retirees, and business professionals who prefer the efficiency and speed of electronic filing over paper submissions. The form simplifies the authorization process for these individuals, ensuring faster processing times and receipt of tax refunds.

Key Elements of the 2012 Blank 8879 Form

- Taxpayer's Name and SSN: Essential for verifying identity.

- Declaration Control Number (DCN): Tracks the e-file submission.

- Tax Year: Crucial for ensuring the form corresponds to the correct fiscal year.

- Signatures and Dates: Both taxpayer and ERO signatures are required to validate authorization.

Important Terms Related to the 2012 Blank 8879 Form

- EROs (Electronic Return Originators): Professionals authorized to submit electronic tax returns.

- PIN (Personal Identification Number): Used for electronic signature purposes.

- DCN (Declaration Control Number): A unique identifier assigned to each e-filed return for tracking purposes.

Legal Use and Compliance of the 2012 Blank 8879 Form

The 2012 blank 8879 form must be used in strict compliance with IRS regulations to ensure it meets legal standards. This includes maintaining the form as a part of the taxpayer's return records for at least three years from the filing date. Failure to comply can result in penalties or audits by the IRS. The form also ensures that the taxpayer consents explicitly to electronic filing, maintaining both the integrity and security of their tax return process.