Definition & Meaning

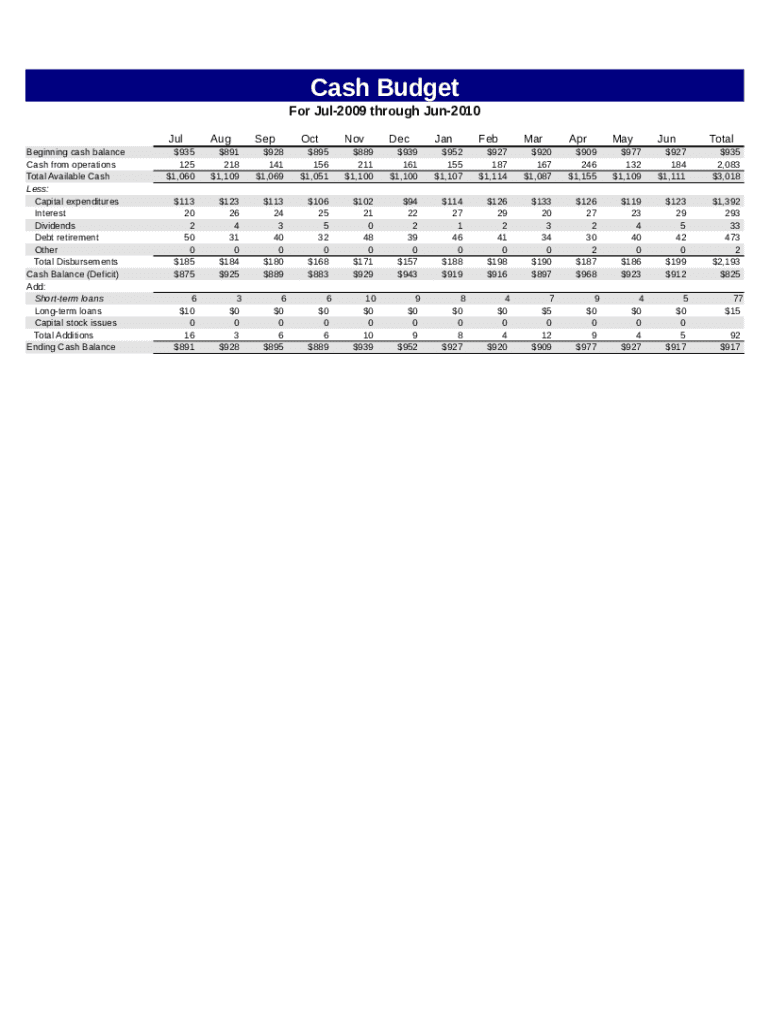

A cash flow worksheet form is a structured financial document used to track the inflow and outflow of cash over a specific period. It serves as a comprehensive tool to document all sources of income and expenses, helping individuals and businesses maintain liquidity and manage their financial resources effectively. The form typically includes sections for various categories of income, such as operations and investments, as well as categories of expenses, including operating expenses and capital expenditures. By analyzing the data in a cash flow worksheet, businesses can make informed decisions about budgeting, planning for future expenses, and identifying areas for cost reduction.

Key Elements of the Cash Flow Worksheet Form

The cash flow worksheet form comprises several essential components designed to facilitate a thorough analysis of cash movement:

- Beginning Cash Balance: The amount of cash available at the start of the period.

- Cash Inflows: Includes cash from operations, investments, and other sources.

- Total Available Cash: The sum of beginning cash balance and cash inflows.

- Disbursements: Covers all cash outflows, such as loan repayments, capital expenditures, and operating expenses.

- Ending Cash Balance: Calculated by subtracting total disbursements from total available cash, showing the cash remaining at the end of the period.

Each section allows users to track financial transactions meticulously, providing a clear picture of their cash flow status.

Steps to Complete the Cash Flow Worksheet Form

Completing a cash flow worksheet form involves several key steps, ensuring all financial transactions are accurately recorded:

- Gather Financial Documents: Collect all relevant financial statements, invoices, and receipts for the period.

- Record Income Sources: Identify and document all cash inflows, including sales revenue, rental income, and interest received.

- Document Expenses: List all outflows, such as salaries, rent, utilities, and loan payments.

- Calculate Total Cash Inflows and Outflows: Sum up all recorded inflows and disbursements to determine net cash flow.

- Verify Accuracy: Review entries for consistency and correctness, ensuring all transactions are accounted for.

- Analyze Results: Use the completed form to assess the financial health and cash flow trends over the designated period.

Properly executing each step provides valuable insights into financial operations and supports strategic decision-making.

How to Use the Cash Flow Worksheet Form

Once completed, the cash flow worksheet form is a versatile tool for financial analysis. It can be used to:

- Budgeting: Establish spending controls by mapping expenses against inflows.

- Financial Forecasting: Project future cash needs and identify potential shortfalls.

- Investment Analysis: Examine the impact of potential investments on cash flow.

- Expense Management: Spot unnecessary costs and implement savings strategies.

- Performance Evaluation: Review how well actual cash flow aligns with projected figures.

By leveraging the form's insights, users can enhance financial planning and achieve better control over their cash management processes.

Legal Use of the Cash Flow Worksheet Form

In the United States, accurate financial documentation is crucial for legal and tax compliance. A cash flow worksheet form can support:

- Tax Reporting: Providing detailed records that facilitate accurate income and expense reporting to the IRS.

- Compliance Audits: Offering documentation that proves financial practices adhere to industry regulations.

- Contractual Obligations: Demonstrating financial stability when seeking loans or entering partnerships.

Maintaining an up-to-date and precise cash flow worksheet helps safeguard against potential legal disputes and penalties.

Important Terms Related to Cash Flow Worksheet Form

Understanding the terminology used within a cash flow worksheet is essential for accurate completion and analysis:

- Liquidity: The availability of cash to meet immediate and short-term obligations.

- Capital Expenditures: Investments in long-term assets to enhance business capabilities.

- Operating Activities: Day-to-day business functions generating cash flow.

- Net Cash Flow: The difference between total inflows and total disbursements, indicating overall liquidity.

Familiarity with these terms helps users accurately categorize financial data and interpret the results correctly.

Examples of Using the Cash Flow Worksheet Form

Consider a small retail business tracking its monthly cash flow:

- Inflows: Includes sales revenue from products sold, rebates on supplies, and interest from bank accounts.

- Outflows: Accounts for employee salaries, rent, inventory purchases, and utility bills.

- Analysis: Enables the owner to identify periods of surplus or deficit, allowing for strategic adjustments in stock levels or marketing efforts to optimize cash flow.

Such practical examples illustrate the value of a well-managed cash flow worksheet in real-world financial management.

Software Compatibility

The cash flow worksheet form typically integrates seamlessly with various accounting software solutions and platforms:

- QuickBooks: Offers tools to automate recording and analyzing transactions, streamlining the cash flow management process.

- Excel: Facilitates the customization and manual input of financial data, allowing for detailed calculations and charting.

- Google Sheets: Provides an accessible way to share and edit the worksheet in a collaborative environment.

These integrations enhance the versatility of the cash flow worksheet and improve the accuracy and efficiency of financial analysis.