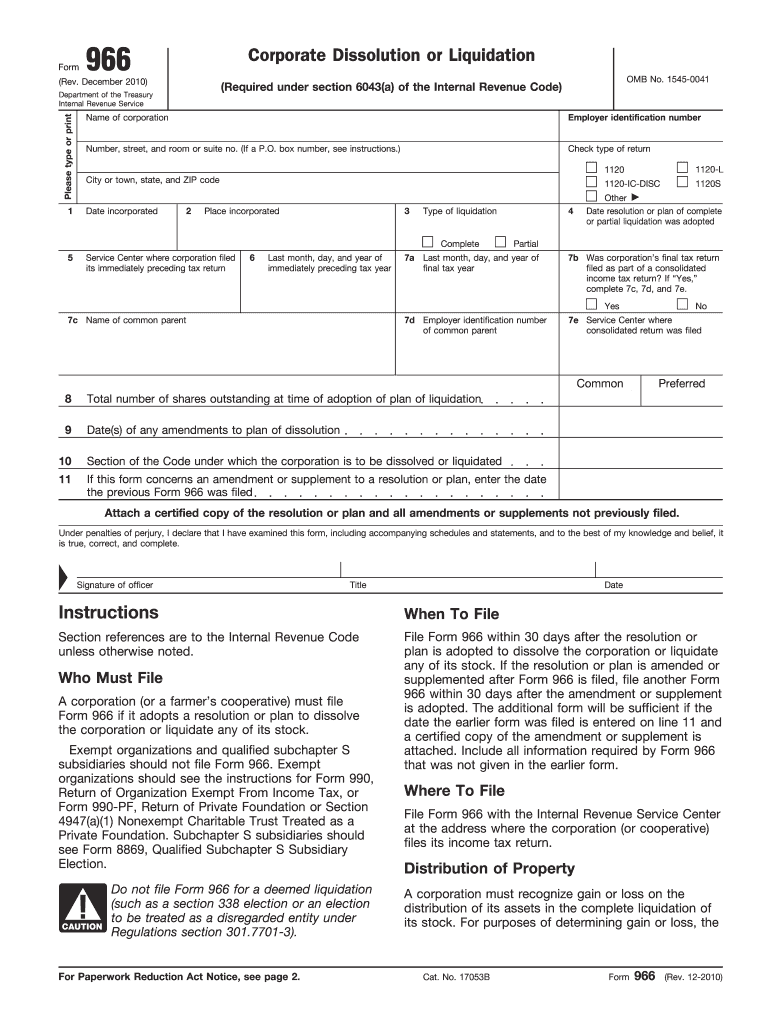

Definition and Purpose of Form 966

Form 966, officially known as the "Corporate Dissolution or Liquidation" form, is required by the IRS for corporations planning to dissolve or liquidate. This form notifies the IRS about the corporation’s intent to cease its operations formally. By submitting Form 966, the corporation provides essential information about the dissolution plan or resolution, which helps the IRS to update its records and manage tax obligations accurately.

Key Elements of Form 966

Form 966 requires detailed information about the corporation, including:

- Corporation Name and EIN: The legal name of the corporation and its Employer Identification Number.

- Plan of Dissolution or Liquidation: Specifics of the plan adopted by the shareholders, including the date of adoption.

- Type of Liquidation Plan: Whether the dissolution is a complete or partial liquidation, with detailed descriptions of each type.

- Additional Amendments: Changes to the original plan, if applicable.

Detailed Steps to Complete Form

-

Gather Corporate Details: Collect the necessary identification information such as the corporation's legal name, address, and EIN.

-

Review Tax Obligations: Ensure all tax obligations and corporate dues are addressed prior to dissolution.

-

Complete Plan Details: Provide detailed information about the resolution or plan, including the date it was adopted and the type of liquidation.

-

Outline Changes: Document any amendments or changes to the original dissolution plan.

-

Sign and Submit: After completing all required sections, an authorized officer must sign the form before submission to ensure accuracy and compliance.

IRS Guidelines for Filing Form

The IRS provides specific guidelines on the filing process. Corporations must file Form 966 within 30 days of adopting a plan to dissolve or liquidate. The form must be sent to the IRS Processing Center. This requirement ensures proper handling and acknowledgment of the corporation's closure.

Filing Deadlines and Important Dates

- Adoption Date: The plan or resolution date must be documented.

- Deadline for Filing: Corporations should file the form within 30 days of plan adoption to avoid penalties.

- Annual Tax Return: The corporation’s final tax return must reflect its dissolution status.

Who Typically Uses Form

Corporations planning to cease operations use Form 966. This form is predominantly utilized by:

- Large Corporations: Businesses with a complex structure planning to dissolve entirely.

- Small Businesses: Firms opting for liquidation due to financial difficulties or strategic restructuring.

- Foreign Corporations: Those that must comply with U.S. tax laws when dissolving operations involving U.S. returns.

Business Entity Types Benefiting from Form 966

- Corporations (C Corps and S Corps): As the form applies specifically to corporate entities undergoing dissolution.

- Foreign Entities with U.S. Presence: Required to file if dissolving U.S.-based activities.

How to Obtain the Form

Form 966 is accessible on the official IRS website. Corporations can download and print the form for manual completion and submission. Alternatively, tax software platforms like TurboTax and QuickBooks provide tools to obtain and fill out the form digitally, integrating seamlessly with existing business tax solutions.

Software Compatibility

- TurboTax: Offers guided filing options and ensures accuracy in submitting Form 966.

- QuickBooks: Integrates financial data for streamlined form completion and submission.

Penalties for Non-Compliance

Failure to file Form 966 timely can result in penalties imposed by the IRS. Non-compliance might also complicate future dealings with the IRS and could potentially lead to financial audits.

Legal Consequences

Corporations that do not adhere to the requirements may face fines, interest on overdue taxes, and legal challenges resulting from inaccuracies in dissolution filings.

Important Terms Related to Form

- Dissolution: Formal closing of the corporation and cessation of its business activities.

- Liquidation: Distribution of remaining assets to shareholders after settling liabilities.

- EIN (Employer Identification Number): A unique identifier for the corporation used throughout its operations and during dissolution.

These terms provide clarity on the procedural and legal aspects attached to the filing and submission of Form 966.