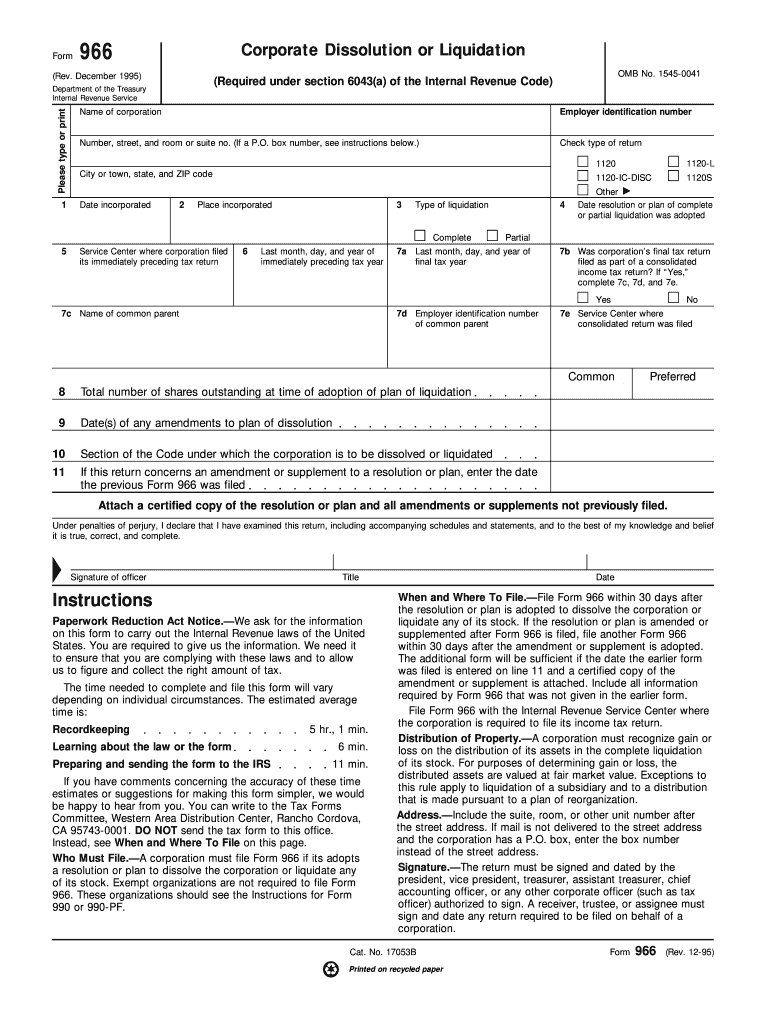

Definition and Purpose of Form 966

Form 966 is a document required by the Internal Revenue Service (IRS) for corporations that are adopting a resolution or plan to dissolve or liquidate. The form provides the IRS with critical details about the business, including corporate information, the type of liquidation being undertaken, and other essential information. The form serves as a formal notification to the IRS, which helps in the proper monitoring and regulation of corporate liquidations.

How to Obtain Form 966

Form 966 can be accessed directly from the IRS website, ensuring that you are using the most current version. Additionally, many tax software programs, such as QuickBooks and TurboTax, include this form as part of their service offerings. It's important to ensure you have all necessary documents ready when downloading the form to facilitate its completion.

Steps to Complete Form 966

- Gather Corporate Information: Begin by collecting accurate details about your corporation, such as its name, address, and Employer Identification Number (EIN).

- Indicate the Resolution Date: State the date on which the corporation's board of directors or shareholders adopted the resolution or plan to dissolve or liquidate.

- Describe the Type of Liquidation: Specify whether the liquidation is complete, partial, or phased.

- Attach Supporting Documents: Gather any additional documents that may support the dissolution or liquidation plan, including board minutes or shareholder resolutions.

- Submit the Form: Ensure the form is signed by an authorized representative before it is mailed or submitted electronically, if applicable.

Filing Deadlines for Form 966

The IRS mandates that Form 966 must be filed within 30 days after the resolution or plan for liquidation has been adopted. Missing this deadline may result in penalties or delayed processing of the liquidation.

Important IRS Guidelines

When filing Form 966, it is crucial to adhere to IRS guidelines concerning the accuracy and completeness of the data submitted. Any misrepresentation or omission might lead to penalties or additional scrutiny from the IRS. Always reference the latest IRS publications for detailed instructions related to corporate liquidations.

Form Submission Methods

- Mail: Form 966 can be mailed to the IRS at the address specified in the IRS instructions for your corporation's geographic location. This is often required to ensure proper handling and processing.

- Electronic Submission: Some corporations may qualify to submit Form 966 electronically through authorized IRS e-file providers.

- In-Person Delivery: Although less common, some may opt to hand-deliver their forms directly to an IRS office to receive immediate acknowledgment of receipt.

Penalties for Non-Compliance

Failing to file Form 966 on time or submitting inaccurate information can result in penalties. The IRS emphasizes the importance of compliance to avoid such consequences, which may include monetary fines or additional audits.

Business Types Using Form 966

Form 966 is typically used by corporations considering the dissolution or liquidation of their business. It is not generally applicable to other types of business entities such as partnerships or sole proprietorships, unless these are part of a corporate group undergoing liquidation.

Legal Implications and Use

Corporations must understand the legal ramifications of liquidation and dissolution, as well as ensure that their use of Form 966 complies with both federal and state laws. Proper legal advice should be sought, if necessary, to navigate complex scenarios and implications related to asset distribution and liability handling.