Definition and Purpose of Form 966

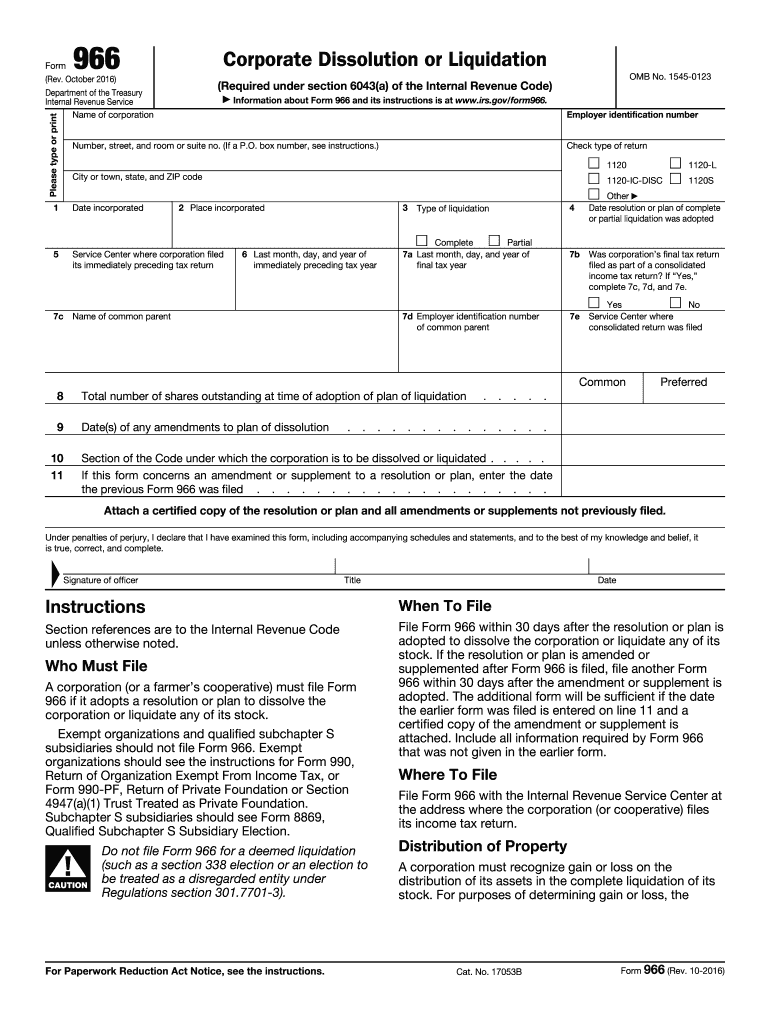

Form 966, also known as the "Corporate Dissolution or Liquidation" form, is a document mandated by the Internal Revenue Service (IRS) for corporations that decide to dissolve or liquidate. The form is critical in ensuring compliance with federal tax laws by notifying the IRS about the impending cessation of a corporation’s activities. When a corporation decides to dissolve or liquidate, it must inform the IRS by filing Form 966. This document helps the IRS keep track of the corporation’s decision to end its business operations. In return, the corporation is expected to ensure accurate and honest reporting to avoid potential legal ramifications.

Key Elements of Form 966

Form 966 consists of several essential sections that corporations are required to complete accurately. These sections include:

- Corporation's Name and Address: The legal name and registered address of the corporation.

- Employer Identification Number (EIN): A unique number assigned by the IRS to identify the corporation.

- Type of Liquidation: Details on whether the corporation is undergoing a complete or partial liquidation.

- Dates Involved: Relevant dates, such as when the resolution to dissolve was adopted.

Importance of Accurate Information

Providing accurate information is crucial as discrepancies can lead to penalties or delays in processing. The form should be filled with high attention to detail, ensuring all sections are completed in accordance with IRS instructions.

How to Use Form 966

Corporations planning to dissolve must utilize Form 966 to officially notify the IRS of their intent. It's an integral step in the dissolution process and should be completed promptly within the specified timeline. Here’s how a corporation should use Form 966:

- Obtain the Form: Access Form 966 via the IRS website or through tax software solutions compatible with IRS forms.

- Complete the Form: Fill out all relevant sections, ensuring that the information provided aligns with the corporate records.

- Submit the Form: File the completed form with the IRS within the required timeframe. Different submission methods are available, including mail and online filing through IRS-approved platforms.

Filing Deadlines and Important Dates

To ensure compliance, corporations must adhere to the filing deadlines specified by the IRS for Form 966:

- Filing Deadline: Form 966 must be filed within 30 days of adopting the resolution to liquidate or dissolve.

- Failure to Meet Deadlines: Missing the filing deadline can result in penalties or delays in processing the corporation’s dissolution.

Understanding and adhering to these deadlines is critical for a smooth dissolution process and compliance with federal tax regulations.

Steps to Complete Form 966

Completing Form 966 involves several precise steps that require careful attention to detail:

- Gather Required Information: Ensure all corporate records are up-to-date and available for reference when filling out the form.

- Provide Corporate Details: Accurately enter the corporation’s legal name and address, EIN, and other identifying information.

- Detail the Type of Liquidation: Indicate whether the dissolution is complete or partial.

- Record Relevant Dates: Enter key dates regarding the adoption of the dissolution plan.

- Review and Submit: Double-check all information for accuracy before submitting the form to the IRS.

Required Documents for Form 966

Filing Form 966 necessitates the inclusion of several supporting documents to ensure the IRS has all necessary information:

- Corporate Resolution: Documentation proving the decision to dissolve.

- Financial Statements: Recent financial documents reflecting the corporation’s financial status.

- Any Other IRS-required Forms: Additional forms as specified by IRS guidelines, if applicable.

These documents serve to verify the corporation’s decision and status, supporting the information provided on Form 966.

Penalties for Non-Compliance

Failing to comply with IRS regulations regarding Form 966 can lead to several penalties:

- Fines and Interest: The IRS may impose financial penalties for non-compliance.

- Legal Ramifications: Continued non-compliance could lead to legal consequences.

- Delays in Dissolution Process: Non-compliance may result in delays in the processing of the corporate dissolution.

Avoiding penalties is critical, necessitating strict adherence to filing requirements and timelines.

Legal Use of Form 966

The legal use of Form 966 is pivotal for corporations undergoing dissolution:

- Official Notification: Signals the corporation’s intention to cease operations to the IRS.

- Compliance with Tax Laws: Ensures the corporation adheres to federal tax requirements in the dissolution process.

- Protection from Future Liabilities: Proper completion and submission can protect the corporation from potential legal liabilities linked to dissolution.

IRS Guidelines

Comprehensive understanding of IRS guidelines for Form 966 is necessary for successful completion:

- Instructions: The IRS provides specific instructions for each section of the form.

- Eligibility Criteria: Only corporations undergoing dissolution should file Form 966.

- Submission Methods: IRS-approved methods for submission include mail and certain digital platforms.

Adhering to these guidelines ensures compliance and facilitates a smooth dissolution process for corporations.