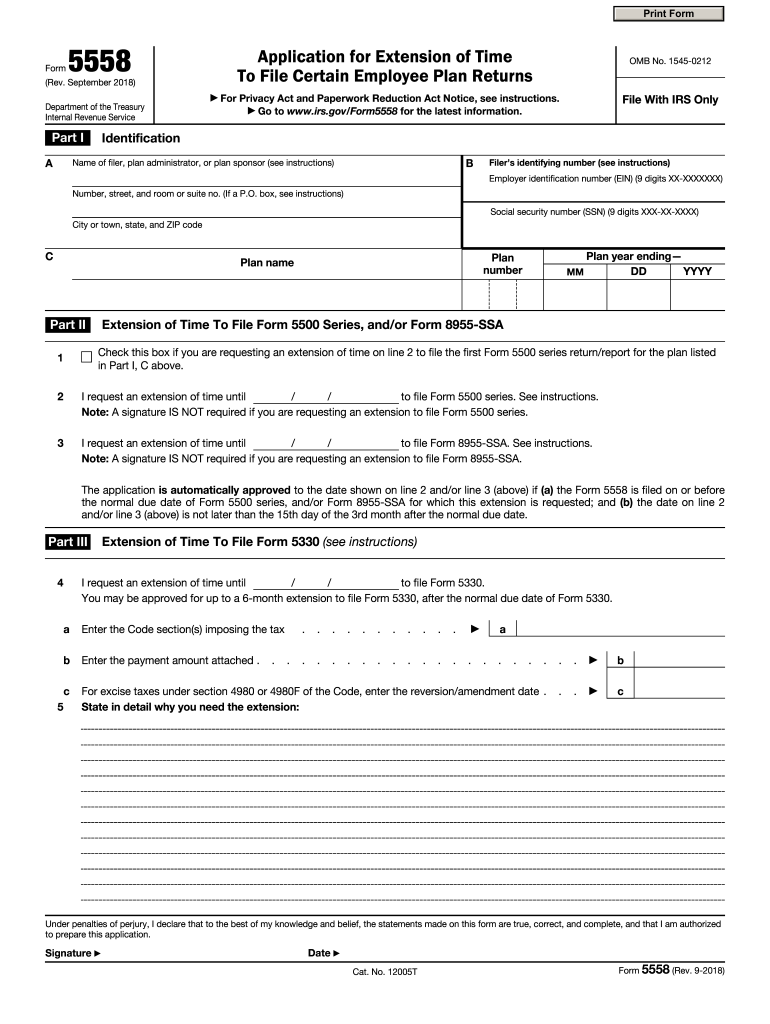

Definition and Purpose of Form 5558

Form 5558, officially known as the "Application for Extension of Time to File Certain Employee Plan Returns," is used to request an extension for filing returns related to employee benefit plans. These include the Form 5500 series and Form 5330, among others. Form 5558 is integral in helping organizations gain additional time without penalties to ensure accurate and compliant filings, thereby assisting in proper financial and regulatory reporting.

Steps to Complete Form 5558

Completing Form 5558 correctly ensures that one can secure the necessary extension without delays. Follow these steps:

- Identify Forms Requiring Extension: Clearly indicate which employee plan returns require extended time on Form 5558.

- Provide Basic Information: Include essential information such as the employer's name, address, and Employer Identification Number (EIN).

- Complete Necessary Sections: Fill out the form's sections dedicated to specific filing extensions being requested.

- Double-Check Details: Before submission, ensure all entered data is correct to avoid processing setbacks.

These steps, when followed diligently, enable effective handling of the form to secure the desired extension.

How to Obtain the Form 5558

Form 5558 can be accessed through multiple channels:

- IRS Website: The form is available for download directly from the IRS website in a printable PDF format.

- Tax Software Packages: Some tax preparation software solutions offer the ability to fill out Form 5558 directly within the software.

- Tax Advisors and Consultants: Engaging with tax professionals or consultants can often result in them providing you with a copy of the form, alongside valuable advice on its completion.

By utilizing these resources, obtaining the form becomes straightforward and accessible for those needing it.

Filing Deadlines and Important Dates

Timely submission of Form 5558 is critical:

- Initial Deadline: Generally, Form 5558 must be filed before the original due date of the employee plan return being extended.

- No Extensions for Extensions: Note that Form 5558 itself cannot be extended, so adhere strictly to the initial filing deadlines.

Ensure awareness of pertinent dates to maintain compliance and prevent potential late filing penalties.

Who Typically Uses Form 5558

Form 5558 is primarily utilized by:

- Businesses with Employee Benefit Plans: Entities with pension or welfare benefit plan obligations when more time is required for accurate form filing.

- Plan Administrators: Those managing the logistics of benefit plans who need additional filing time.

- Tax-Exempt Organizations: Non-profit organizations that oversee benefit plans needing to extend filing deadlines.

This form is essential for these groups to maintain regulatory compliance with employee plan reporting requirements.

Legal Use of Form 5558

Legal adherence is paramount when using Form 5558:

- Single Use Only: The form permits a one-time extension request per filing, so ensure complete and accurate submission the first time.

- Mandatory Compliance: While no signature is required for many extensions under Form 5558, all tax payments associated with the filing must occur by their due dates.

Adhering to these legal guidelines ensures the extension request is valid and your entity remains compliant.

Penalties for Non-Compliance

Failure to file or inaccurately completing Form 5558 can yield serious consequences:

- Late Filing Penalties: If the form is filed late, or not at all, resulting in a missed deadline for the affected plan return, significant financial penalties can be levied.

- Interest on Overdue Taxes: Interest may accrue on any tax payments associated with delayed filings, increasing the financial burden.

Recognizing these risks underscores the importance of timely and accurate filing of Form 5558 to avoid unnecessary penalties.

Examples of Using Form 5558

Consider the following scenarios where Form 5558 proves invaluable:

- A Large Corporation: Needs more time to compile complex data for several employee benefit plans, hence files a Form 5558 to extend their Form 5500 series deadline.

- A Non-Profit Organization: Is undergoing structural changes affecting its employee benefits, so it seeks an extension via Form 5558 for adequate resolution time before submitting Form 5330.

These scenarios illustrate the form's flexibility and utility across various organizations needing controlled filing extensions.

IRS Guidelines and Instructions

Understanding IRS guidelines for Form 5558 is critical:

- IRS Publication Guidance: Official IRS publications provide comprehensive guides on completing and submitting Form 5558 effectively.

- Eligible Extensions: The form covers extensions for specific filings, underscoring which can and cannot be postponed.

Staying current with IRS-issued guidelines ensures a firm understanding of using Form 5558 effectively and in accordance with federal requirements.