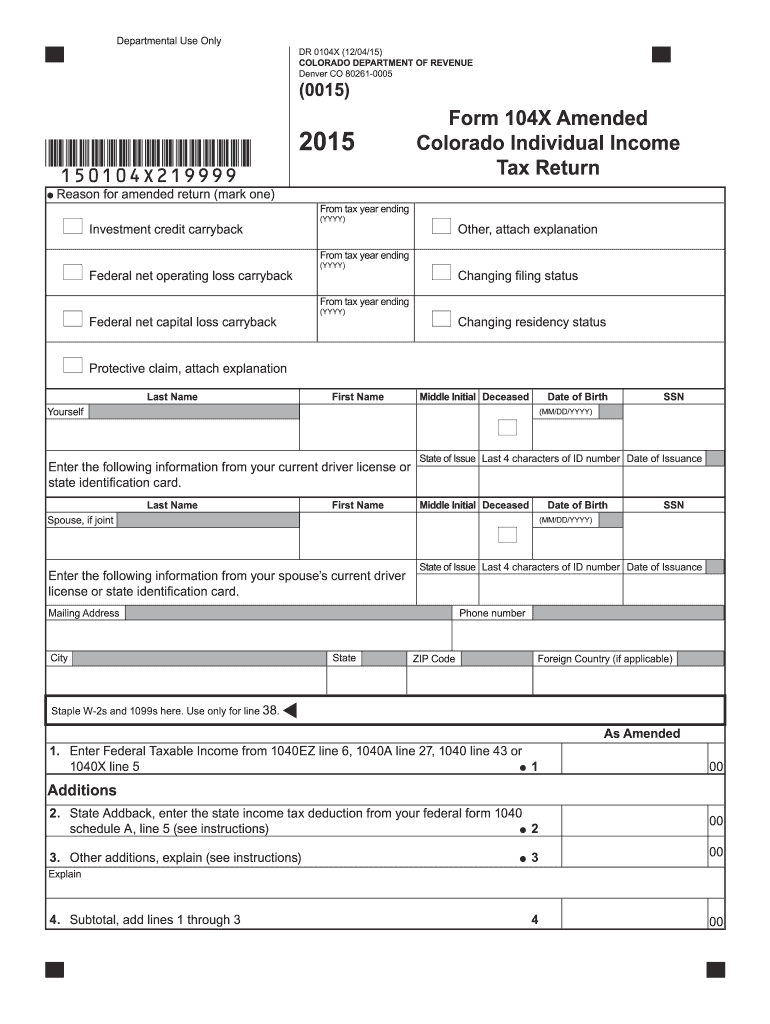

Definition and Overview of the 2015 Colorado Form 104X

The 2015 Colorado Form 104X is the official amendment form for the Colorado Income Tax Return. This form allows taxpayers to correct errors or make changes to their previously submitted income tax returns for the tax year 2015.

Important aspects of Form 104X include:

- Purpose: To amend previously filed income tax returns to ensure accuracy in reported income, deductions, and tax credits.

- Eligibility: Any individual taxpayer who finds discrepancies in their originally filed income tax return can use this form.

- Legal Basis: The use of Form 104X is governed by Colorado state tax regulations, ensuring compliance with both state and federal laws.

This form is essential for maintaining accurate tax records and may also be necessary for the proper calculation of refunds or outstanding tax obligations.

Steps to Complete the 2015 Colorado Form 104X

Filing the 2015 Colorado Form 104X requires a structured approach to ensure all necessary information is included and accurate. The following steps outline the process:

-

Gather Documentation: Collect all relevant documents, including the original tax return, supporting documentation for any changes, and any additional forms needed (e.g., W-2s, 1099s).

-

Obtain the Form: Access the 2015 Colorado Form 104X from the Colorado Department of Revenue website or through other official sources.

-

Complete the Form:

- Identification Section: Provide your name, Social Security number, and filing status.

- Amendment Details: Clearly indicate the changes being made. This may involve correcting income figures, changing deductions, or adjusting credits.

- Explanation of Changes: Offer a brief explanation for why you are amending the return in the designated section.

-

Attach Required Documentation: Include copies of any forms or documents that support the changes you are making. This ensures that the amendment is processed accurately.

-

Review for Accuracy: Carefully check all entries for completeness and correctness before submission.

-

Submit the Form: File the completed Form 104X either electronically or by mail based on your preference and applicable guidelines from the Colorado Department of Revenue.

Important Dates and Filing Deadlines for the 2015 Colorado Form 104X

Filing deadlines for the 2015 Colorado Form 104X are crucial to comply with state tax regulations. Key dates include:

- Initial Filing Deadline: The original income tax return for 2015 was due on April 18, 2016.

- Amendment Filing Period: Taxpayers can file Form 104X within three years of the original filing date or within two years of paying the tax owed, whichever is later.

- Deadline for Refund Claims: If amending for a refund, be aware that claims must be submitted within the specified timelines to ensure eligibility for any adjustments.

Staying within these deadlines is vital to avoid potential penalties and to secure any refunds owed from prior years.

Submission Methods for the 2015 Colorado Form 104X

The 2015 Colorado Form 104X can be submitted in several ways, each with its own benefits:

-

Electronic Filing: Taxpayers can utilize online tax preparation software to file their amendments electronically. This method typically allows for quicker processing times and confirmation of submission.

-

Mail Submission: For those who prefer a manual approach, Form 104X can be printed, completed, and mailed to the Colorado Department of Revenue. Ensure that the proper address is used for tax amendments to avoid processing delays.

-

In-Person Submission: Some taxpayers may opt to drop off their form at a local Department of Revenue office. This option may provide immediate confirmation of receipt.

Choosing the appropriate submission method depends on individual preferences and the urgency of the amendment.

Who Typically Uses the 2015 Colorado Form 104X

The 2015 Colorado Form 104X is relevant for various taxpayers, including:

-

Individual Taxpayers: Anyone who filed a personal income tax return for 2015 and needs to make corrections or updates can use this form.

-

Self-Employed Individuals: Those operating as freelancers or business owners may find it necessary to amend their returns due to changes in income or eligible deductions.

-

Taxpayers Seeking Refunds: Individuals who discover they overpaid their taxes will need to submit Form 104X to claim their refunds properly.

Understanding the diverse user base for this form highlights its importance in maintaining accurate tax records and ensuring compliance with state tax laws.