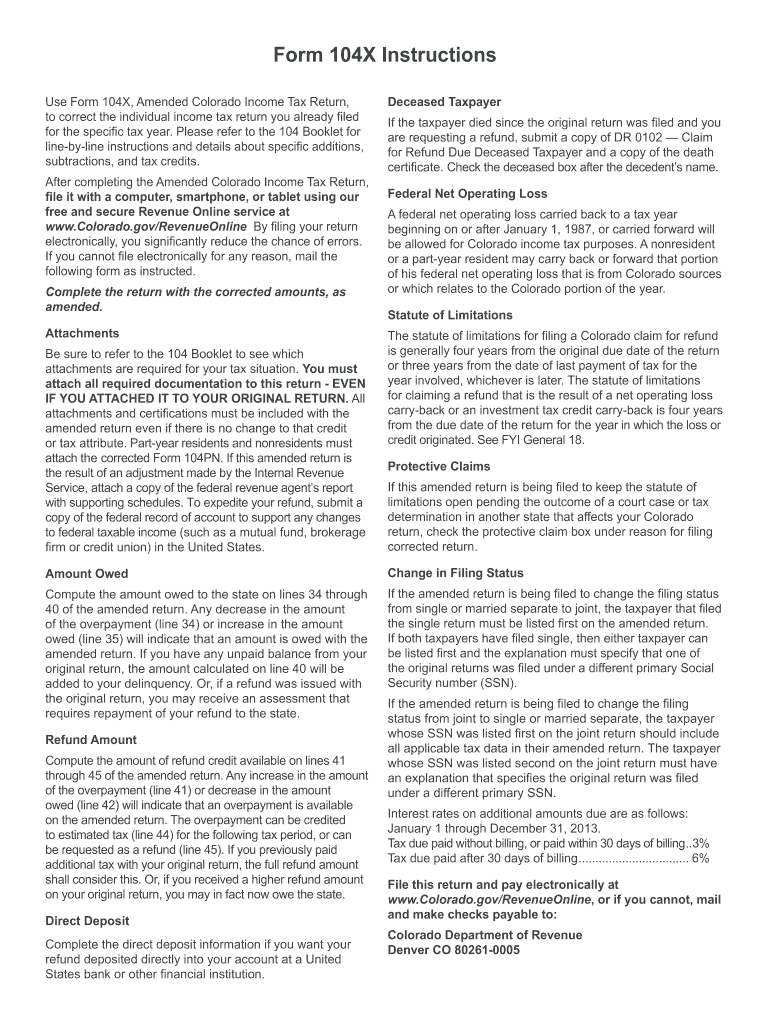

Definition and Purpose of the 2012 Colorado Form 104X

The 2012 Colorado Form 104X is an amended Colorado individual income tax return. This form allows taxpayers to correct errors made on previously filed returns for the tax year 2012. Adjustments may include updating income figures, making corrections to tax credits or deductions, and addressing any discrepancies discovered after the initial filing. The purpose of the 104X is to ensure taxpayers report accurate financial information to the Colorado Department of Revenue (CDOR), potentially impacting the amount of tax liability or refund due.

Utilization of Form 104X is essential for maintaining accurate tax records. If a taxpayer fails to amend their return when necessary, they may face penalties or miss out on refunds owed. The form is specifically structured to guide users through the process of revising their income tax returns, offering a straightforward approach to managing amendments.

How to Obtain the 2012 Colorado Form 104X

To acquire the 2012 Colorado Form 104X, taxpayers can access several options:

-

Online Access: Individuals can download the form directly from the Colorado Department of Revenue's website. The official site provides a PDF version that can be printed and filled out.

-

Mail Request: Taxpayers may request a physical copy by contacting the CDOR. This could involve calling their service center or sending a written request for the form.

-

Local Tax Offices: Some local tax offices or libraries may carry printed copies of the form. These establishments often provide resources and assistance for taxpayers needing to file amendments.

Acquiring the form promptly is important, especially given potential filing deadlines for amendments.

Steps to Complete the 2012 Colorado Form 104X

Completing the 2012 Colorado Form 104X involves several key steps, ensuring all necessary information is accurately provided:

-

Download the Form: Access the 2012 Colorado Form 104X from the CDOR website or obtain a physical version.

-

Review Previous Tax Return: Refer to the originally filed 2012 return to identify specific areas requiring correction.

-

Enter Personal Information: Fill in your name, Social Security number, and any other personal details as required.

-

Indicate Changes: Specify which figures have been amended. Common changes include corrected income amounts, tax credits, or deductions. It is vital to thoroughly read the instructions provided with the form, which detail how to represent these changes.

-

Calculate Adjusted Tax Liabilities: Recompute any tax owed or refund due based on the amended figures. The form includes designated areas for entering these calculations, ensuring they're clear and distinct from the original amounts.

-

Include Supporting Documentation: Attach any necessary documentation that supports the amendments. This may involve W-2 forms, 1099s, or any other related tax records that substantiate your claims.

-

Sign and Date the Form: Ensure you provide your signature and date it appropriately to validate the submission.

-

Submit the Form: Choose your preferred method of submission—either electronically via the appropriate channels or through the mail.

Following these steps correctly will help in streamlining the amendment process and avoiding unnecessary delays.

Common Reasons for Filing the 2012 Colorado Form 104X

Taxpayers may find themselves needing to submit the 2012 Colorado Form 104X for various reasons:

-

Erroneous Income Reporting: If a taxpayer realizes they reported incorrect income from wages, self-employment, or other sources, amending their return will correct the discrepancy.

-

Missed Deductions or Credits: Discovering that you qualify for certain deductions or credits after filing can also prompt a need for amendments. This may lead to a higher refund or reduced tax liability.

-

Changes in Tax Situation: Life events such as divorce, loss of a dependent, or modifications in employment status may necessitate updates to previously filed returns.

Understanding these common triggers helps taxpayers proactively address their tax obligations.

Key Elements of the 2012 Colorado Form 104X

Several critical components are essential when dealing with the 2012 Colorado Form 104X:

-

Personal Information: This includes name, address, and Social Security number, which ensures the form is correctly attributed to the taxpayer.

-

Amendment Section: This section prompts the taxpayer to outline what changes have been made to the original return, clarifying the modifications being requested.

-

Revised Tax Calculations: Areas for entering new calculations—detailing tax owed or refunds requested—are pivotal, ensuring transparency in amendments.

-

Attachments: Inclusion of supporting documents is crucial in justifying the claims made on the amended return, as the CDOR may require verification.

Recognizing these elements allows taxpayers to navigate the form more efficiently and ensures compliance with Colorado tax laws.

Important Filing Deadlines for the 2012 Colorado Form 104X

Adhering to critical deadlines is crucial for taxpayers filing the 2012 Colorado Form 104X. Key deadlines include:

-

General Amending Deadline: The deadline for filing an amended return generally falls within three years of the original filing date or within two years from the date the tax was paid.

-

Special Cases: If claiming an overpayment for a given year, the return must be filed by the statute of limitations, adhering to the respective timeframes indicated by the CDOR.

Remaining attentive to these deadlines is essential to ensure the timely processing of amendments and avoids potential penalties or forfeitures.