Understanding Form 104X Colorado 2016

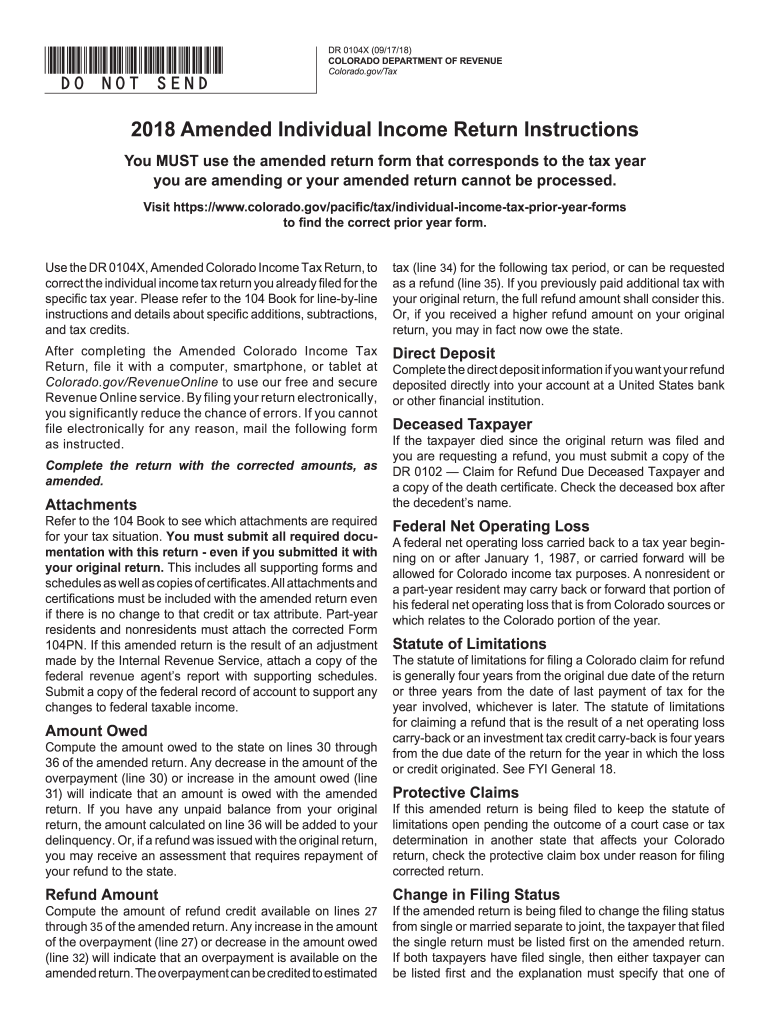

Form 104X Colorado 2016 is the official document for amending an individual income tax return. This form is crucial for taxpayers who need to correct errors or make changes to their previously filed returns. It allows for adjustments to income, deductions, and credits claimed in the original submission. Filing an amended return ensures that taxpayers comply with state tax laws and avoid potential penalties.

How to Use Form 104X Colorado 2016

To properly utilize Form 104X Colorado 2016, follow these steps:

- Determine Eligibility: Ensure that your original return has been filed and that any amendments fall within the appropriate statute of limitations for the tax year in question.

- Access the Form: Download the form from the Colorado Department of Revenue's website or access it through tax preparation software.

- Complete the Form: Input the changes you wish to make, detailing the original information and the corrected figures. Include explanations for all amendments.

Using the correct form and following these steps facilitates a smoother process when interacting with state tax authorities.

How to Obtain the Form 104X Colorado 2016

The 2016 Form 104X Colorado can be obtained through several channels:

- Online: Download the form directly from the Colorado Department of Revenue's official website, where previous years’ forms are archived.

- Tax Software: Many commercial tax preparation software packages include options for filing amendments, making it easier to generate Form 104X automatically.

- Local Tax Offices: Visit local Colorado Department of Revenue offices to request physical copies of the form.

Having access to the correct version of the form is critical for ensuring accurate completion.

Steps to Complete Form 104X Colorado 2016

Completing Form 104X Colorado 2016 involves a straightforward process:

- Review Your Original Return: Ensure you understand the details on your original filing, as mistakes in this document need correction.

- Fill Out Personal Information: Include your name, address, and Social Security number as on the original return.

- Describe Changes: Clearly articulate what adjustments you are making to the original return, providing context for each change.

- Calculate Adjusted Tax Liability: Reassess your total tax liability after accounting for the amendments, indicating any refund or payment due.

- Submit Supporting Documents: Attach any necessary documentation that supports your amendments, such as W-2s or 1099s.

- File the Form: Submit the completed Form 104X via mail or electronically through approved channels if available.

Ensuring accuracy throughout this process can prevent delays and facilitate quicker resolutions.

Why You Should File Form 104X Colorado 2016

Filing Form 104X Colorado 2016 is necessary for several reasons:

- Correcting Errors: Mistakes made in income, deductions, or credits can lead to incorrect tax liability.

- Claiming Additional Deductions: New information or eligibility for additional deductions that were overlooked in the original filing may require an amended return.

- Avoiding Penalties: By proactively filing an amendment, taxpayers demonstrate good faith in complying with state tax laws, possibly averting penalties associated with inaccuracies.

Filing this form can lead to a more favorable outcome in your tax situation.

Important Terms Related to Form 104X Colorado 2016

Understanding specific terminology related to Form 104X Colorado 2016 can aid in navigating the amendment process:

- Adjusted Gross Income (AGI): The total income subject to taxes after certain deductions; this is often recalculated in amended returns.

- Deductions: Expenses that can be subtracted from gross income to reduce taxable income; correctly documenting these is essential on Form 104X.

- Credits: Tax credits directly reduce the amount of tax owed; changes to credits can significantly impact tax liability.

Familiarity with these terms enhances comprehension and increases the likelihood of a successful amendment.

State-Specific Rules for Form 104X Colorado 2016

Understanding Colorado's specific rules when filing Form 104X is vital. Here are critical considerations:

- Filing Deadlines: Amendments must typically be filed within three years of the original return’s due date, including extensions.

- State Regulations: Keep abreast of any state-specific regulations or updates regarding tax filings for the year of your return.

- Documentation Requirements: Ensure that any changes are supported by the appropriate documentation to facilitate a smoother review by tax authorities.

Familiarizing yourself with these specific rules can lead to fewer complications in the filing process.

Examples of Using Form 104X Colorado 2016

Here are some scenarios illustrating the use of Form 104X Colorado 2016:

- Example 1: A taxpayer discovers they omitted income from a side job after submitting their tax return. They need to file Form 104X to include this income and adjust their tax liability accordingly.

- Example 2: After consulting with a tax professional, an individual realizes they qualify for a previously overlooked tax credit. They would utilize Form 104X to amend their return for the applicable tax year.

- Example 3: A mistake in reporting a dependent leads to tax benefits that were not claimed. By filing Form 104X, the taxpayer can correct this oversight and potentially receive a refund.

These examples underscore the form's relevance in various tax correction scenarios.