Definition and Meaning of CPP Fact Sheet #3

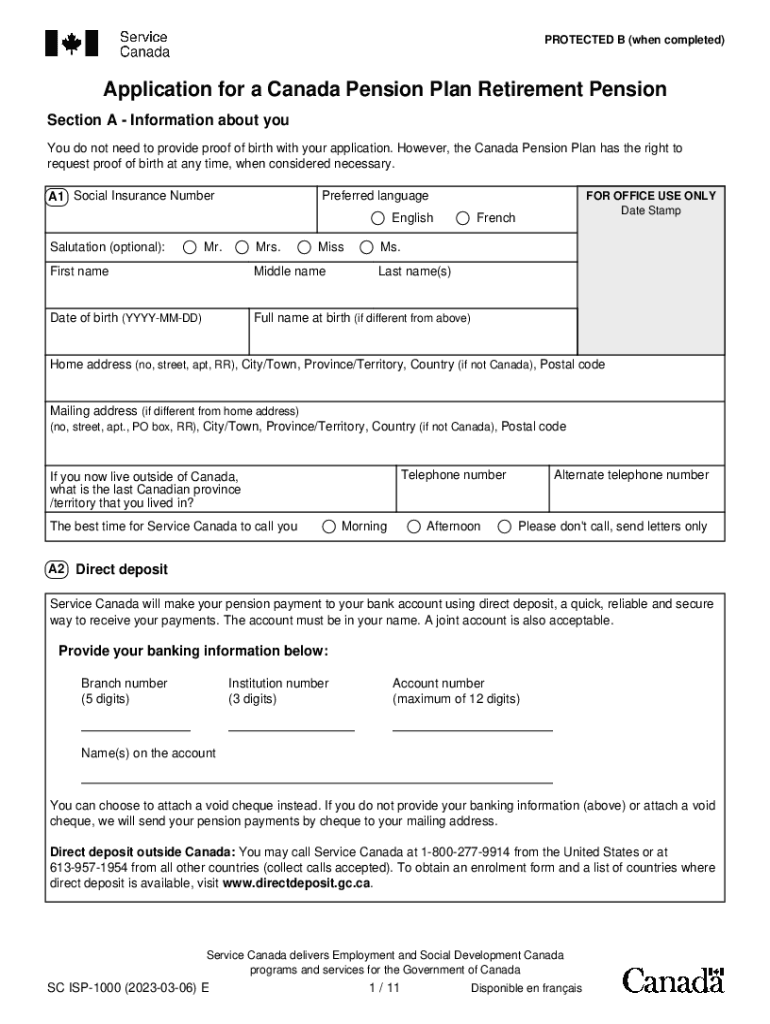

"CPP Fact Sheet #3" relates to the Canada Pension Plan (CPP) retirement pension, providing information on eligibility, application procedures, and options for receiving benefits. Primarily designed for individuals planning their retirement, the document explains crucial aspects like valid contributions to the CPP, the age requirement of at least 60 years, and options for pension sharing and child-rearing provisions. It serves as an essential guide for those looking to understand the workings of the Canada Pension Plan and its implications on retirement planning.

Eligibility Criteria

To qualify for the CPP, individuals must meet certain criteria. First, applicants need to be at least 60 years old. Additionally, they must have made valid contributions to the CPP during their working years. Contributions serve as proof of employment history and income earned within Canada. This fact sheet helps potential applicants determine if they meet the set requirements, offering guidance on contribution assessment and ways to verify eligibility.

Steps to Complete the CPP Fact Sheet #3

Filling out the CPP Fact Sheet #3 requires attention to detail and proper documentation. Here's a step-by-step guide to help you:

-

Gather Necessary Documents: Start by collecting all relevant personal and financial documents, including Social Insurance Numbers (SIN), proof of age, and contribution statements.

-

Complete Personal Information: Fill in sections requiring personal details, such as your name, contact information, and SIN.

-

Detail Employment History: Accurately record employment details and contributions to the CPP over the years.

-

Include Pension Sharing Options: If applicable, indicate if you wish to opt for pension sharing with a spouse or partner.

-

Submit Supporting Documents: Enclose any additional documents that may be required based on your specific scenario.

-

Review and Submit: Carefully review the completed form for accuracy before submission. Submit via the preferred method – online, mail, or in-person.

Requirements and Important Dates

It's crucial to understand the timelines and document requirements to avoid delays. Ensure that all submission deadlines are met, which reflects the standard timeline for processing applications. Keep track of key dates related to the CPP to secure timely benefits.

Legal Use of the CPP Fact Sheet #3

Understanding the legalities and implications of the CPP Fact Sheet #3 is pivotal for applicants. The legal framework surrounding CPP applications mandates accuracy and honesty in reporting details. Misrepresentation can lead to legal consequences and potential penalties. This document ensures a legally compliant approach to applying for retirement benefits.

Penalties for Non-Compliance

Failure to comply with the provisions of the CPP could result in penalties. These could be monetary fines or delays in receiving benefits. The fact sheet provides details on how to avoid such pitfalls through careful adherence to submission norms and guidelines.

Who Typically Uses the CPP Fact Sheet #3

The primary users of the CPP Fact Sheet #3 are individuals nearing retirement age who reside in Canada. It is also frequently used by financial advisors, lawyers specializing in retirement planning, and family members assisting seniors with their applications. These groups rely on the document to navigate the CPP system effectively.

Important Terms Related to CPP Fact Sheet #3

This section offers a glossary of key terms commonly associated with the CPP process:

- Pension Sharing: An option allowing spouses to split pension incomes for tax benefits.

- Child-Rearing Provision: Credits provided to those who took time off work to raise children.

- ESIGN Act: U.S. legislation making electronic signatures legally enforceable.

Diverse Scenarios and Terminology

Understanding these terms in various contexts – whether for a retired professional or a new retiree planning long-term benefits – is crucial. These terminologies help in interpreting the form's requirements correctly and in aligning them with individual needs.

Software Compatibility of CPP Fact Sheet #3

Utilizing software like TurboTax or QuickBooks may streamline the application process, particularly when dealing with complex financial histories. While the CPP Fact Sheet #3 is pivotal for manual comprehension, integrating it with compatible software can aid in accurate financial analysis and contribute to a more efficient submission process.

Key Elements of the CPP Fact Sheet #3

This form is designed to gather comprehensive information to determine eligibility for pension benefits. Central elements include sections for personal information, employment history, and contribution records. By meticulously capturing these details, the form ensures that applicants receive the benefits they are entitled to.

Detailed Document Structure

Breaking down the document’s sections helps applicants to organize their submissions effectively. Each part must be completed in full to improve the chances of a successful application and ensure prompt benefit disbursement.

Examples of Using the CPP Fact Sheet #3

Consider examples where individuals have used this form to address unique need points. Retirees who opted for pension sharing successfully moderated tax implications, while others benefited from child-rearing provisions to increase their pension credits. These scenarios highlight the versatility of the fact sheet in meeting diverse retirement planning objectives.