Definition and Meaning

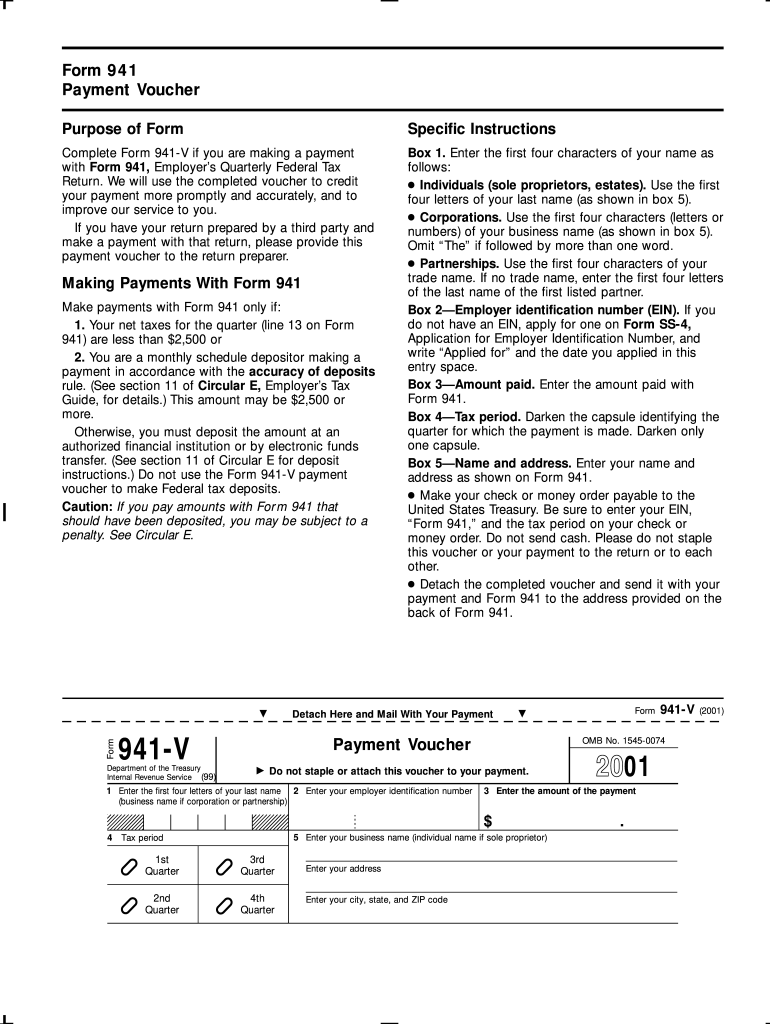

The Form 941-V is a payment voucher specifically used for making payments along with Form 941, the Employer's Quarterly Federal Tax Return. This form ensures that employers can accurately report and pay withholding taxes for Social Security, Medicare, and federal income tax. Utilizing Form 941-V facilitates proper allocation of payments to the corresponding tax period, reducing errors and potential penalties.

Function of Form 941-V

Form 941-V is primarily a tool for processing payments. By including this form when submitting payments, employers can specify the amount directed towards their tax liabilities. Its use is critical for clarity and efficiency in the financial operations of a business, ensuring that funds are applied as intended.

How to Use the 941-V Form

Using Form 941-V involves a few specific steps to ensure accuracy and compliance. It's vital to accompany your quarterly tax payment with this form when submitting payments through mail, aligning with the filing of Form 941.

Step-by-Step Instructions

- Complete Form 941: Ensure all employer tax information is accurate and current.

- Fill Out Form 941-V:

- Provide your EIN, business name, and address on the voucher.

- Indicate the amount you are paying.

- Specify the tax period for which the payment applies.

- Attach Payment: Include a check or money order paid to the "United States Treasury."

- Mail the Package: Send the completed Form 941, Form 941-V, and your payment to the designated IRS address.

Important Considerations

Using Form 941-V is not always necessary, particularly if payments are made electronically. Electronic payments prevent postage delays and are typically the IRS's preferred method. However, using Form 941-V is required when sending a payment by mail to prevent misallocations.

How to Obtain the 941-V Form

Form 941-V can be obtained directly from the Internal Revenue Service website, where it is available for download as a PDF file. It is also accessible through tax preparation software or directly at local IRS offices.

Online Access

- IRS Website: A reliable resource for the most current version of the form.

- Tax Software: Platforms like TurboTax or QuickBooks often have integrated access for their users.

Physical Copies

- Local IRS Offices: Physical copies can be picked up or requested by mail.

- Accountant or Tax Preparer: Often have access to forms and can provide advice on completion.

Steps to Complete the 941-V Form

Completing the 941-V form involves filling out personal and payment information accurately. This ensures that payments correlate precisely with the submitted Form 941.

Detailed Completion Guide

- Enter Employer Identification Number (EIN): Clearly state your unique business identification number.

- Business Information: Include your business name and address to identify the payer properly.

- Payment Details:

- Specify the exact payment amount.

- Write the check number used if applicable.

- Indicate the Tax Period: Ensure the payment aligns with the intended quarter. Misalignments can lead to misapplied payments and potential discrepancies later.

Confirm Accuracy

Before mailing, double-check the entries for accuracy and completeness. The form must accompany a check or money order with the correct amount and must be signed and dated.

Important Terms Related to the 941-V Form

Understanding key terms related to Form 941-V aids in accurate completion and submission, preventing delays or errors in tax processing.

Essential Terms

- EIN: Employer Identification Number, necessary for identifying the business.

- Tax Period: The specific quarter for which tax payments are applicable.

- Withholding Tax: Deductions from employee wages that form the basis of the payment.

Practical Definitions

Accuracy in these terms ensures precise completion of the form, preventing IRS disputes and aligning with best practices for business administration.

Filing Deadlines and Important Dates

Accurate adherence to deadlines for Form 941 and associated payments is critical to avoid penalties. Mark these dates for preparatory and submission purposes.

Quarterly Deadlines

- First Quarter: April 30

- Second Quarter: July 31

- Third Quarter: October 31

- Fourth Quarter: January 31 of the following year

Extension Options

While direct extensions for payment deadlines aren't typical, timely filing helps avoid accruing interest on overdue payments. Consulting tax professionals helps demystify any uncertainties in this process.

Legal Use and Compliance of the 941-V Form

Legal correctness in use of Form 941-V safeguards against potential liabilities or regulatory issues. Adhering to IRS directives is non-negotiable for remaining in good legal standing.

Adherence Responsibilities

- Accurate Reporting: Correct reporting mitigates legal issues.

- Complete Payment: Ensure payments cover all indicated tax liabilities fully.

Compliance Checks

Routine audits by the IRS underscore the importance of consistent compliance. Regular self-review of entries and payment accuracy enhances compliance.

Examples of Using the 941-V Form

Practical scenarios illustrate the utility of Form 941-V, clarifying its role in business tax obligations and easing interpretation.

Scenarios

- Small Business Owners: Owner-managed businesses addressing quarterly wage deductions.

- Payroll Firms: Firms managing multiple clients can consistently utilize Form 941-V to streamline client submissions.

- Seasonal Employers: Adjusting payments to align with fluctuating employee numbers across different periods.

Adapting to Circumstances

Understanding these varied scenarios can help ensure your approach to Form 941-V suits your business context, enhancing utility and compliance.