Overview of the SSA Form

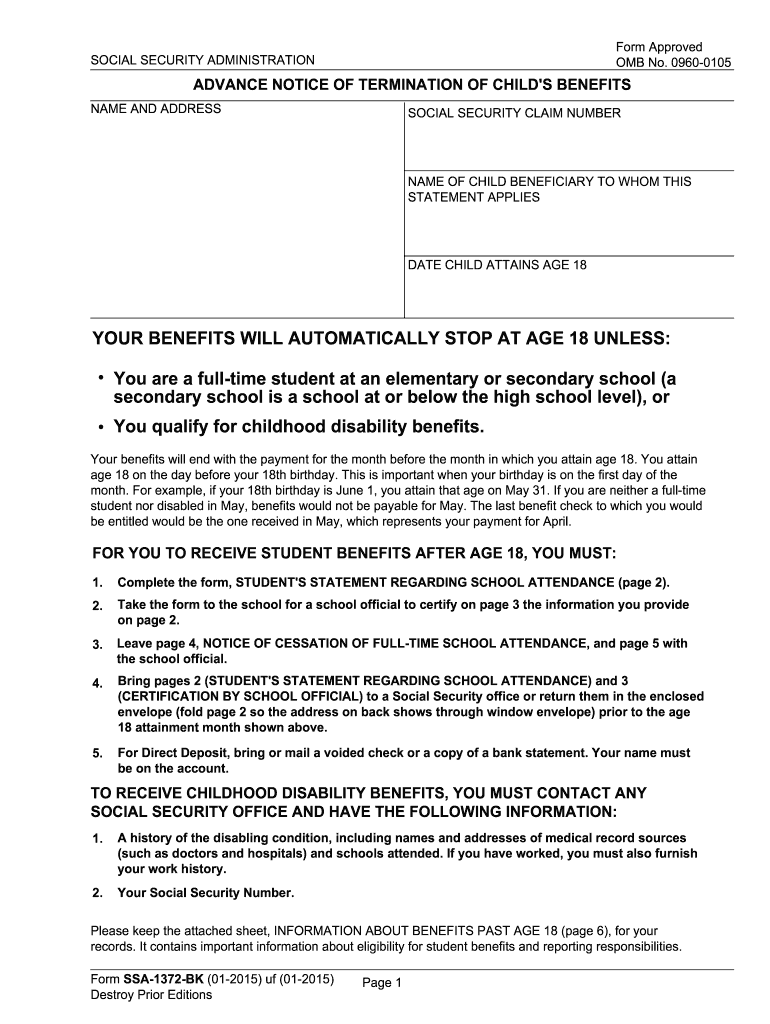

The SSA 1372 form, officially known as the Advance Notice of Termination of Child's Benefits, is an essential document issued by the Social Security Administration. It serves to inform beneficiaries that their child benefits will terminate automatically when they reach the age of 18 unless certain conditions are met.

Purpose and Importance of the SSA 1372 Form

The primary purpose of the SSA 1372 form is to communicate the cessation of benefits once a child reaches adulthood. This alert is crucial for beneficiaries, as it outlines the circumstances under which benefits may continue, such as full-time enrollment in school or eligibility for childhood disability benefits.

- Benefits automatically end when the child turns 18.

- Continuation of benefits is possible for full-time students or disabled individuals.

- The form helps avoid confusion regarding the benefits status as the child approaches adulthood.

Key Components of the SSA Form

Understanding the essential elements of the SSA 1372 form can greatly assist beneficiaries in navigating their benefits.

- Personal Information: The form requires personal details of the child and the primary beneficiary, which includes names, Social Security numbers, and addresses.

- School Certification: If the child is a full-time student, schools must provide certifications that confirm their enrollment status.

- Disability Information: The form must include information about any disability claims that may affect benefits.

Steps to Complete the SSA 1372 Form

Filling out the SSA 1372 form effectively requires careful attention to detail. Below are the steps for proper completion:

- Gather Necessary Documents: Collect the child’s Social Security number, proof of school enrollment, or documentation of any disabilities.

- Fill Out Personal Information: Provide accurate personal information for both the child and the beneficiary.

- Complete School Verification: If applicable, obtain the required certification from the educational institution.

- Review Changes: Ensure all information is complete and accurate to avoid processing delays.

- Submit the Form: Follow submission guidelines as provided in the form instructions, either online or via mail.

Submission Methods for the SSA Form

Submitting the SSA 1372 form can be done in several ways, ensuring convenience for the beneficiaries.

- Online Submission: Many can utilize the SSA’s online services to submit the completed form directly through a secure portal.

- Mail: Alternatively, beneficiaries can send the form through traditional mail to the appropriate Social Security administration office.

- In-Person: Some individuals may prefer to deliver their forms directly to a local Social Security office, where staff can assist if needed.

Eligibility Criteria and Compliance

Understanding the eligibility criteria for maintaining benefits under the SSA 1372 form is crucial for beneficiaries to ensure compliance and avoid any disruption in their benefits.

- Age Limit: Benefits cease automatically at age 18 unless other conditions are met.

- School Requirements: Beneficiaries must provide proof of full-time student status.

- Disability Status: Those seeking to continue benefits due to disabilities must provide supporting documentation.

Important Dates and Filing Deadlines

Being aware of critical filing deadlines can help beneficiaries manage their benefits effectively.

- Age Review: Benefits termination is fixed to the child’s 18th birthday unless documentation is submitted in advance to secure benefits under student or disability clauses.

- Annual Reviews: If the child is a continuing student or disabled, periodic reviews may be required to retain benefits, along with timely updates provided to the SSA.

Potential Penalties for Non-Compliance

Failing to adhere to the SSA 1372 requirements can result in significant consequences.

- Benefit Termination: Inaccuracies or omissions may lead to an abrupt loss of benefits at the age threshold.

- Overpayment Claims: Incorrect filings can trigger overpayment situations, which must be repaid to the SSA.

- Legal Repercussions: Non-compliance may lead to investigations or further inquiries regarding the beneficiary's claims.

By understanding the SSA Form and its complexities, beneficiaries can better navigate the requirements and secure their benefits as needed.