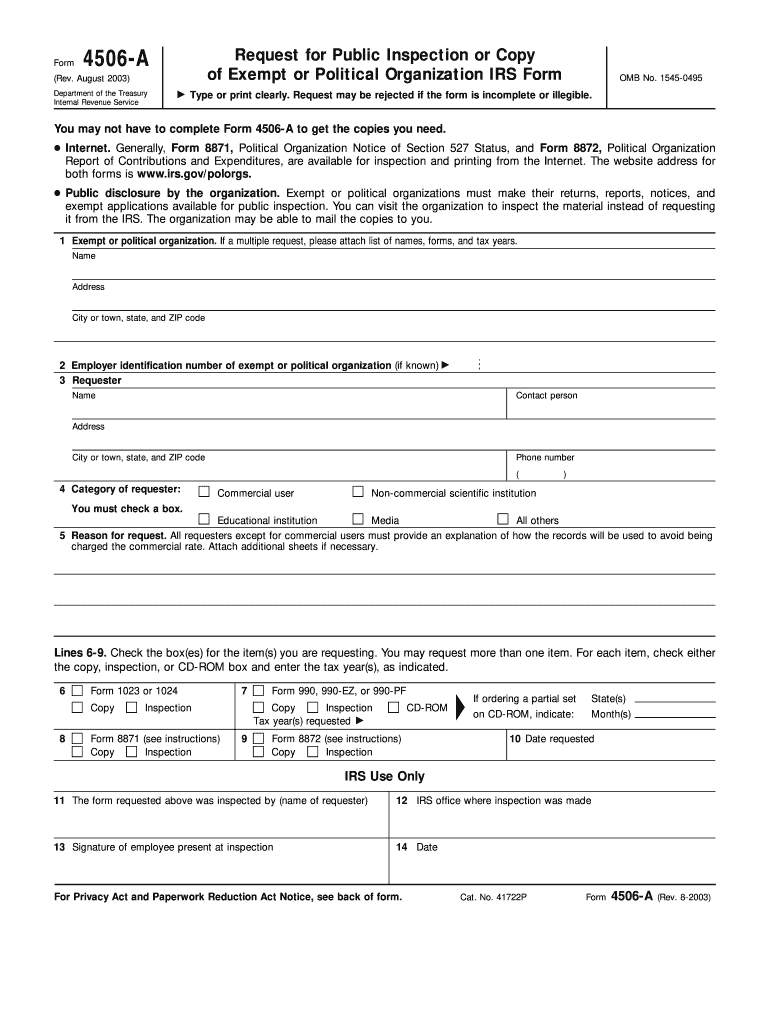

Definition and Purpose of Form 4506-A

Form 4506-A is used to request copies or inspections of certain IRS documents for exempt or political organizations under Internal Revenue Code Section 6104. This form enables organizations to assess their compliance and maintain transparency by allowing requests for various exempt returns, reports, notices, or applications. Understanding this form is crucial to ensuring that organizations meet legal obligations while also permitting stakeholders to access important information related to financial practices and compliance.

Key Features of Form 4506-A

- Request Categories: The form outlines different requester categories, including individuals, organizations, and authorized representatives.

- Available Documents: The requested documents may include tax returns, exemption applications, and other related filings.

- Legal Framework: It operates under federal laws ensuring public access while maintaining confidentiality and data protection for sensitive information.

How to Use Form 4506-A Online in 2003

To efficiently use Form 4506-A online for the year 2003, organizations should follow specific guidelines.

Accessing the Form

- Online Access: Visit the IRS website or trusted online document platforms like DocHub to access Form 4506-A.

- Filling Out the Form: Utilize integrated tools for filling out the form. Ensure the organization name, address, and specific details are accurately entered to avoid delays.

Submission Process

- The completed form must be printed, signed, and then submitted as per the designated guidelines provided in the IRS instructions.

- Online platforms may offer submission methods, including electronic filing via IRS e-Services or mailing a printed copy.

Steps to Complete Form 4506-A Online in 2003

Completing Form 4506-A requires attention to detail to ensure the successful processing of requests.

Step-by-Step Instructions

- Download the Form: Access the form from an official IRS resource or a trusted online document service.

- Fill in Identification: Provide the full name of the tax-exempt organization and the Employer Identification Number (EIN).

- Specify the Documents Needed: Clearly indicate which forms or applications you are requesting, detailing the years required.

- Contact Information: Add the name and contact details of the requestor, ensuring easy communication regarding the request status.

- Choose Delivery Method: Indicate whether you want the documents sent to the organization or the requestor’s address.

Important Tips

- Review all entries for accuracy before submission.

- Consider including a cover letter summarizing the request, enhancing clarity and context.

Important Terms Related to Form 4506-A

Familiarizing oneself with the terminology associated with Form 4506-A can streamline the completion process.

Key Terms Defined

- Exempt Organization: Entities recognized by the IRS, such as charitable organizations, which are exempt from federal income tax.

- EIN: The Employer Identification Number is essential for any tax-exempt organization, acting as a unique identifier for administrative purposes.

- Section 6104: Refers to the Internal Revenue Code provision that governs requests for disclosure of exempt organization documents.

Utilization of Terms

Understanding these terms is beneficial for better communication and comprehension within organizations handling tax-related matters.

Who Typically Uses Form 4506-A?

Form 4506-A is primarily utilized by specific groups involved with or interested in tax-exempt organizations.

Typical Users Include

- Exempt Organizations: Nonprofits and charities seeking to verify their tax filings or provide documentation for governance or funding needs.

- Research Institutions: Scholars and researchers investigating tax-exempt organizations for transparency or compliance studies.

- Donors and Funders: Entities interested in assessing the financial accountability of organizations they consider supporting.

Importance of Use

Applicants use this form to retain transparency in operations and ensure that all stakeholders have access to significant IRS filings that confirm compliance.

Legal Use and Compliance Considerations for Form 4506-A

Understanding the legal aspects surrounding Form 4506-A ensures that requesters operate within compliance guidelines established by the IRS.

Key Legal Points

- Public Disclosure Requirements: The IRS mandates that certain documents be available to the public, but not all information is subjected to disclosure; understanding these boundaries is crucial.

- Confidentiality Practices: While this form facilitates access to necessary documents, it also protects sensitive information that should not be publicly disclosed.

Compliance Recommendations

Organizations must maintain adherence to federal regulations when using Form 4506-A, ensuring that the request is made for legitimate purposes tied to tax exemption governance or accountability practices.