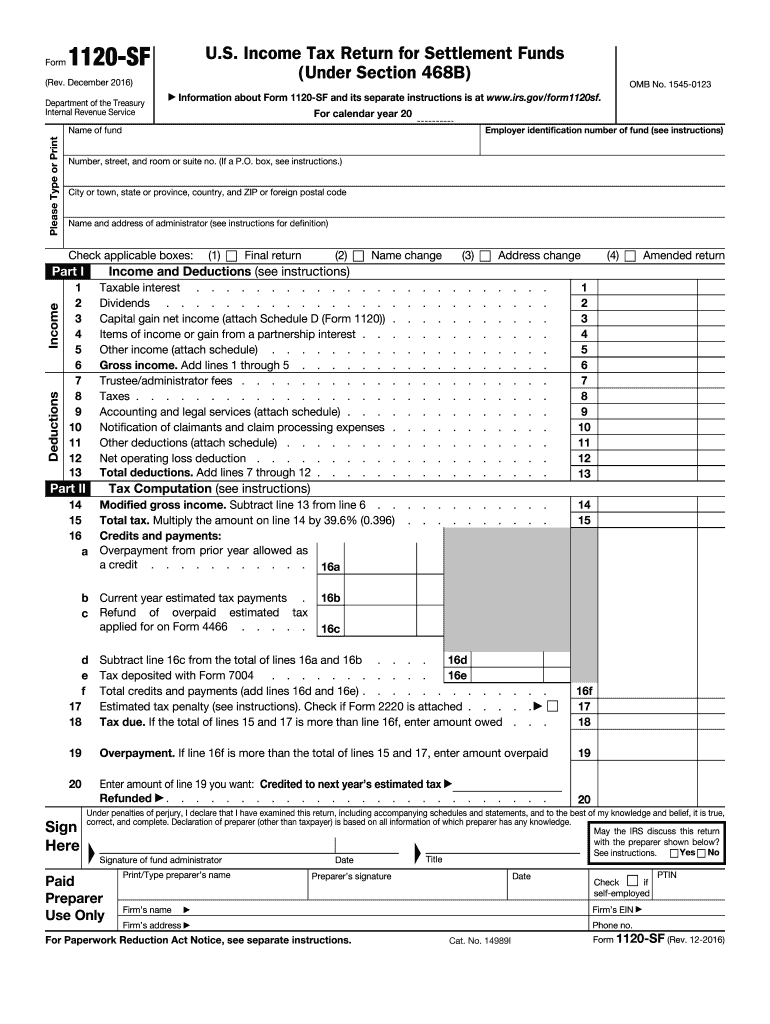

Definition and Purpose of Form 1120-SF

Form 1120-SF (Rev. December 2016) is the U.S. Income Tax Return for Settlement Funds under Section 468B. This form is specifically designed for settlement funds, or qualified settlement funds (QSFs), to report their income, deductions, and tax liabilities to the Internal Revenue Service (IRS). A QSF is a trust or account established to hold and distribute settlement proceeds in legal disputes.

The primary purpose of Form 1120-SF is to ensure proper reporting of financial transactions related to settlement funds, which typically involve large sums of money from legal settlements. This includes reporting gross income, deductions, and calculating the taxes owed or any overpayment. The form incorporates sections that require identifying details about the fund and the distributions made to claimants.

Key aspects included in Form 1120-SF are:

- Identification of the settlement fund, including name and employer identification number (EIN).

- A breakdown of financial information, including sources of income and allowable deductions.

- Calculations pertaining to tax liabilities, including credits that may offset the amount owed.

How to Use Form 1120-SF (Rev. December 2016)

Using Form 1120-SF involves several steps to ensure compliance with IRS regulations. The form must be filled out accurately to reflect the fund’s financial activities over the tax year. It is advisable to consult with a tax professional specializing in settlement funds to navigate the complexities involved.

Key Steps to Complete the Form

- Gather Financial Information: Compile all relevant financial data, including income from settlements, expenses, and any distributions made to claimants during the tax year.

- Identify Fund Details: Enter the fund's name, address, and EIN at the top of the form.

- Report Income: Document all sources of income on the appropriate lines of the form. This includes interest earned and any other earnings derived from investments made by the fund.

- Claim Deductions: Identify and list allowable deductions. Common deductions for settlement funds may include administrative expenses and attorney fees associated with managing the fund.

- Calculate Tax Liability: Use the provided calculations to determine the tax owed or any refunds due based on overpayment from prior years.

- Complete Signature and Declaration: Ensure that the form is signed by an authorized individual associated with the fund, typically a trustee or fund manager.

Accurate completion is critical, as errors can lead to penalties or increased scrutiny from the IRS.

Steps to Complete Form 1120-SF

Completing Form 1120-SF requires thorough attention to detail and knowledge of the tax regulations governing settlement funds. The following steps provide a structured approach to filing this form:

Initial Preparation

- Collect Required Documentation: Gather financial statements, records of income, expenses, and any distributions made to claimants. This documentation will support the entries made in the form.

- Familiarize Yourself with Tax Regulations: Understanding IRS guidelines for settlement funds will help ensure compliance and maximize allowable deductions.

Detailed Step-by-Step Instructions

- Header Information: Fill in the fund's name, address, and EIN.

- Income Section: Record all income received during the year. This includes interest and any amounts received from settlements. Accurate reporting will influence overall tax calculations.

- Deductions Section: Document all eligible deductions, such as legal fees and administrative costs. Ensure to have supporting documentation for any deductions claimed.

- Tax Calculation: Utilizing the calculated income and deductions, compute the taxable income and apply the appropriate tax rates as indicated in IRS guidance. The required tax form schedules for calculations should be referred to if needed.

- Review and Sign: After all entries are made, review the document for accuracy and completeness. Ensure the form is signed by an authorized person.

Failing to follow these steps can result in delays or complications with the IRS.

Important Terms Related to Form 1120-SF

Understanding key terms associated with Form 1120-SF is essential for accurate completion and compliance. Here are some important definitions:

- Qualified Settlement Fund (QSF): An account established under section 468B of the Internal Revenue Code to hold settlement proceeds for the purpose of ensuring timely distribution to claimants.

- Tax Identification Number (EIN): A unique number assigned by the IRS to business entities for tax reporting.

- Gross Income: All sources of income received by the fund from various financial activities before any deductions are applied.

- Deductions: Expenses that can be subtracted from gross income, such as legal fees and costs associated with fund administration.

- Taxable Income: The amount of income subject to tax after deductions have been applied.

Familiarity with these terms helps clarify the precise requirements and reporting obligations of Form 1120-SF.

Filing Deadlines and Important Dates

Timely filing of Form 1120-SF is essential to avoid penalties. Meeting deadlines ensures compliance with IRS regulations. The standard deadline for filing this form depends on the fiscal year adopted by the settlement fund.

Key Deadlines

- Annual Filing Deadline: Form 1120-SF must be filed by the 15th day of the third month following the end of the fund’s tax year. For funds using a calendar year, this means the deadline is March 15 of the following year.

- Extensions: If more time is needed, an extension can be requested, typically extending the deadline up to six months. However, the extension must be filed before the original due date.

Keeping track of these deadlines is critical to ensure timely submission and avoid unnecessary penalties.

IRS Guidelines for Form 1120-SF Submission

The IRS outlines specific guidelines for the completion and submission of Form 1120-SF to maintain compliance. Understanding these guidelines can aid in accurate filing and avoidance of issues.

Key Guidelines

- Electronically Filing: Form 1120-SF can be filed electronically using IRS e-file services if supported by tax software. This method is often faster and allows for quicker processing.

- Record Keeping: Maintain all records related to the fund's income, expenses, and distributions for at least three years following the filing, as the IRS may require documentation during audits.

- Accuracy and Completeness: Double-check all entries and calculations before submission. Any errors may lead to penalties, interest on late payments, or an audit.

Being aware of these guidelines helps to ensure successful submission and promotes adherence to IRS requirements.