Definition and Meaning of the 1093 Tax Form

The 1093 tax form is an essential document utilized by entities to report specific tax information to the Internal Revenue Service (IRS). It is primarily designed for organizations involved in particular tax-exempt activities. Understanding the purpose behind the 1093 tax form is crucial for compliance with IRS regulations. This form is often employed by entities that need to disclose their income and expenditures in relation to their tax-exempt status.

Entities must provide accurate details on the 1093 tax form, including revenue, expenses, and certain deductions. By doing so, they ensure their compliance with IRS regulations regarding non-profit organizations or other tax-exempt entities. The timely and accurate completion of the 1093 tax form can help organizations maintain their tax-exempt status and avoid potential penalties.

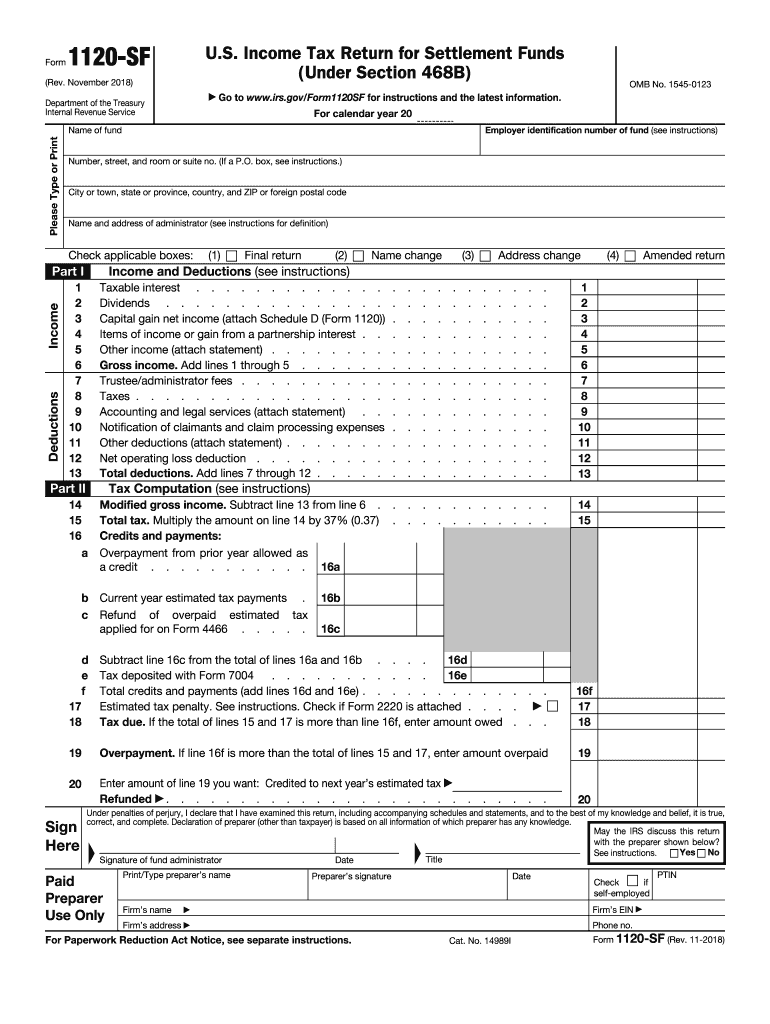

Steps to Complete the 1093 Tax Form

Completing the 1093 tax form involves a series of structured steps aimed at ensuring accuracy and compliance. Here are the fundamental steps to guide users through the process:

-

Gather Required Information: Collect all necessary documentation, including financial records, previous tax returns, and any supporting schedules required for the 1093.

-

Identify the Tax Year: Ensure you are filling out the correct form for the specific tax year you are reporting. The IRS typically updates forms annually.

-

Fill Out the Basic Information: Enter your entity’s name, address, and Employer Identification Number (EIN) at the top of the form. This section provides the IRS with fundamental identification details.

-

Report Income and Expenses: Document your organization’s income sources, differentiating between taxable and non-taxable income. Next, accurately present your expenses, ensuring you include allowable deductions.

-

Review and Submit: After completing all sections, review the form for accuracy. Ensure that all calculations are correct and that you have included any necessary signatures. Submit the form to the IRS either online or via mail, following the submission guidelines specific to the 1093 tax form.

Each aspect of the process requires careful attention. Common errors, such as misreporting income or failing to include required schedules, can lead to delays or audits.

IRS Guidelines for Filing the 1093 Tax Form

The IRS provides comprehensive guidelines on filing the 1093 tax form. It is imperative for organizations to adhere strictly to these guidelines to ensure compliance. Key points to consider include:

- Filing Frequency: Organizations must understand whether they need to file the 1093 annually or on a different schedule based on their specific situation.

- Submission Methods: The IRS allows various methods for submitting the form, including electronic filing through approved software or paper filing via regular mail.

- Accuracy and Completeness: The IRS emphasizes the importance of accuracy. All income and expense entries should be supported by proper documentation to substantiate claims made on the form.

- Deadline Awareness: Keeping track of filing deadlines is crucial to avoid late penalties or issues with the IRS. Organizations should mark their calendars to ensure timely submissions.

Understanding IRS guidelines helps prevent common pitfalls and facilitates smoother reporting processes for organizations using the 1093 tax form.

Important Terms Related to the 1093 Tax Form

When engaging with the 1093 tax form, several key terms should be clearly understood:

-

Exempt Status: Refers to the tax-exempt status granted to organizations by the IRS, indicating they do not have to pay federal income tax on the income they receive related to their exempt activities.

-

Unrelated Business Income (UBI): Income that is generated from a trade or business activity that is not substantially related to the organization’s exempt purpose.

-

Filing Requirements: Regulations that specify the conditions under which an entity must file the 1093 tax form with the IRS.

-

Eligibility Criteria: The specific conditions entities must meet to qualify for filing the 1093 tax form. These may include the type of activities they engage in and their revenue thresholds.

Familiarity with these terms enhances comprehension of the 1093 tax form and supports compliance with IRS regulations.

Who Typically Uses the 1093 Tax Form

The 1093 tax form is primarily utilized by entities such as:

-

Non-Profit Organizations: Many non-profits utilize the 1093 tax form to report their finances and maintain compliance with IRS guidelines.

-

Charitable Organizations: These entities often rely on this form to disclose their income, ensure tax-exempt status, and maintain transparency with stakeholders.

-

Religious Institutions: Churches and other religious organizations frequently use the 1093 tax form to maintain their financial records and report income accurately.

-

Foundations: Private foundations utilize the 1093 to report their earnings and expenditures to further their philanthropic goals.

Understanding the types of organizations that typically use the 1093 tax form can help stakeholders and tax professionals better navigate compliance and reporting requirements specific to these entities.

Filing Deadlines and Important Dates for the 1093 Tax Form

Timely filing of the 1093 tax form is essential for compliance. Here are the critical deadlines related to this form:

-

Annual Filing Deadline: The 1093 tax form is generally due on the fifteenth day of the fifth month after the end of the organization’s tax year. For example, if your tax year ends on December 31, the form must be submitted by May 15.

-

Extension Requests: Organizations may file for extensions, allowing additional time to complete the form. However, it is critical to understand that an extension does not extend the deadline for payment of any taxes owed.

-

State Compliance Dates: In addition to federal deadlines, many states have their own specific filing deadlines for tax-exempt organizations. Organizations must be aware of state-specific requirements to ensure compliance at both levels.

Being vigilant about filing deadlines helps organizations avoid potential penalties and maintain their good standing with the IRS.