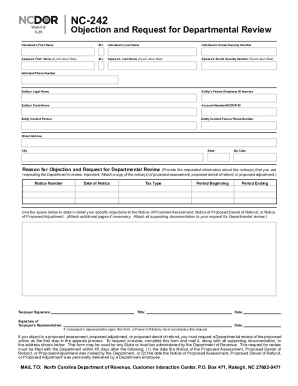

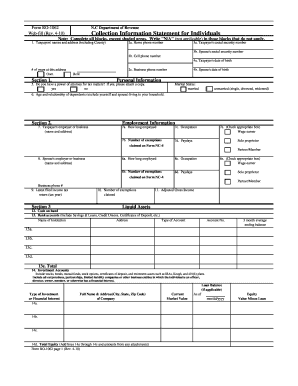

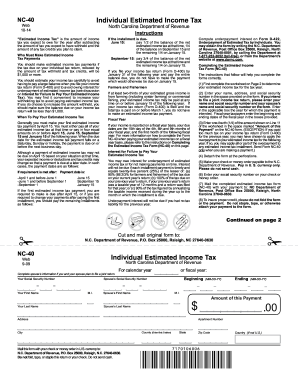

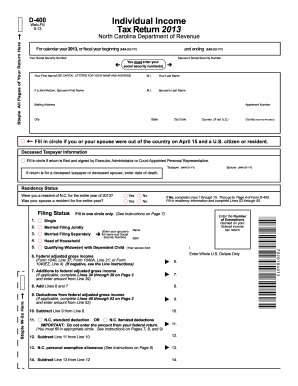

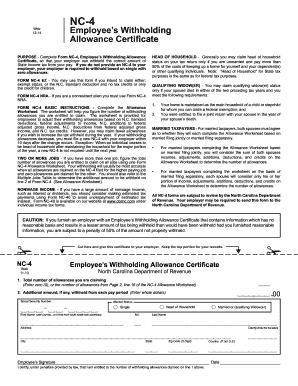

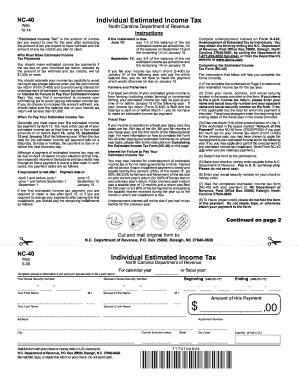

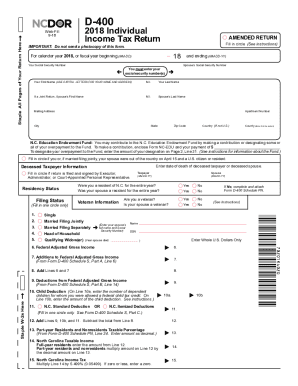

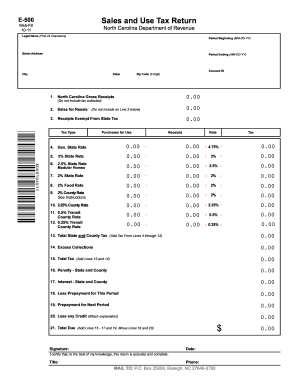

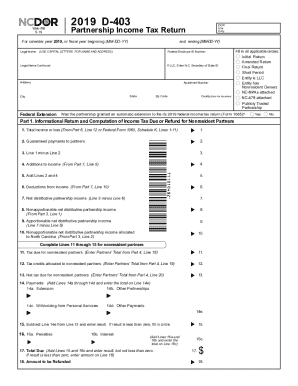

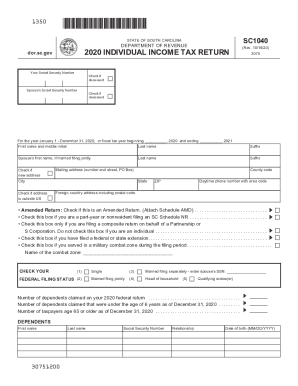

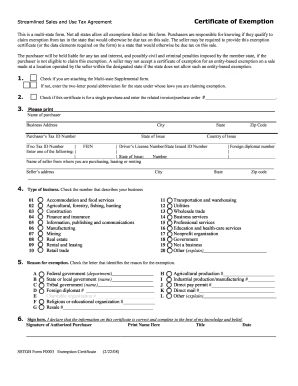

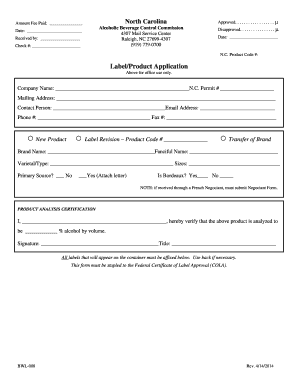

Locate appropriate forms with Nc tax Order Forms catalog. Pick the template, modify and share it, and safely store finished documents in your DocHub account.

Form administration occupies to half of your business hours. With DocHub, you can easily reclaim your office time and improve your team's productivity. Get Nc tax Order Forms online library and investigate all form templates relevant to your day-to-day workflows.

The best way to use Nc tax Order Forms:

Boost your day-to-day document administration with our Nc tax Order Forms. Get your free DocHub profile right now to explore all forms.