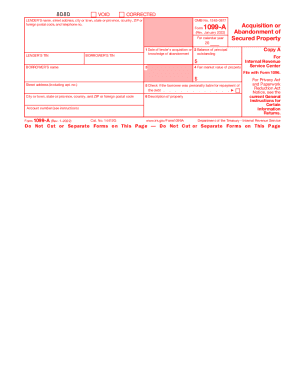

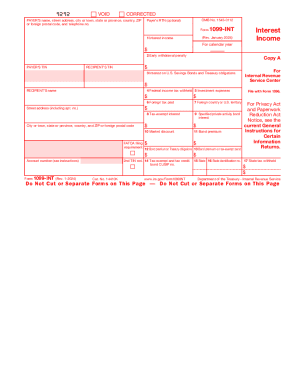

Enhance your document management with DocHub's 1099 oid Order Forms templates. Modify, distribute, and securely save your order documents hassle-free.

Your workflows always benefit when you can locate all of the forms and documents you need on hand. DocHub provides a a huge collection of documents to relieve your day-to-day pains. Get hold of 1099 oid Order Forms category and quickly find your form.

Start working with 1099 oid Order Forms in a few clicks:

Enjoy seamless record management with DocHub. Explore our 1099 oid Order Forms online library and get your form today!