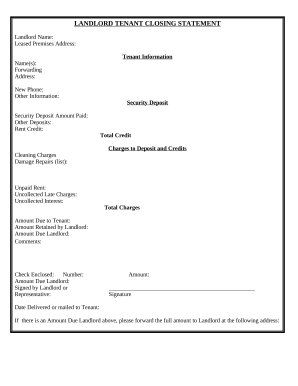

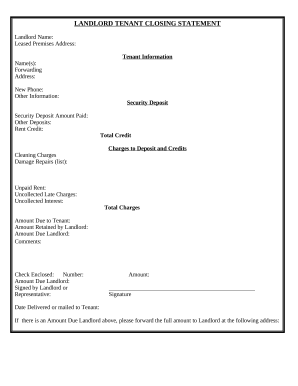

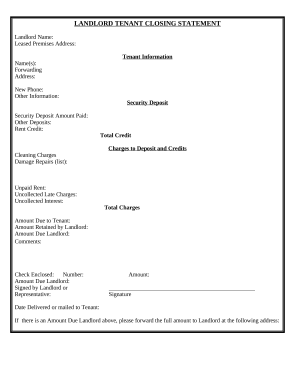

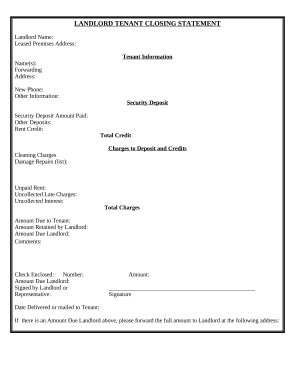

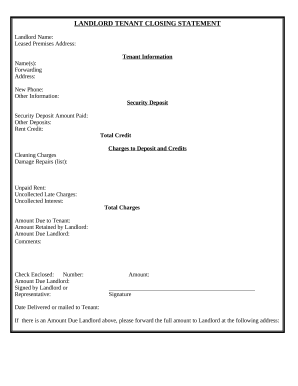

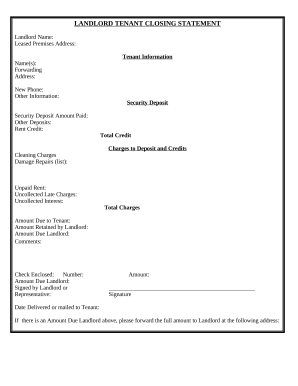

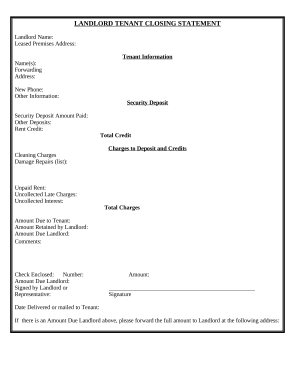

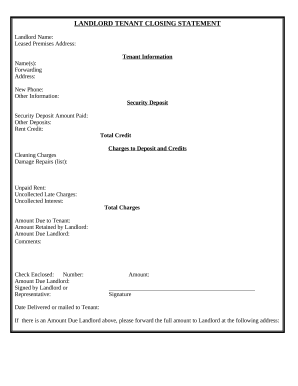

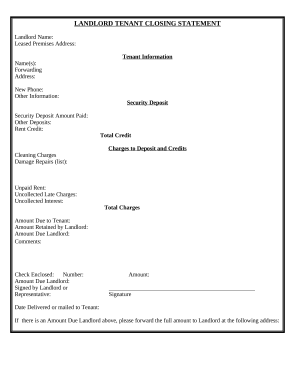

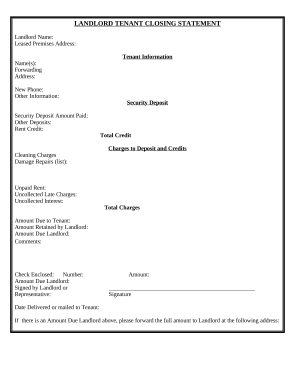

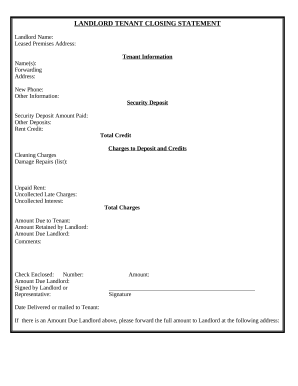

Boost your form management with our Security Deposit Reconciliation Statement collection with ready-made form templates that suit your requirements. Get the document template, change it, complete it, and share it with your contributors without breaking a sweat. Start working more efficiently with the forms.

The best way to manage our Security Deposit Reconciliation Statement:

Examine all of the possibilities for your online file management using our Security Deposit Reconciliation Statement. Get a free free DocHub account today!