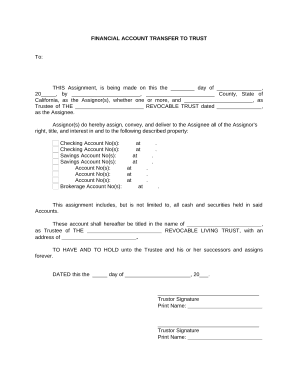

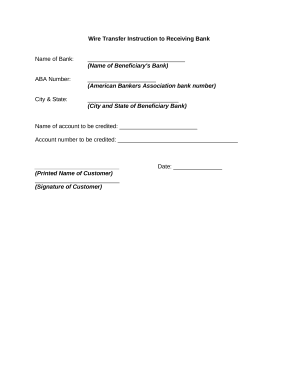

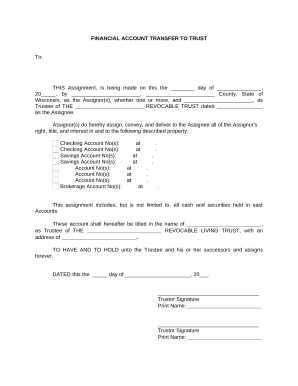

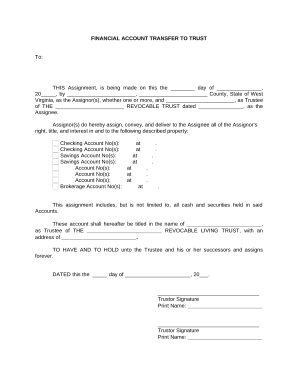

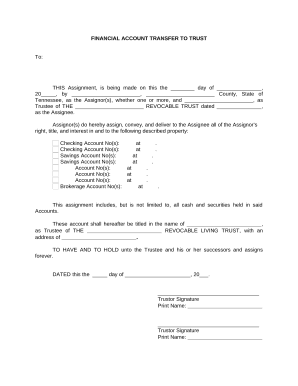

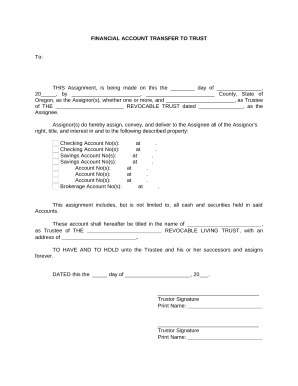

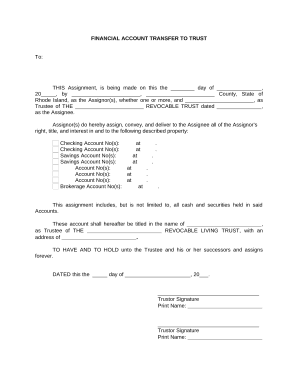

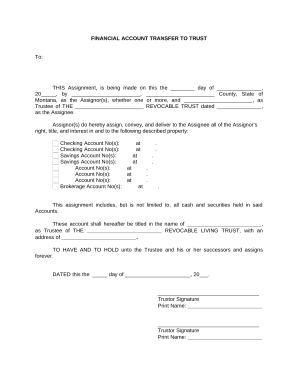

Your workflows always benefit when you are able to find all of the forms and documents you need at your fingertips. DocHub offers a vast array of document templates to ease your daily pains. Get a hold of Financial Transfer Forms category and quickly find your document.

Start working with Financial Transfer Forms in several clicks:

Enjoy easy form administration with DocHub. Explore our Financial Transfer Forms collection and look for your form today!