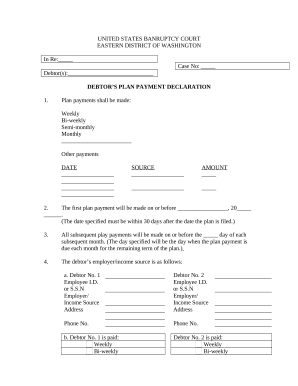

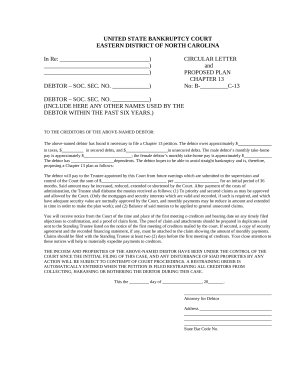

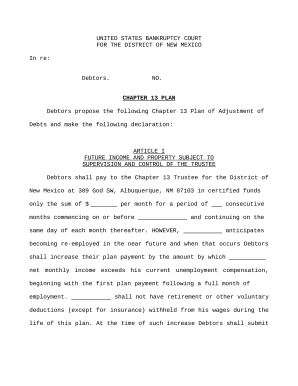

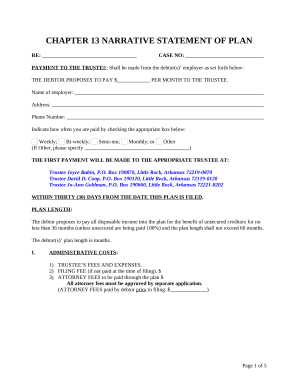

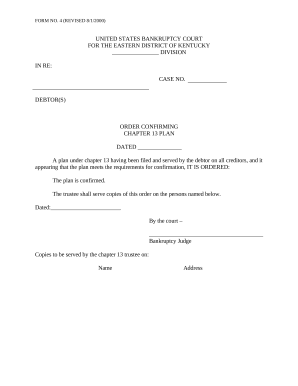

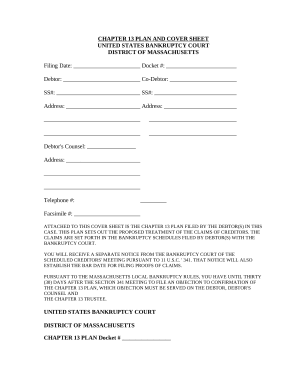

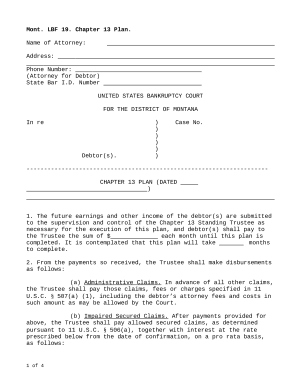

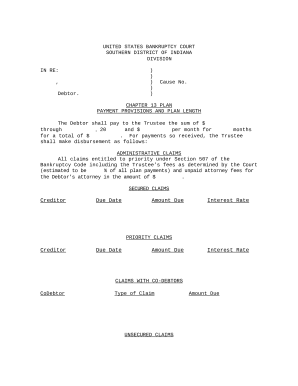

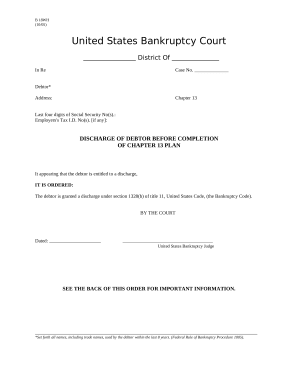

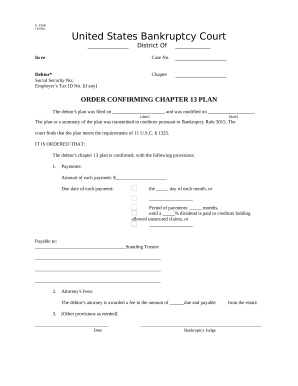

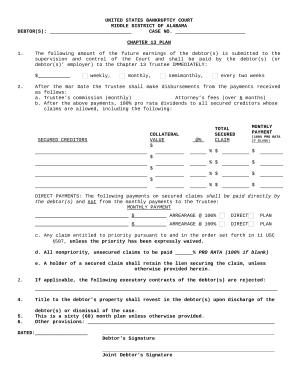

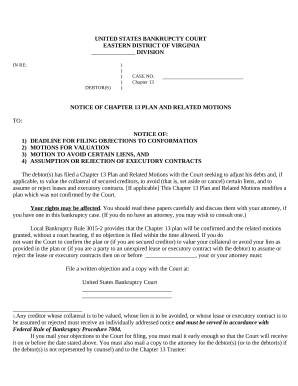

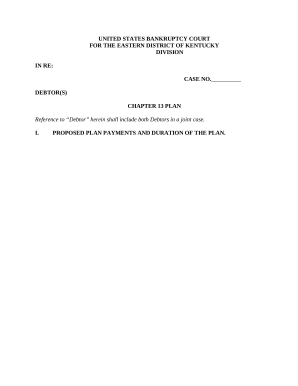

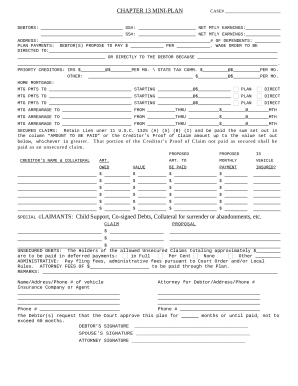

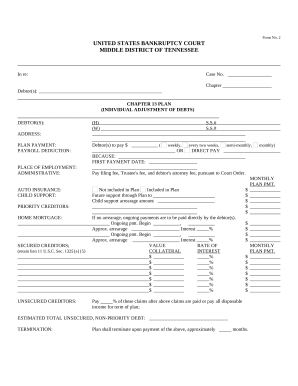

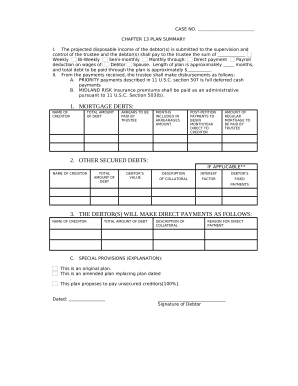

Improve your document administration using our Chapter 13 Forms library with ready-made form templates that suit your needs. Access your form template, edit it, complete it, and share it with your contributors without breaking a sweat. Start working more effectively with the forms.

The best way to use our Chapter 13 Forms:

Discover all of the possibilities for your online document administration with our Chapter 13 Forms. Get your free free DocHub profile right now!