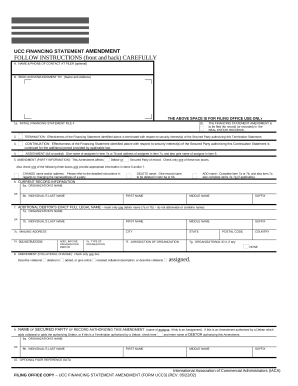

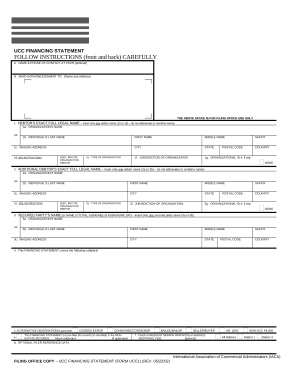

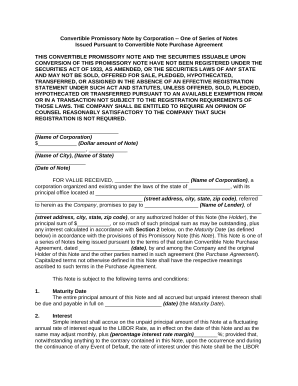

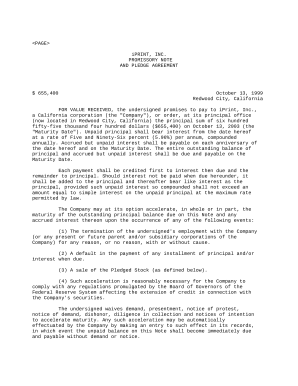

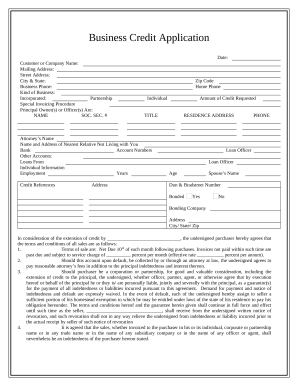

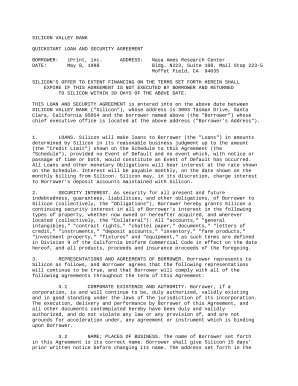

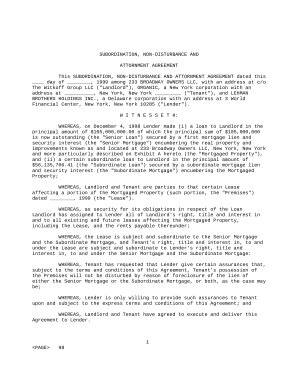

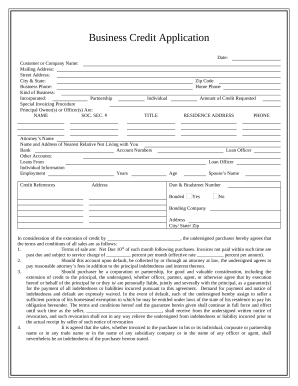

Speed up your form managing with the Business Finance Legal Forms online library with ready-made templates that meet your needs. Access your form, alter it, fill it, and share it with your contributors without breaking a sweat. Start working more effectively together with your documents.

How to use our Business Finance Legal Forms:

Discover all of the opportunities for your online file administration with the Business Finance Legal Forms. Get a totally free DocHub account today!