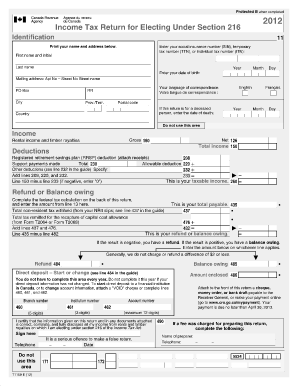

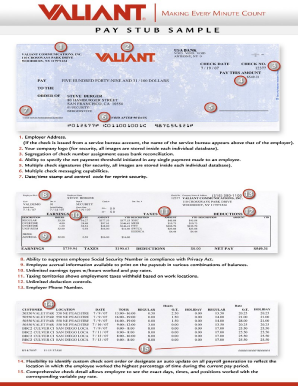

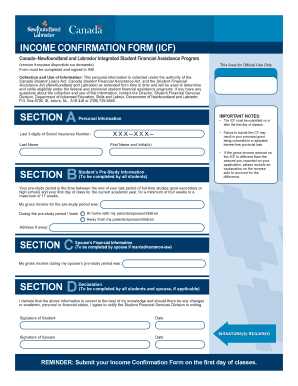

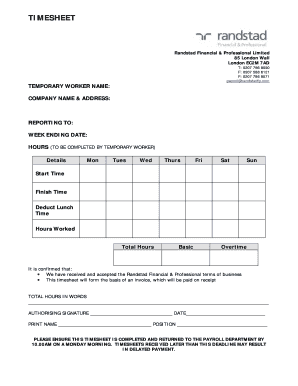

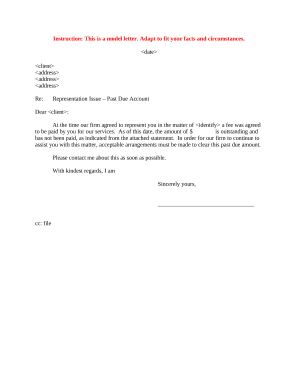

Simplify your common processes with Employee pay stub Canada Forms. Access, modify, and distribute forms online with DocHub robust document management features.

Your workflows always benefit when you can obtain all the forms and documents you may need at your fingertips. DocHub gives a vast array of templates to alleviate your day-to-day pains. Get hold of Employee pay stub Canada Forms category and quickly find your form.

Start working with Employee pay stub Canada Forms in several clicks:

Enjoy easy document administration with DocHub. Explore our Employee pay stub Canada Forms online library and locate your form today!