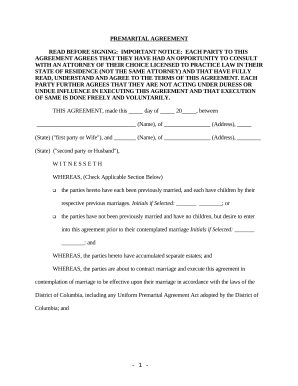

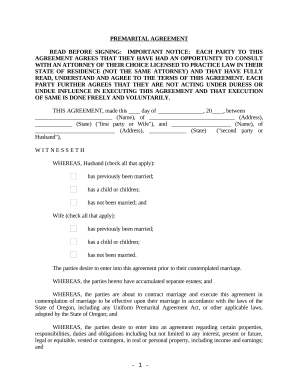

Record administration takes up to half of your office hours. With DocHub, it is easy to reclaim your time and effort and enhance your team's productivity. Get Premarital Agreement without Financial Statements online library and explore all templates relevant to your everyday workflows.

The best way to use Premarital Agreement without Financial Statements:

Accelerate your everyday file administration using our Premarital Agreement without Financial Statements. Get your free DocHub account right now to discover all templates.