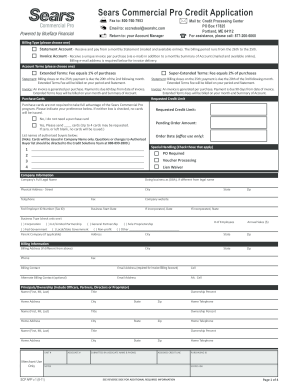

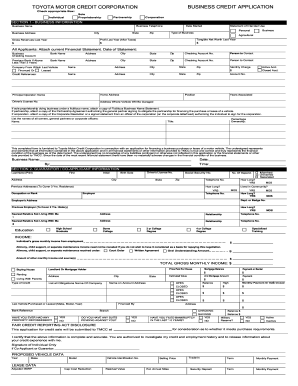

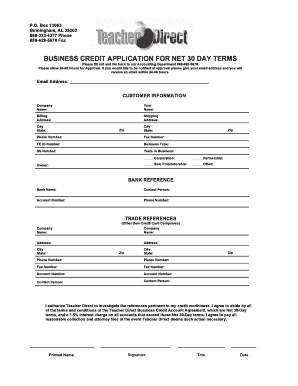

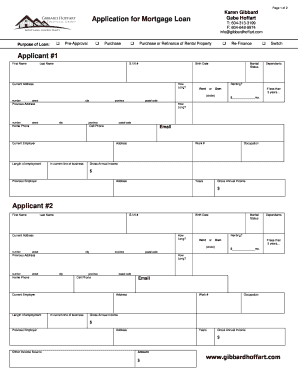

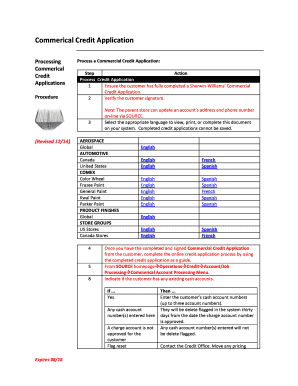

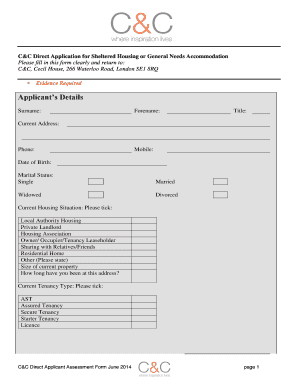

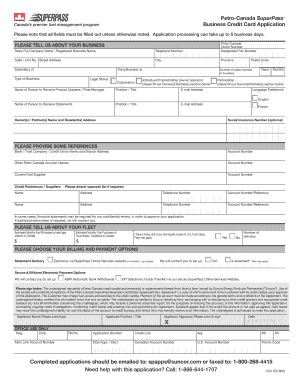

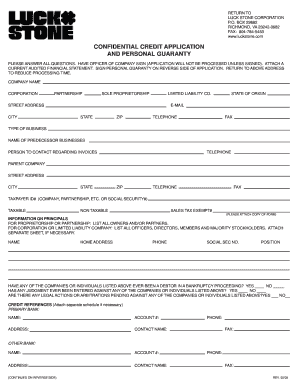

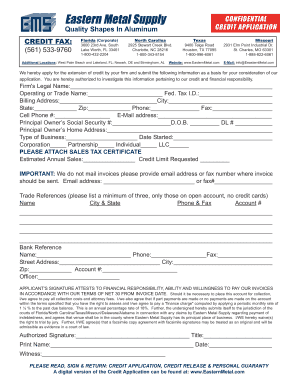

Find and fill Commercial credit application Canada Forms online with DocHub. Get all essential Canada-specific forms, focus on your document accuracy, and securely keep finished documents in your profile.

Boost your document operations with our Commercial credit application Canada Forms online library with ready-made form templates that suit your needs. Access your form template, alter it, fill it, and share it with your contributors without breaking a sweat. Begin working more effectively together with your forms.

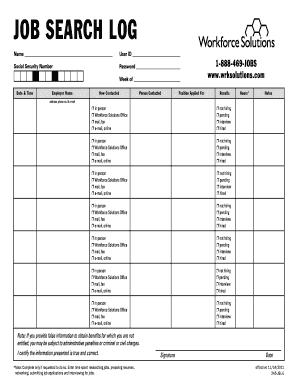

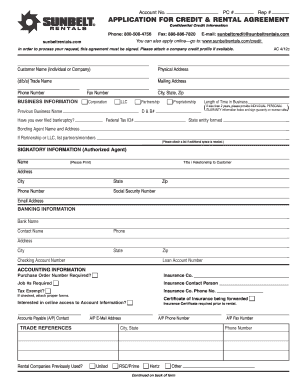

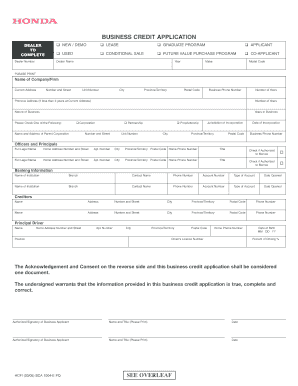

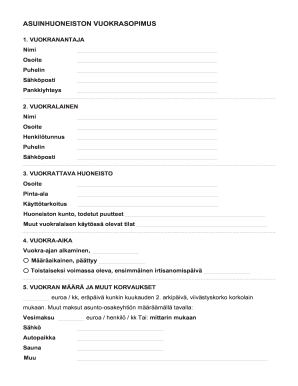

How to use our Commercial credit application Canada Forms:

Explore all the opportunities for your online file management with the Commercial credit application Canada Forms. Get a totally free DocHub account right now!