Get state-specific Utah Business Forms and streamline their organization with DocHub. Effortlessly save, adjust, and distribute documents and remain secure and compliant at every stage of the process.

Record management occupies to half of your office hours. With DocHub, you can easily reclaim your office time and increase your team's efficiency. Access Utah Business Forms category and investigate all form templates relevant to your daily workflows.

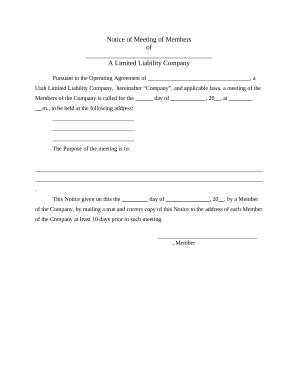

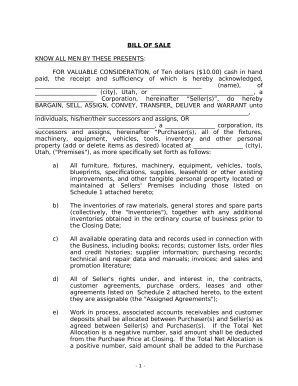

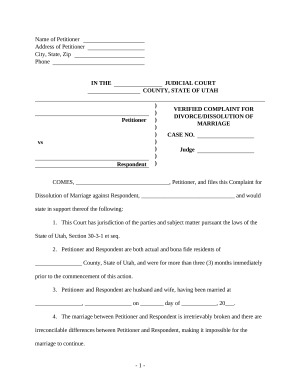

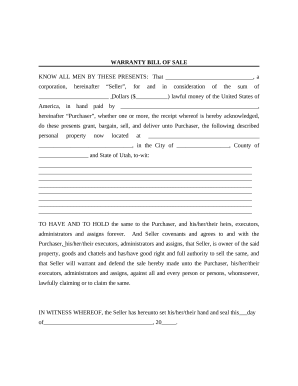

Effortlessly use Utah Business Forms:

Speed up your daily document management using our Utah Business Forms. Get your free DocHub profile right now to discover all templates.