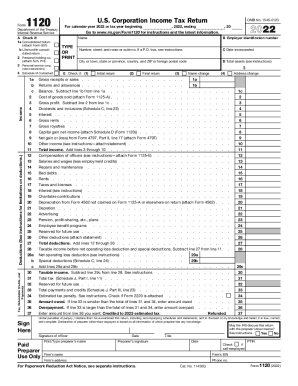

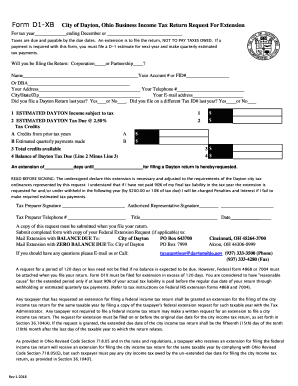

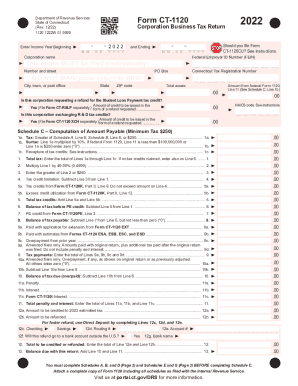

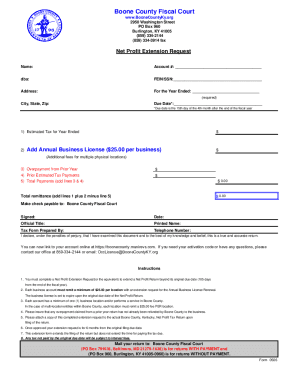

Obtain business-specific Federal income tax Business Forms with the DocHub web collection. Ensure security and compliance when editing and completing your forms.

Papers administration occupies to half of your business hours. With DocHub, it is possible to reclaim your time and improve your team's productivity. Access Federal income tax Business Forms online library and check out all document templates relevant to your everyday workflows.

The best way to use Federal income tax Business Forms:

Accelerate your everyday document administration using our Federal income tax Business Forms. Get your free DocHub profile today to discover all templates.