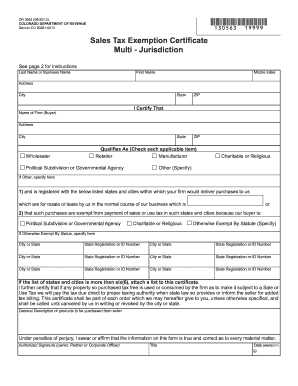

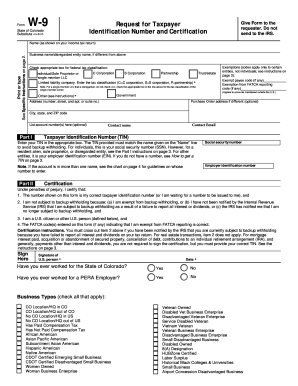

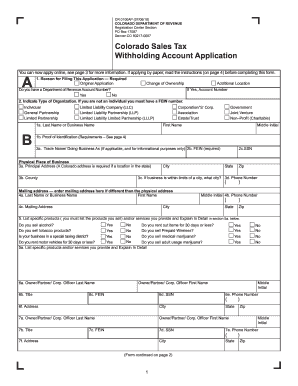

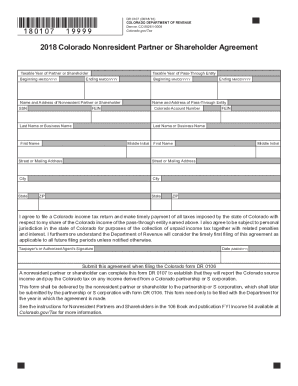

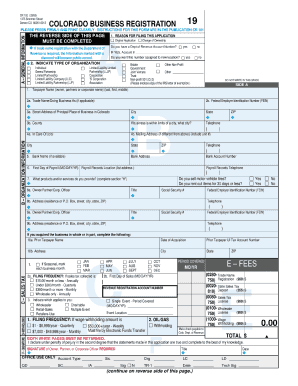

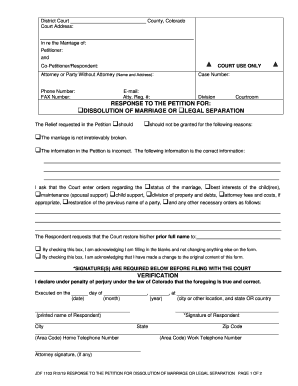

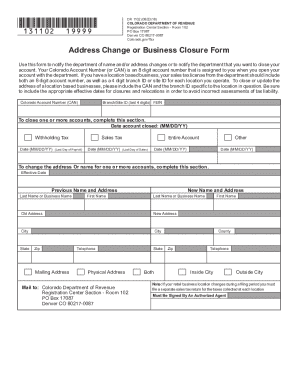

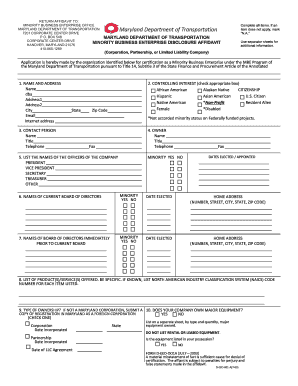

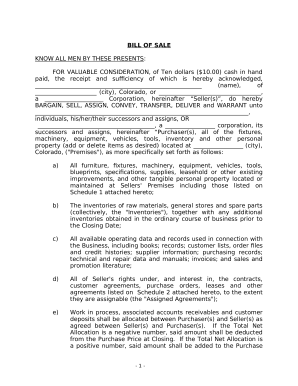

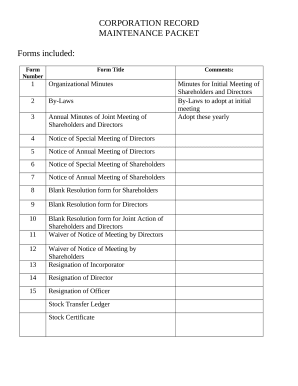

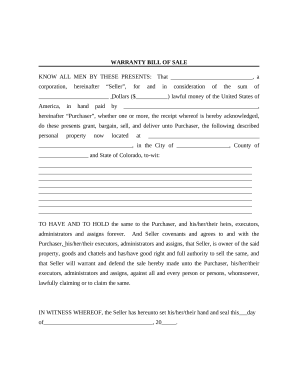

Collect and manage your business details with Colorado Business Forms. Eliminate manual mistakes and enhance your document accuracy with the DocHub online editing tools.

Your workflows always benefit when you can easily locate all the forms and files you need on hand. DocHub provides a vast array of document templates to alleviate your everyday pains. Get a hold of Colorado Business Forms category and quickly browse for your document.

Begin working with Colorado Business Forms in a few clicks:

Enjoy easy form management with DocHub. Explore our Colorado Business Forms collection and locate your form right now!