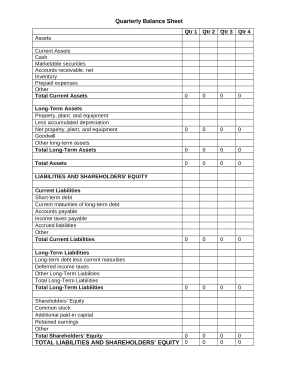

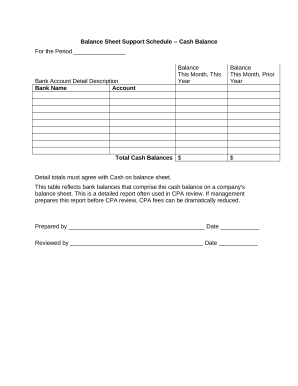

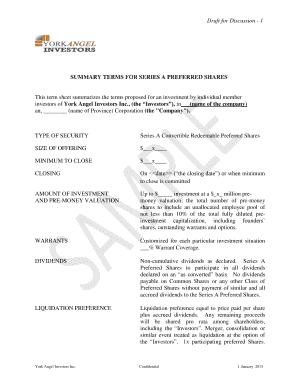

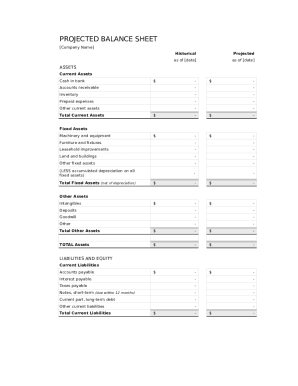

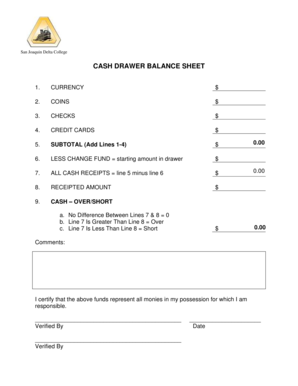

View and download Start up Balance Sheet Templates to ensure the precision and transparency of your financial statement documents. The DocHub web catalog offers numerous ready-made customizable forms.

Document managing can stress you when you can’t discover all of the forms you need. Luckily, with DocHub's vast form collection, you can discover all you need and quickly deal with it without the need of changing between apps. Get our Start up Balance Sheet Templates and start working with them.

How to use our Start up Balance Sheet Templates using these simple steps:

Try out DocHub and browse our Start up Balance Sheet Templates category easily. Get a free account right now!