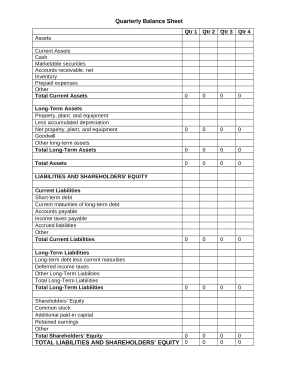

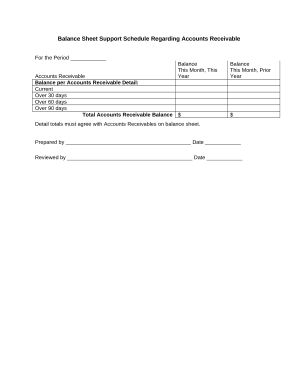

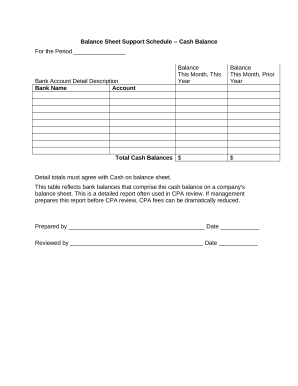

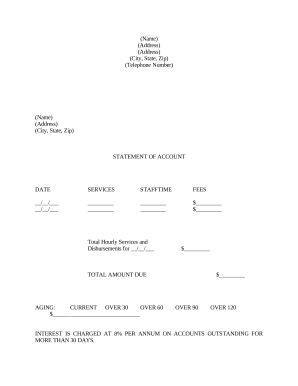

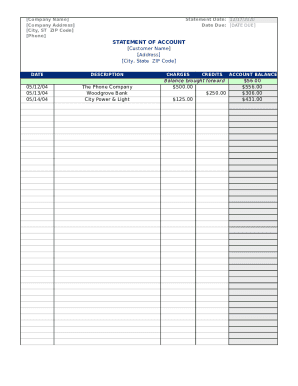

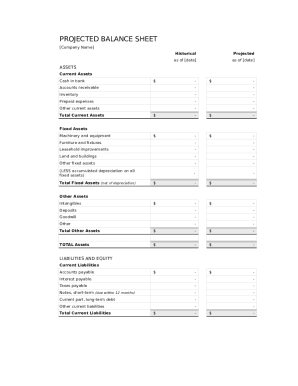

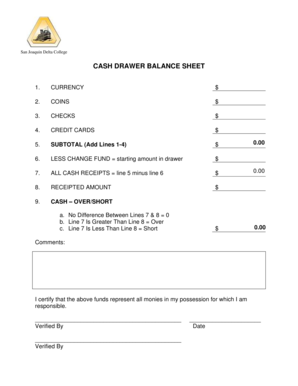

Personalize Opening day Balance Sheet Templates online with DocHub flexible editing tools. Create and manage your business documents all in one location without compromising your data and security.

Document managing can overwhelm you when you can’t locate all of the forms you require. Luckily, with DocHub's considerable form categories, you can get all you need and quickly manage it without the need of changing among software. Get our Opening day Balance Sheet Templates and start utilizing them.

Using our Opening day Balance Sheet Templates using these basic steps:

Try out DocHub and browse our Opening day Balance Sheet Templates category easily. Get your free account right now!