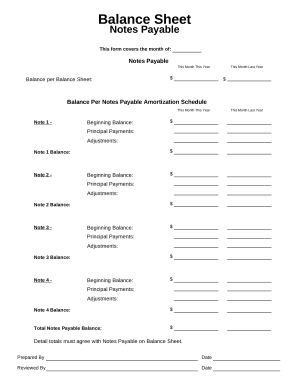

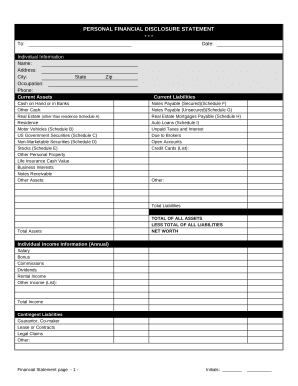

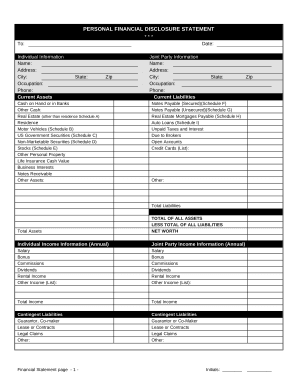

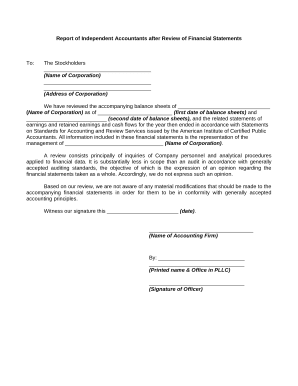

Discover A cash based business Balance Sheet Templates and effortlessly handle them online without logging off from your DocHub profile. Edit and personalize your financial statements, share them with your contributors, and securely store finished documents in your account.

Papers management consumes to half of your business hours. With DocHub, it is possible to reclaim your time and effort and enhance your team's productivity. Get A cash based business Balance Sheet Templates category and explore all form templates relevant to your day-to-day workflows.

Easily use A cash based business Balance Sheet Templates:

Boost your day-to-day file management using our A cash based business Balance Sheet Templates. Get your free DocHub profile today to discover all templates.