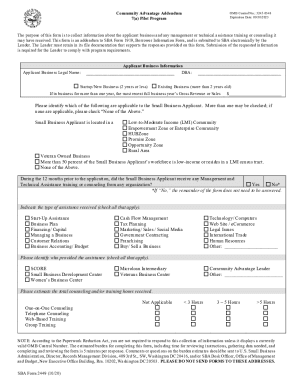

Navigate various Sba 7a loan Application Forms suitable to your needs. Enhance the submission process and securely keep finished forms within your DocHub account.

Boost your file management using our Sba 7a loan Application Forms library with ready-made templates that suit your requirements. Access the document, change it, complete it, and share it with your contributors without breaking a sweat. Start working more effectively with your forms.

The best way to use our Sba 7a loan Application Forms:

Examine all the opportunities for your online file administration using our Sba 7a loan Application Forms. Get your free free DocHub account today!