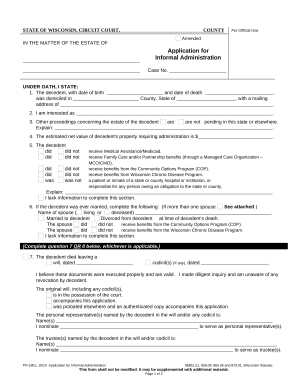

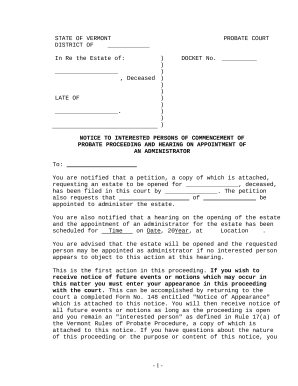

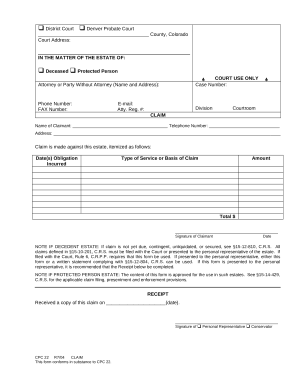

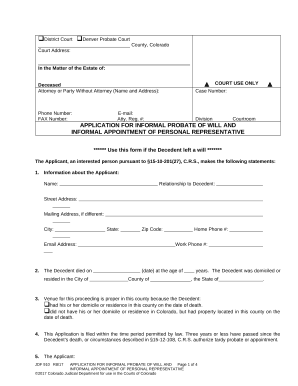

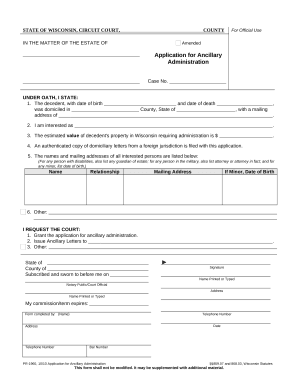

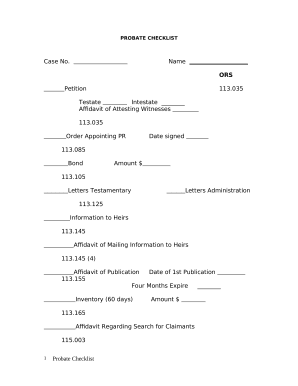

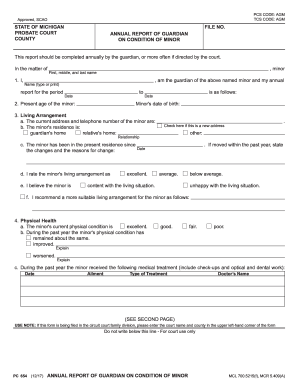

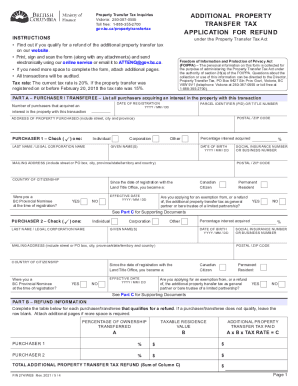

Customize and organize Probate Application Forms online for free with DocHub. Download, edit, and share application forms, reducing mistakes and streamlining the workflow.

Record managing consumes to half of your business hours. With DocHub, you can easily reclaim your office time and improve your team's productivity. Get Probate Application Forms collection and check out all templates relevant to your daily workflows.

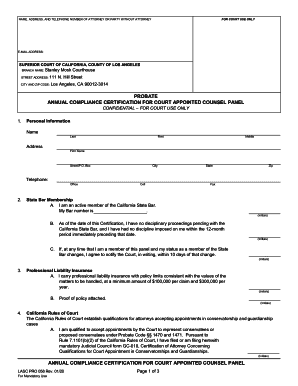

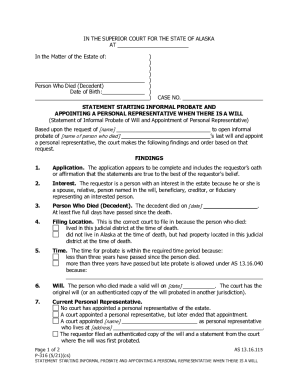

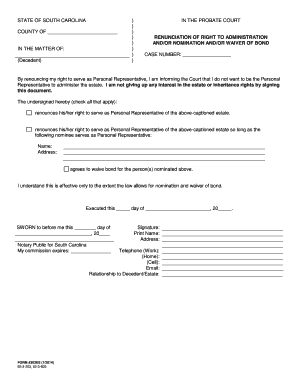

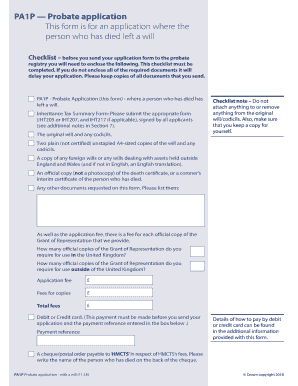

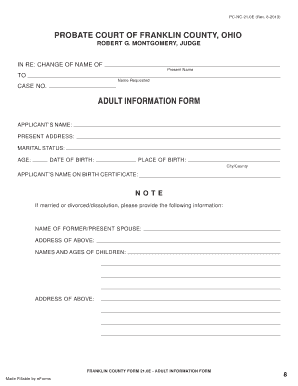

Easily use Probate Application Forms:

Speed up your daily file managing using our Probate Application Forms. Get your free DocHub profile right now to discover all forms.