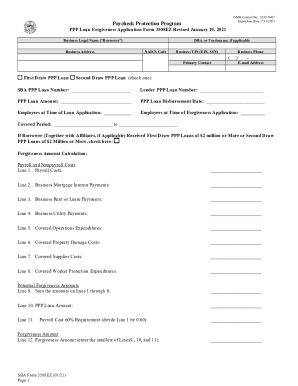

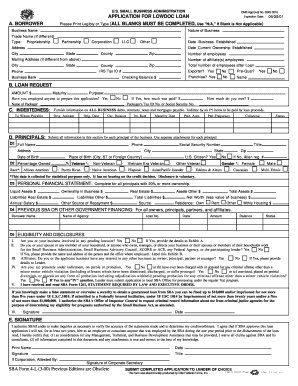

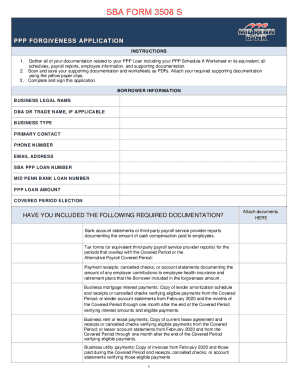

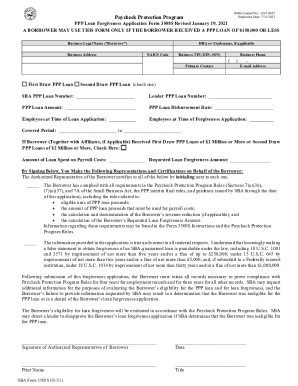

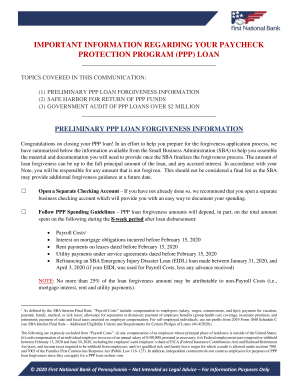

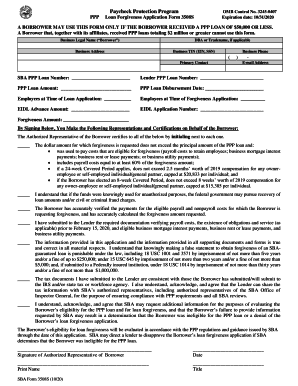

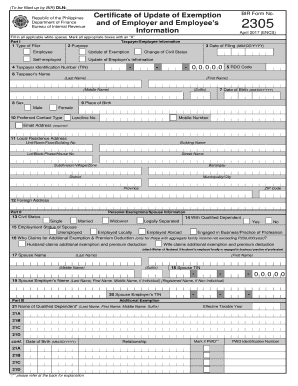

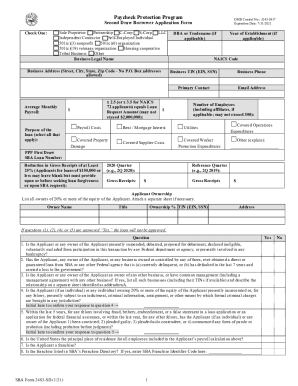

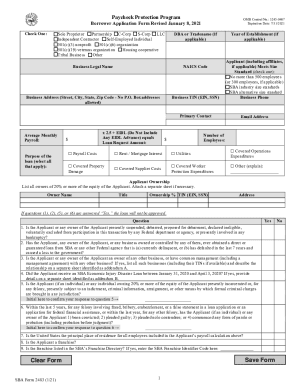

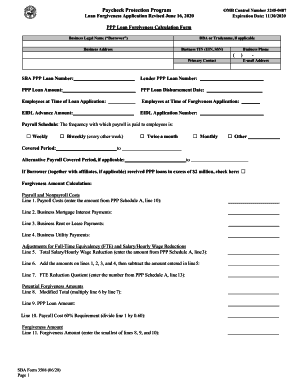

View and pick Ppp loan forgiveness 3508s Application Forms from our comprehensive template library. Streamline your application submission procedures with DocHub: modify, fill out, and securely keep completed documents online.

Speed up your form operations with the Ppp loan forgiveness 3508s Application Forms online library with ready-made form templates that meet your needs. Get your document, edit it, complete it, and share it with your contributors without breaking a sweat. Begin working more efficiently with your documents.

How to use our Ppp loan forgiveness 3508s Application Forms:

Discover all of the possibilities for your online document administration with our Ppp loan forgiveness 3508s Application Forms. Get your totally free DocHub account right now!